Connecticut Certificate of Ownership and Merger

Description

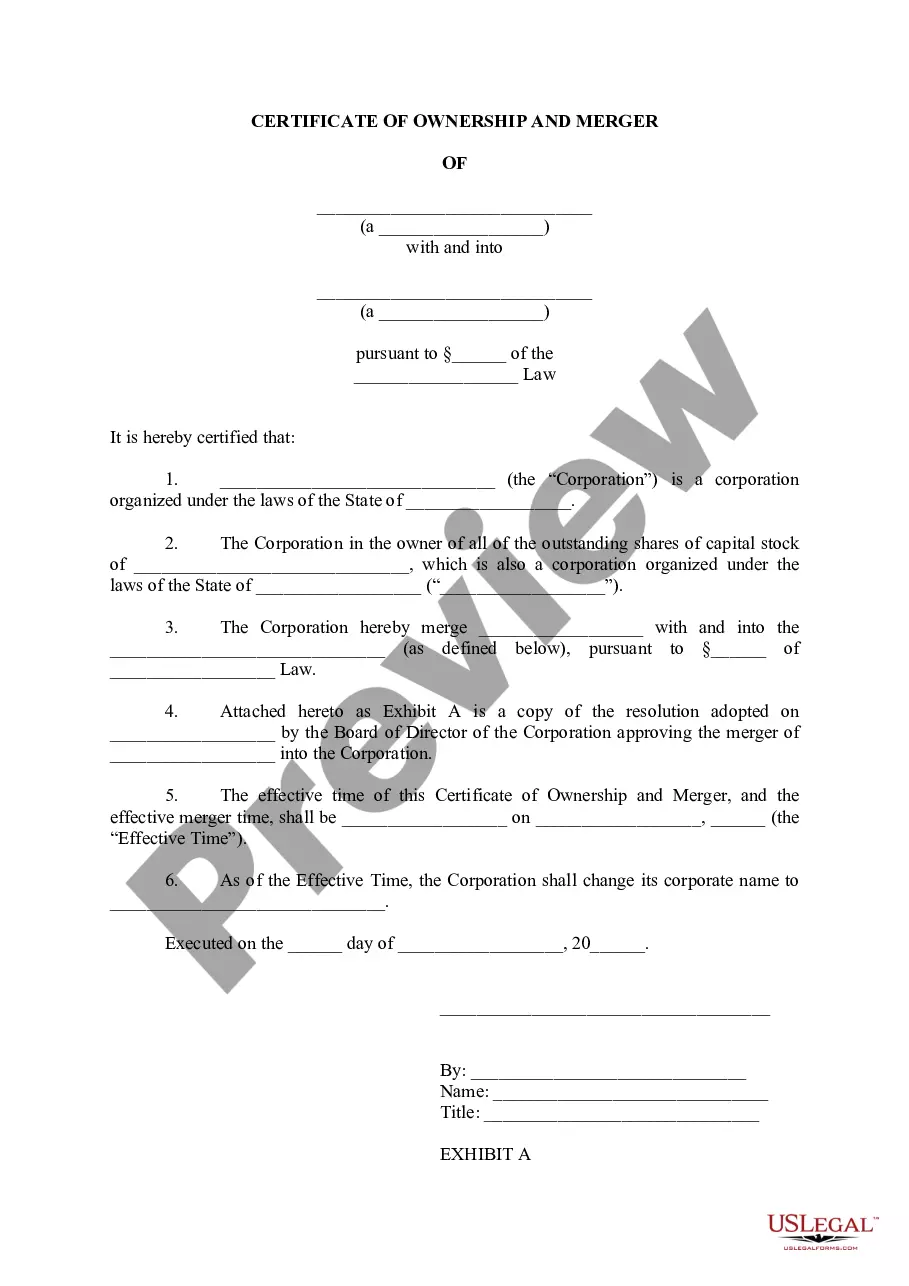

How to fill out Connecticut Certificate Of Ownership And Merger?

Utilize US Legal Forms to acquire a printable Connecticut Certificate of Ownership and Merger.

Our court-acceptable forms are created and consistently updated by qualified attorneys.

Ours is the most comprehensive forms library available online and offers economical and precise templates for clients, lawyers, and small to medium-sized businesses.

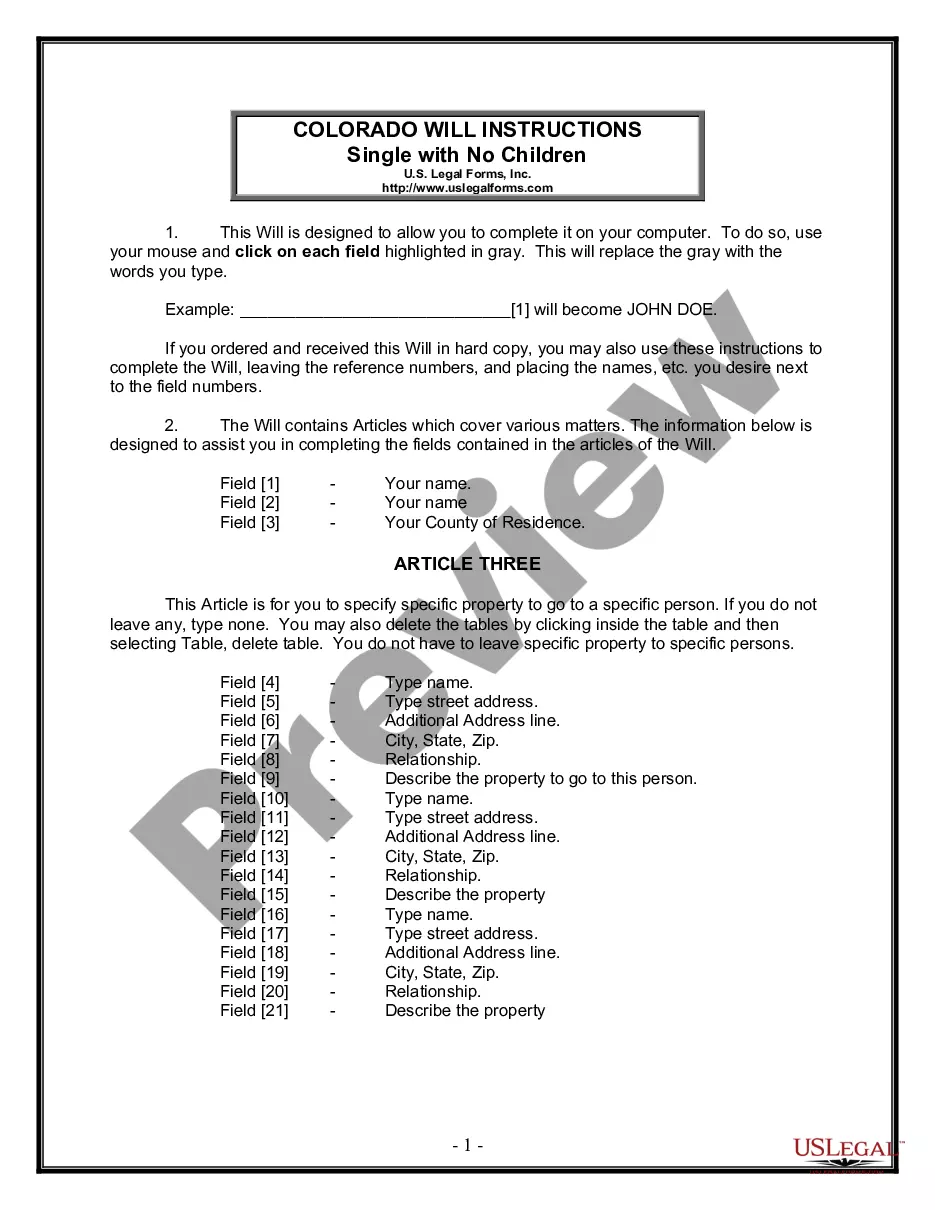

Select Buy Now if it’s the document you wish to obtain. Create your account and complete payment via PayPal or credit card. Download the form to your device and feel free to use it repeatedly. Utilize the Search engine if you need to locate another document template. US Legal Forms offers a vast range of legal and tax documents and packages for both business and personal needs, including the Connecticut Certificate of Ownership and Merger. Over three million users have successfully used our service. Choose your subscription plan and receive high-quality documents in just a few clicks.

- The templates are categorized by state, and a selection can be previewed before downloading.

- To access templates, users must have a subscription and Log In to their account.

- Click Download next to any form you require and locate it in My documents.

- For individuals without a subscription, follow the guidelines below to easily locate and download the Connecticut Certificate of Ownership and Merger.

- Ensure you have the correct template corresponding to the required state.

- Examine the form by browsing its description and using the Preview function.

Form popularity

FAQ

The certificate of merger must be signed by an authorized representative of each merging entity. This could be an officer or director of the company who has the authority to make such commitments. Their signatures validate the intent to merge and signify compliance with state requirements. For additional support in preparing the Connecticut Certificate of Ownership and Merger, explore the tools offered by the US Legal platform.

Approval for a merger generally rests with the board of directors and may also require the consent of the shareholders for both businesses. In Connecticut, it is essential to follow the state’s guidelines to ensure a smooth merger. Gaining approval from stakeholders is crucial to avoid any potential legal issues. The US Legal platform provides valuable resources to navigate the approval process for the Connecticut Certificate of Ownership and Merger.

The certificate of formation typically requires the signatures of the organizers or incorporators of the business. These individuals initiate the creation of the company and take legal responsibility for filing the certificate. In Connecticut, it is essential for the signatories to understand the implications of their signatures. The US Legal platform can guide you through the process of filing a Connecticut Certificate of Ownership and Merger effectively.

The Connecticut Secretary of State is responsible for approving the valid articles of merger or consolidation. This crucial step ensures that the merger is compliant with state laws. Both parties involved in the merger must submit the necessary documentation for approval. For assistance in this process, consider the resources available on the US Legal platform regarding the Connecticut Certificate of Ownership and Merger.

To change ownership of an LLC in Connecticut, start by reviewing your operating agreement and discussing the transfer with other members, if applicable. Subsequently, you will need to file an updated Certificate of Organization reflecting the new ownership. Consulting tools from US Legal Forms can simplify this process, ensuring compliance with the Connecticut Certificate of Ownership and Merger.

A merger document typically refers to the legal paperwork that outlines the terms and conditions under which two companies agree to merge. This document includes details on the assets, liabilities, and governance structure of the new entity. Having a well-prepared merger document is vital for compliance with the Connecticut Certificate of Ownership and Merger.

Transferring an LLC online can be straightforward if you use the right resources. Begin by checking your state’s requirements and using platforms like US Legal Forms to draft the necessary documents. Ensure you file any required amendments to your Certificate of Organization to reflect the new ownership accurately, adhering to the Connecticut Certificate of Ownership and Merger regulations.

In real estate, a merger refers to the combination of properties or business entities to streamline operations and assets. When companies merge, they can enhance their market presence and resource management. This process often requires careful consideration of legal documentation consistent with the Connecticut Certificate of Ownership and Merger.

A merger certificate is another term for the document that formally states that two or more entities have merged to operate as a single business. This official paperwork is critical for legal recognition and is filed with the state to reflect the change. It is a key element in the Connecticut Certificate of Ownership and Merger process.

A certificate of merger is a formal document that signifies the union of two or more companies. This certificate outlines the terms of the merger and is essential for officially recognizing the new entity in Connecticut. Understanding this document is crucial for complying with the Connecticut Certificate of Ownership and Merger.