Colorado Clauses Relating to Accounting Matters

Description

How to fill out Clauses Relating To Accounting Matters?

You can devote hours on the web looking for the lawful record template that meets the state and federal requirements you want. US Legal Forms offers thousands of lawful forms that happen to be evaluated by professionals. It is simple to obtain or print the Colorado Clauses Relating to Accounting Matters from your support.

If you already possess a US Legal Forms accounts, you may log in and click on the Down load button. Following that, you may complete, modify, print, or sign the Colorado Clauses Relating to Accounting Matters. Each lawful record template you acquire is the one you have eternally. To get an additional backup of the acquired develop, proceed to the My Forms tab and click on the related button.

Should you use the US Legal Forms website the first time, keep to the basic recommendations under:

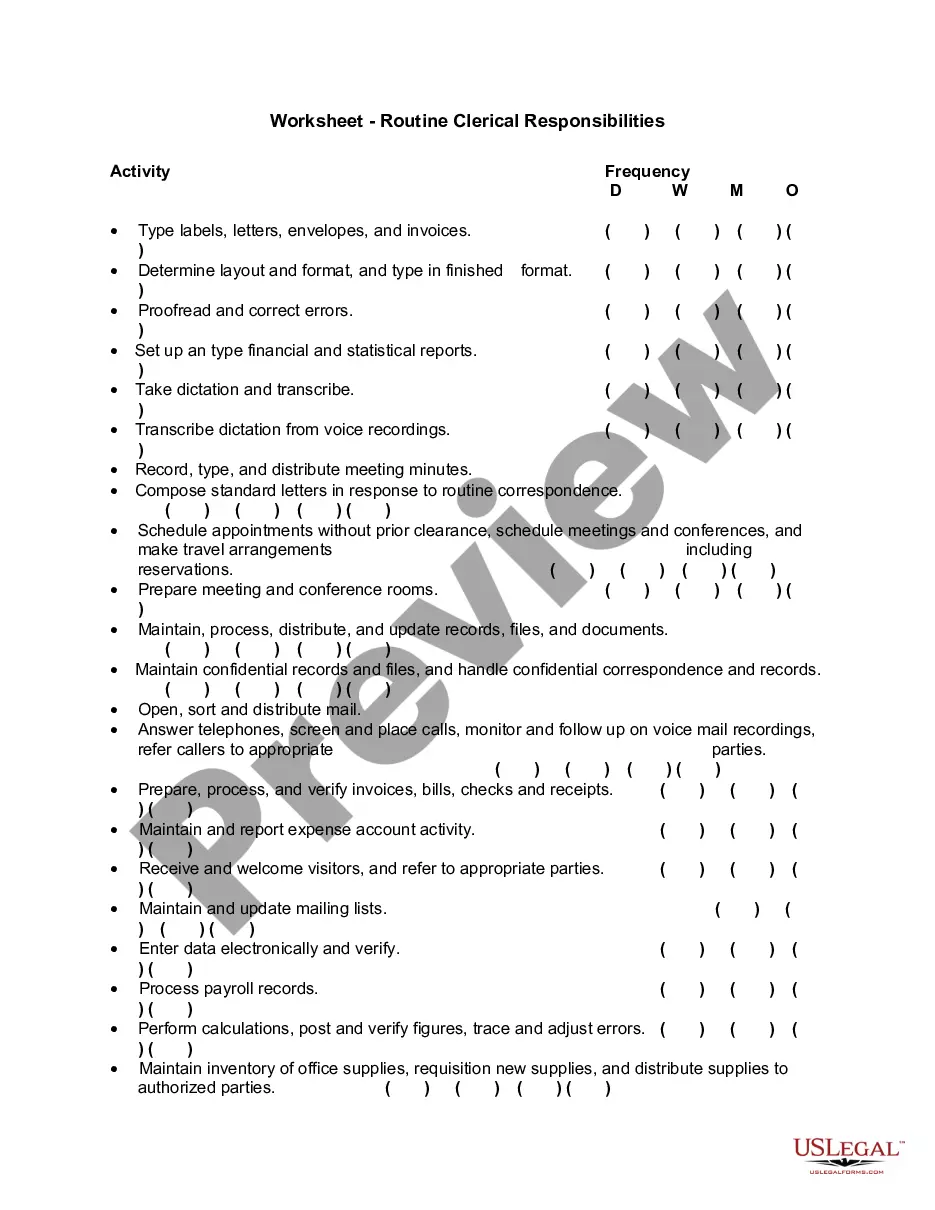

- First, make certain you have selected the proper record template to the area/area that you pick. See the develop description to ensure you have chosen the proper develop. If accessible, utilize the Review button to search throughout the record template as well.

- If you want to get an additional variation in the develop, utilize the Look for industry to discover the template that suits you and requirements.

- After you have located the template you desire, click Get now to move forward.

- Select the rates plan you desire, enter your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your charge card or PayPal accounts to fund the lawful develop.

- Select the file format in the record and obtain it to your system.

- Make alterations to your record if needed. You can complete, modify and sign and print Colorado Clauses Relating to Accounting Matters.

Down load and print thousands of record web templates utilizing the US Legal Forms web site, that provides the most important variety of lawful forms. Use specialist and condition-certain web templates to handle your company or personal requires.

Form popularity

FAQ

The Colorado Board of Accountancy regulates certified public accountants (CPAs). CPAs perform a variety of accounting services and will often have the CPA designation after their name.

To apply for the CPA license: A bachelor's degree or higher plus 30 additional hours (150 total hours). 33 total semester hours of non-duplicative accounting coursework. 27 of these hours must be above the introductory level. ... 27 total semester hours of non-duplicative business administration coursework.

Non-CPAs may hold minority ownership in a Colorado CPA firm. Majority ownership of a Colorado CPA firm must be held by CPAs licensed in some state.

By agreement with the six chartered accountancy bodies, the FRC has a non-statutory role for oversight of the regulation by the professional accountancy bodies of their members beyond those that are statutory auditors. The six chartered accountancy bodies are: Association of Chartered Certified Accountants (ACCA)

Individuals who want to become a CPA in Colorado need to spend up to 18 months on the uniform CPA exam, complete relevant work, and meet educational requirements. Candidates with a bachelor's degree can complete these concurrently, but should expect to take at least one and a half years to meet the requirements.

Under the CPA, consumers have the right to access their personal data collected and maintained by the controller. Consumers also have a right to obtain this data in a portable and readily usable format. Controllers must provide information to consumers free of charge for the first request within a twelve-month period.

The CPA grants Colorado Consumers new rights with respect to their personal data, including the right to access, delete, and correct their personal data as well as the right to opt out of the sale of their personal data or its use for targeted advertising or certain kinds of profiling.