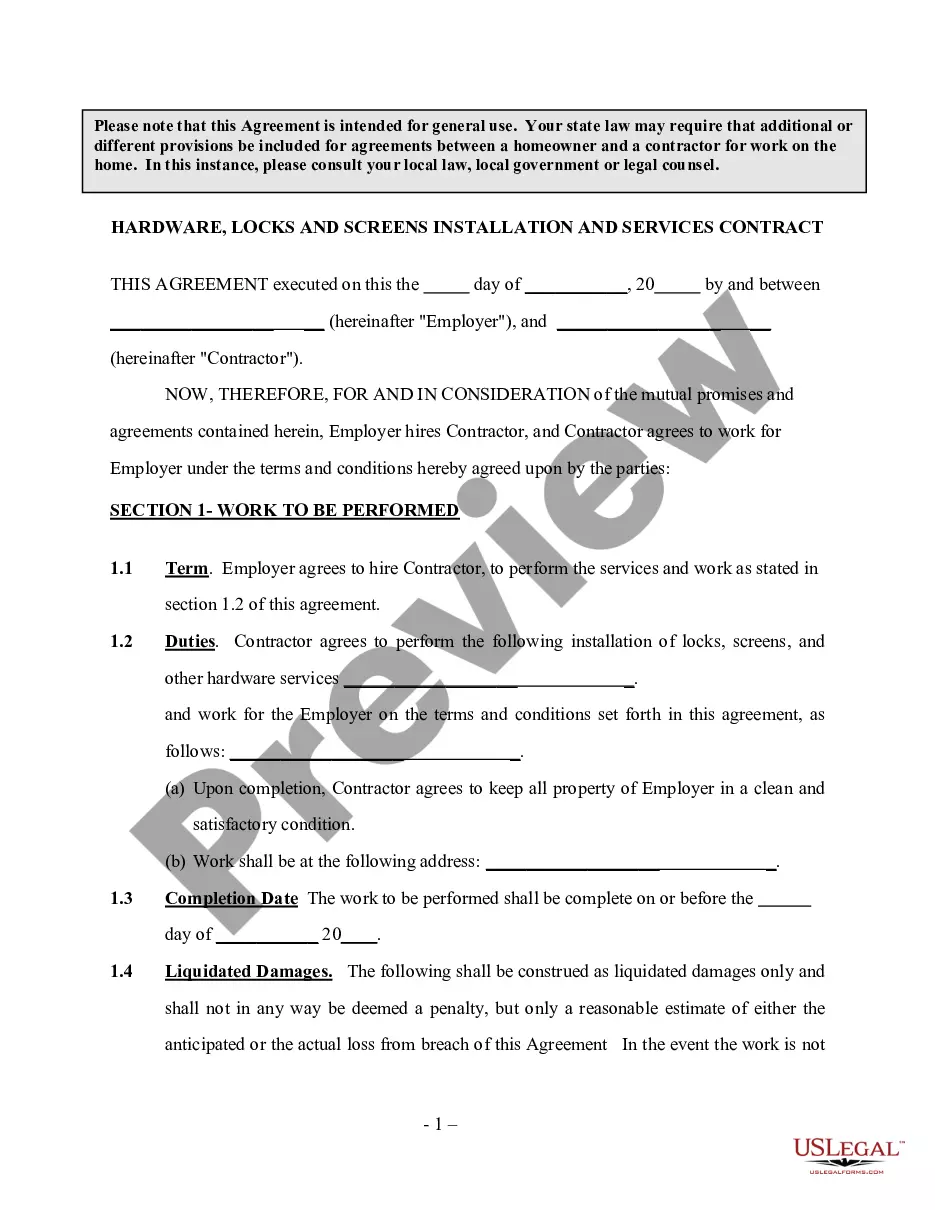

Colorado Wage and Income Loss Statement

Description

How to fill out Wage And Income Loss Statement?

If you have to total, download, or print authorized file layouts, use US Legal Forms, the largest selection of authorized forms, which can be found on the Internet. Make use of the site`s basic and handy lookup to obtain the papers you will need. Various layouts for business and individual purposes are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the Colorado Wage and Income Loss Statement in a couple of mouse clicks.

If you are presently a US Legal Forms customer, log in to the account and click on the Download key to obtain the Colorado Wage and Income Loss Statement. You may also access forms you formerly delivered electronically in the My Forms tab of your account.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the form for the appropriate town/region.

- Step 2. Utilize the Preview solution to check out the form`s articles. Do not overlook to read the explanation.

- Step 3. If you are not happy using the type, make use of the Research area at the top of the display to get other models from the authorized type design.

- Step 4. After you have located the form you will need, go through the Acquire now key. Pick the pricing prepare you favor and put your accreditations to sign up for an account.

- Step 5. Method the financial transaction. You should use your charge card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the formatting from the authorized type and download it in your device.

- Step 7. Total, edit and print or indicator the Colorado Wage and Income Loss Statement.

Every authorized file design you purchase is the one you have permanently. You may have acces to each type you delivered electronically within your acccount. Click the My Forms area and pick a type to print or download again.

Compete and download, and print the Colorado Wage and Income Loss Statement with US Legal Forms. There are millions of specialist and condition-certain forms you can use for your personal business or individual requirements.

Form popularity

FAQ

The Colorado Wage Act (C.R.S. 8-4-101 et seq.) requires Colorado employers to pay employees their earned wages in a timely manner. The Wage Act is commonly referred to as the Colorado Wage Law, the Colorado Wage Claim Act, or the Colorado Wage Protection Act.

Form DR 0004 is the new Colorado Employee Withholding Certificate that is available for 2022. It is not meant to completely replace IRS form W-4 for Colorado withholding, but to help employees in a few specific situations fine-tune their Colorado withholding.

Anyone wishing to file a complaint with the Division of Workers' Compensation may do so via the Tip and Lead Form(opens in new window) or by email to cdle_wc_complaints@state.co.us. Your complaint will be forwarded to the proper party for review and response.

On August 7, 2023 the Protecting Opportunities and Workers' Rights (POWR) Act goes into effect, significantly transforming Colorado's employment discrimination legal landscape. This change expands the Colorado Anti-Discrimination Act (CADA).

Does Colorado have a W-4 form? Yes. Starting in 2022, an employee may complete a Colorado Employee Withholding Certificate (form DR 0004), but it is not required.

Do all employees need to complete both IRS form W-4 and Colorado form DR 0004? No. Colorado form DR 0004 is optional for employees to complete.

The following states have no income tax and don't require state W-4s: Alaska. Florida. Nevada. New Hampshire. South Dakota. Tennessee. Texas. Washington.

APPLICABLE TO CURRENT TAX YEAR We have received federal 1040 and 1040-SR tax forms, 1040 instructions, and Colorado state 104 tax booklets. These are the only forms and instructions issued to us for the current tax year.