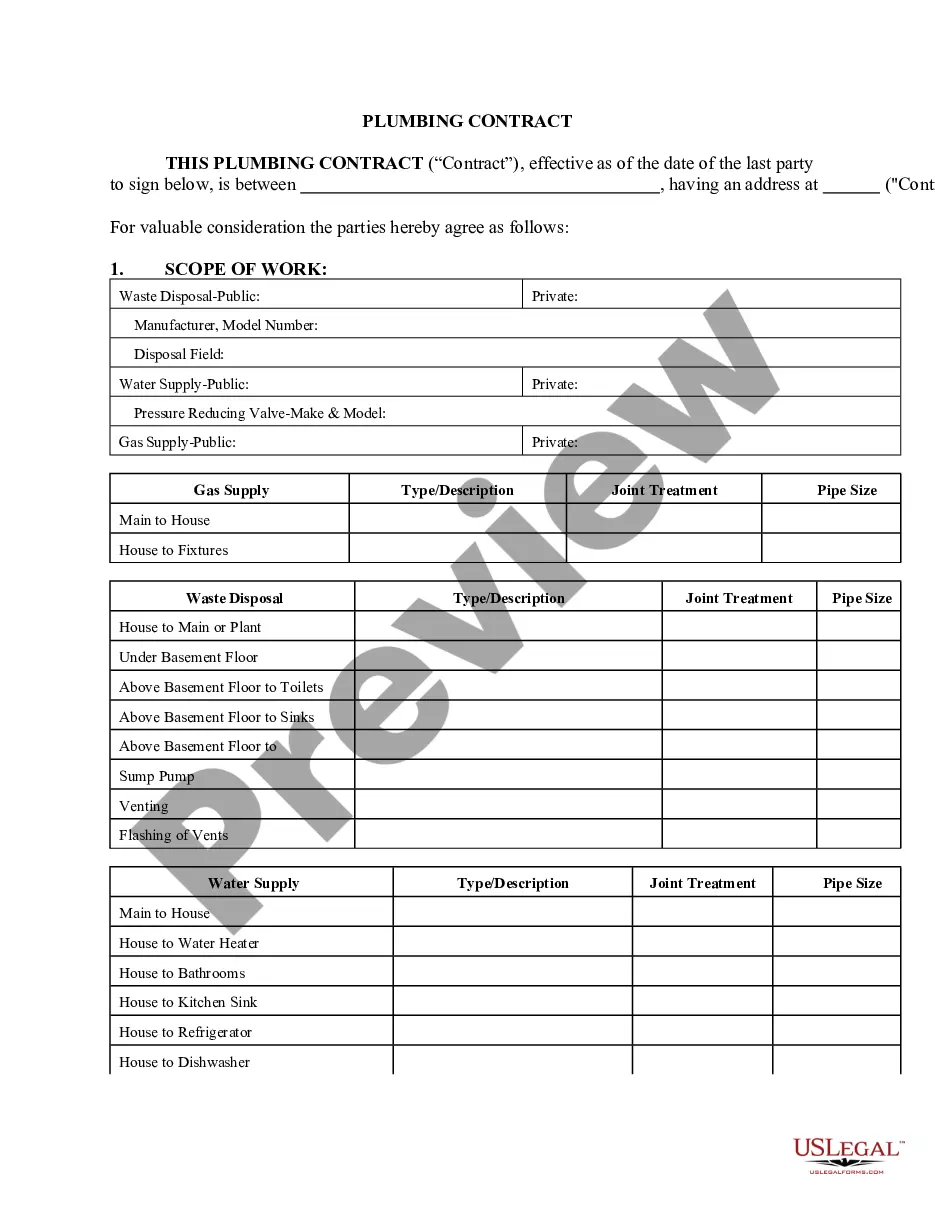

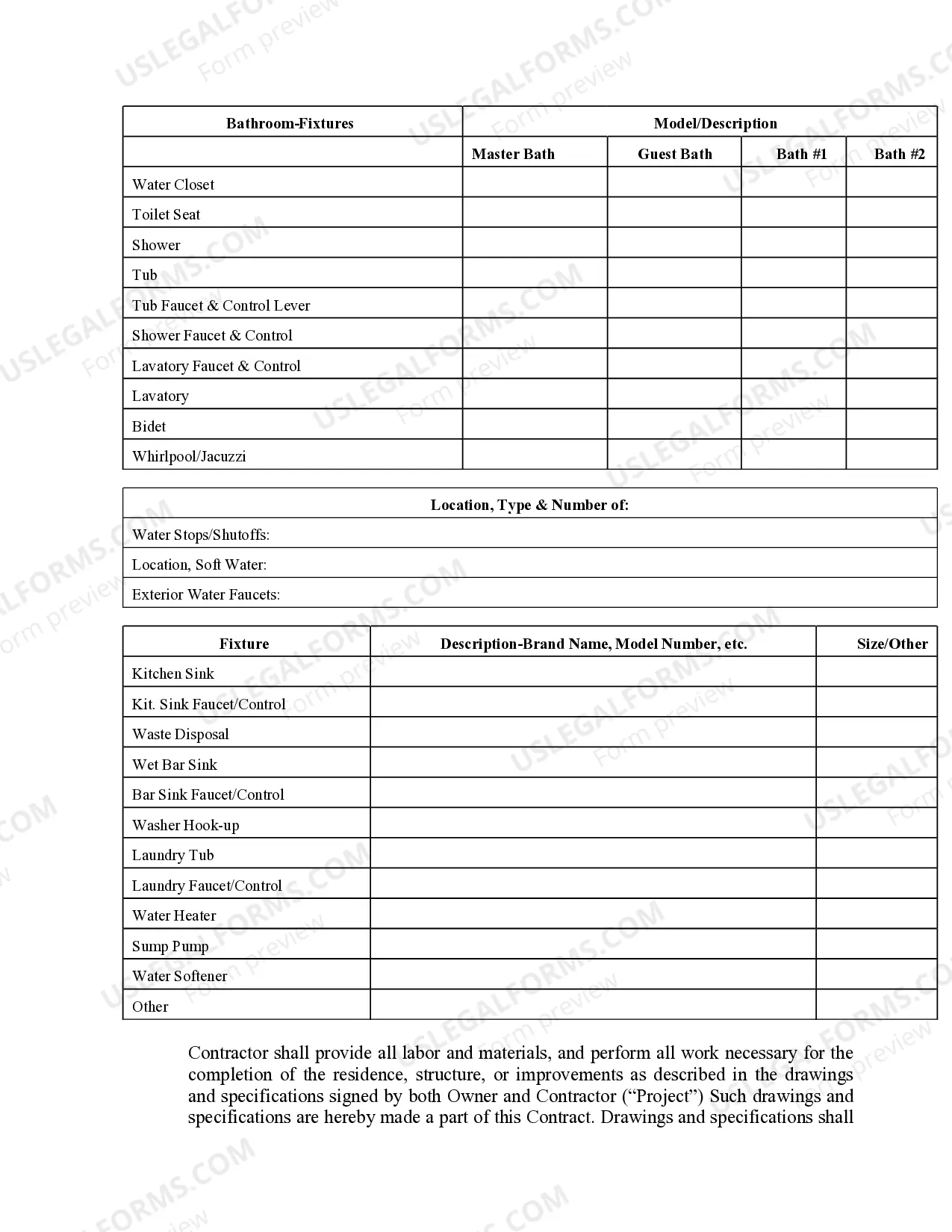

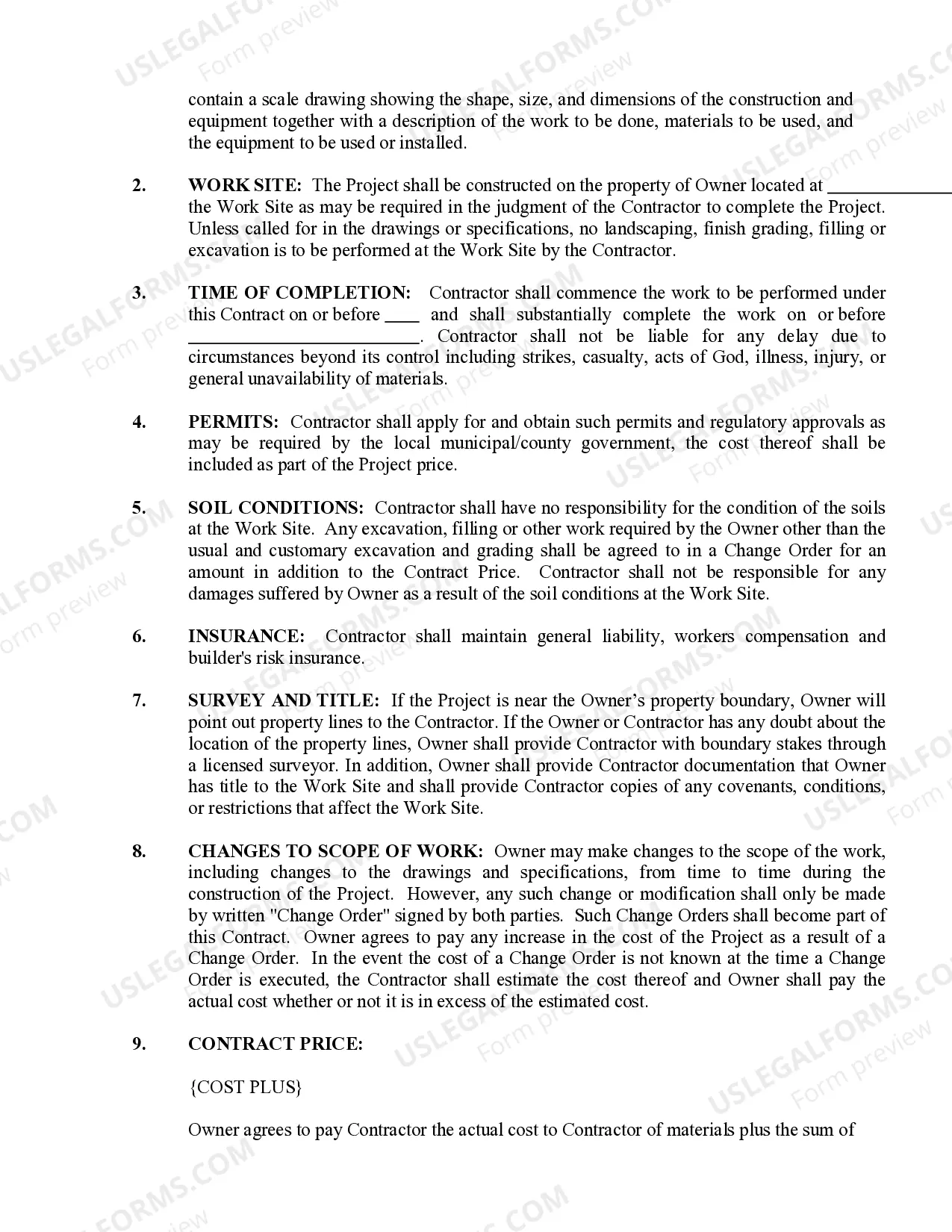

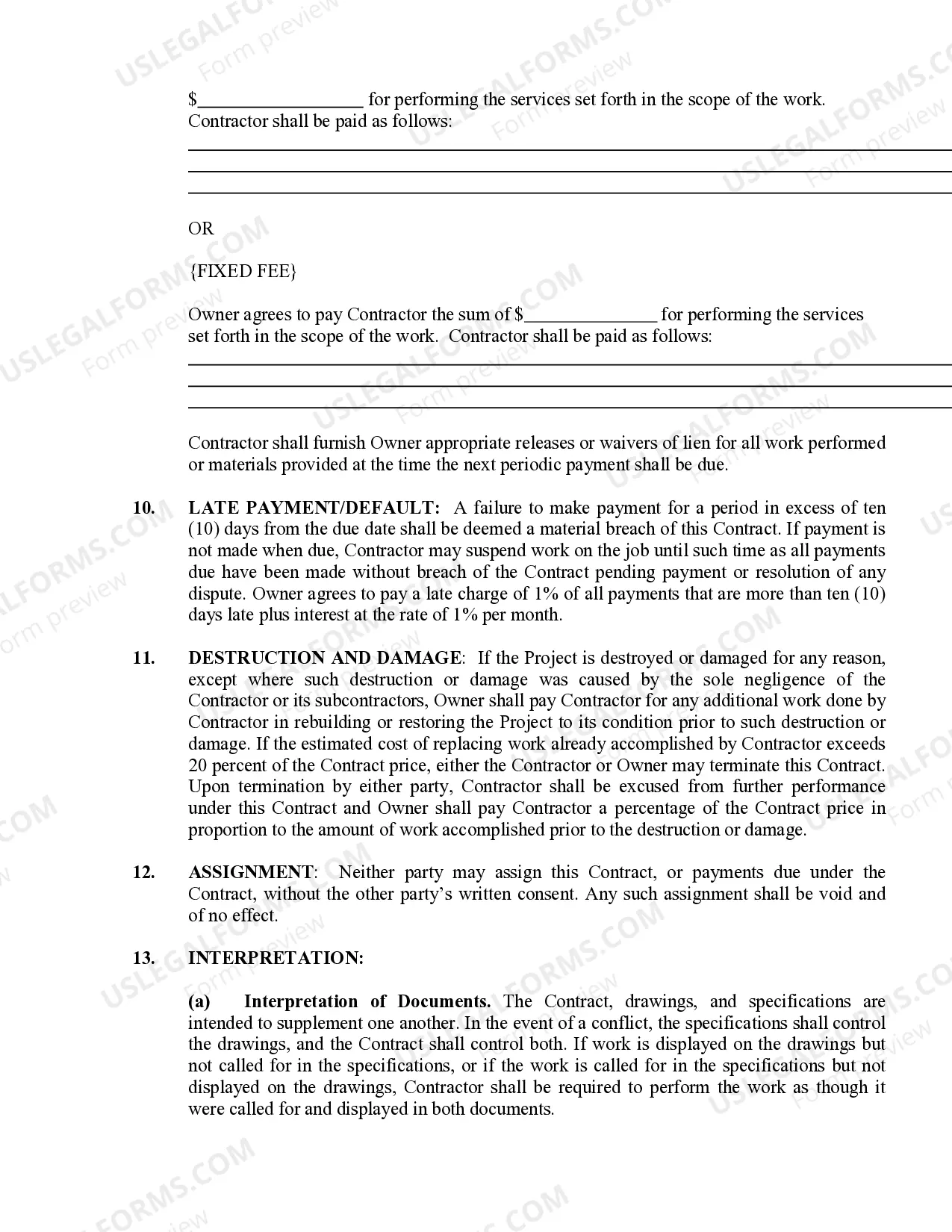

This form is designed for use between Plumbing Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Connecticut.

Connecticut Plumbing Contract for Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Plumbing Contract for Contractor is a legally binding agreement between a plumbing service provider and either a homeowner or a commercial client for performing plumbing installations and repairs. Key terms related to this include Plumbing Contract Template, which is a standardized document that outlines the terms and conditions of the plumbing services to be provided. Residential Plumbing Contracts refer specifically to agreements targeted towards housing plumbing needs.

Step-by-Step Guide

- Review Contract Terms: Ensure all services, costs, and responsibilities are clearly stated in the plumbing contract. Use a Construction Contract Example for guidance on structuring the document.

- Detail Plumbing Services Cost: Include a complete breakdown of costs for services like installations, maintenance, and emergency repairs within the contract.

- Include Plumbing Company Details: Clearly list contractor's contact information, license number, and qualifications.

- Intellectual Property Considerations: Consult with an intellectual property lawyer to ensure any designs or unique processes are properly handled within the contract.

- Finalize and Sign: Review the completed contract with all parties involved and sign it to make it official. Provide options to Download Contract Template for convenience.

Risk Analysis

- Risks of incomplete contracts can lead to disputes over service scope and payments.

- Lack of clear contract terms might result in underpayment or overcharging.

- Non-specification of materials can cause misunderstandings about the quality and types of materials to be used in plumbing constructions.

Key Takeaways

Effective plumbing contracts protect both parties by clearly defining expectations and responsibilities. It's vital to include comprehensive service details, cost breakdowns, and legal considerations in any plumbing construction project agreement.

Common Mistakes & How to Avoid Them

- Not using a detailed plumbing service quote can lead to cost-related disputes. Always provide a detailed quote and ensure it is part of the contract.

- Failing to consult a lawyer may leave room for legal vulnerabilities. An intellectual property lawyer can be invaluable, especially when contracts include unique designs or patented processes.

FAQ

Q: Where can I find a reliable plumbing contract template?

A: Templates can be found online, often available for download; however, it's recommended to tailor the template to specifics of the project.

Q: What should be included in the cost breakdown?

A: Itemize all expenses such as labor, materials, and additional fees to avoid misunderstandings.

How to fill out Connecticut Plumbing Contract For Contractor?

The larger amount of documents you need to produce - the more anxious you become.

You can discover a vast array of Connecticut Plumbing Contract for Contractor templates online, but you are unsure which to rely on.

Eliminate the stress and simplify the process of finding samples with US Legal Forms. Obtain expertly crafted documents that are designed to comply with state requirements.

Enter the required information to create your account and pay for the order using your PayPal or credit card. Choose a convenient document format and download your sample. Access every document you download in the My documents section. Simply visit there to prepare a new copy of the Connecticut Plumbing Contract for Contractor. Even when utilizing professionally prepared templates, it remains important to consider consulting with a local attorney to ensure that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you already have a subscription to US Legal Forms, Log In to your account, and you will find the Download option on the webpage of the Connecticut Plumbing Contract for Contractor.

- If you’ve never utilized our service before, complete the registration process by following these instructions.

- Ensure that the Connecticut Plumbing Contract for Contractor is applicable in your state.

- Double-check your choice by reviewing the description or by using the Preview feature if it's available for the selected document.

- Click Buy Now to start the registration process and choose a pricing option that suits your needs.

Form popularity

FAQ

Connecticut law imposes a 6.35% sales tax on all retail sales and certain business and professional services (CGS § 12-408). Business and professional services in Connecticut are presumed to be exempt from the state's sales tax unless specifically identified as taxable by state law.

Handymen do not need a state license to work in Connecticut. However, if you consider yourself a home improvement contractor who creates permanent changes to a residential property, you'll need to register with the Department of Consumer Protection.

In most states, construction contractors must pay sales tax when they purchase materials used in construction.In some cases, this can be an advantage because any markup you charge to your customer on the materials, supplies and labor, won't be subject to sales tax.

Connecticut's sales tax is assessed on goods and services, including labor.You pay sales tax on labor when it occurs as part of a taxable service. Taxable services include the work of building contractors, computer specialists, personal service providers and business service providers.

Sales Tax Exemptions in Connecticut Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

Connecticut's sales tax is assessed on goods and services, including labor.You pay sales tax on labor when it occurs as part of a taxable service. Taxable services include the work of building contractors, computer specialists, personal service providers and business service providers.

Many sellers believe there is a general exemption from sales tax for labor charges. However, in California many types of labor charges are subject to tax. Generally, if you perform taxable labor in California, you must obtain a seller's permit and report and pay tax on your taxable sales.

On the eLicensing Website screen, click on ONLINE SERVICES" in the top right corner. Then Select "Lookup a License". Jones as a last name found 3 pages of results. This screen provides verification of the license, permit or registration in the "Credential Status" column.

In other words, contractors pay sales and use tax on all their purchases as is the case in Connecticut. Typically, the gross receipts of contractors are not subject to sales or use tax.