Colorado Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

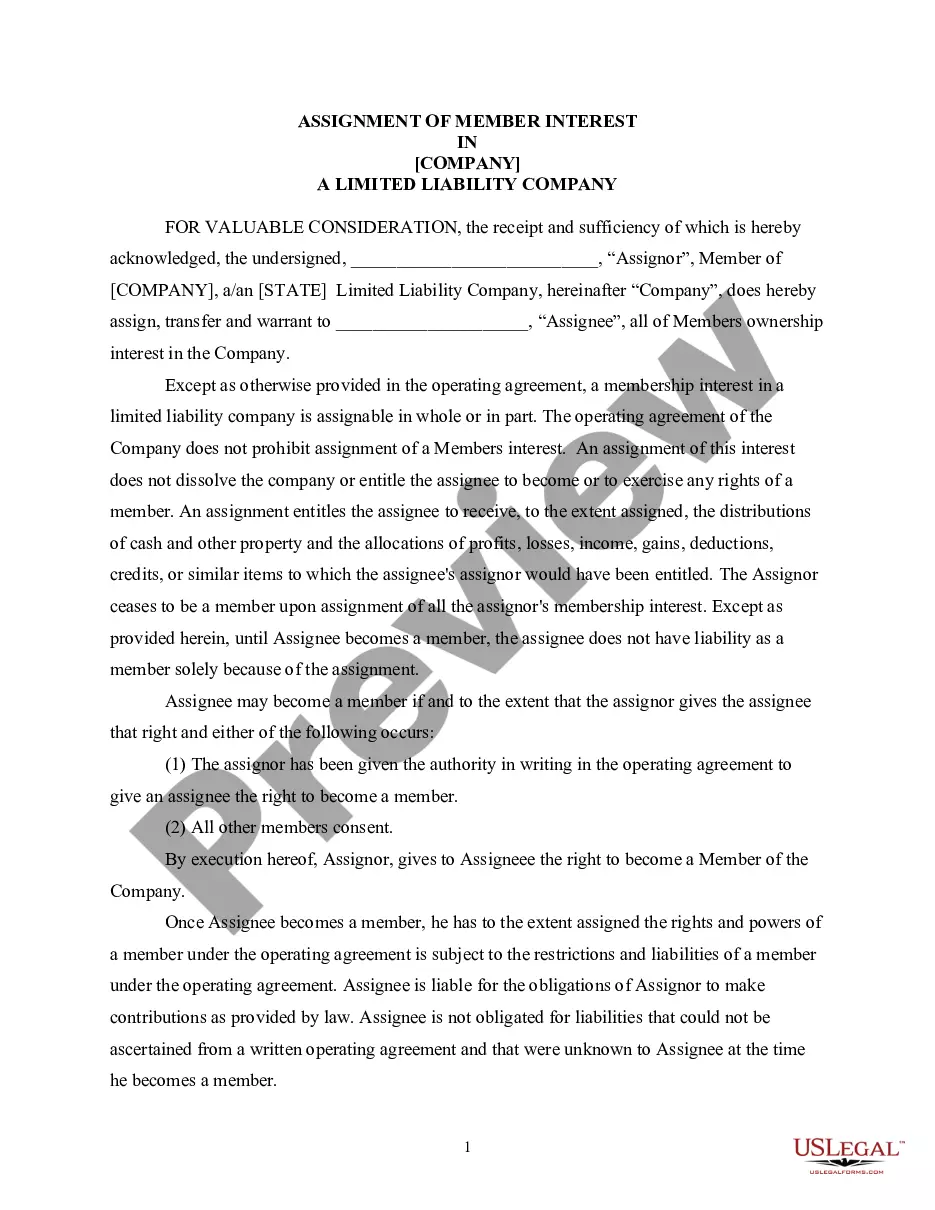

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Have you been within a position where you need files for either company or individual functions virtually every day? There are a lot of lawful record themes available on the net, but locating types you can rely on isn`t effortless. US Legal Forms offers thousands of kind themes, just like the Colorado Assignment of Overriding Royalty Interest (No Proportionate Reduction), which are written in order to meet federal and state needs.

Should you be presently informed about US Legal Forms site and possess an account, merely log in. Next, you can down load the Colorado Assignment of Overriding Royalty Interest (No Proportionate Reduction) design.

If you do not have an profile and want to begin using US Legal Forms, adopt these measures:

- Obtain the kind you will need and make sure it is to the appropriate metropolis/county.

- Use the Preview switch to examine the form.

- See the description to ensure that you have chosen the proper kind.

- In the event the kind isn`t what you`re seeking, make use of the Search industry to get the kind that fits your needs and needs.

- Whenever you get the appropriate kind, just click Acquire now.

- Opt for the prices strategy you desire, fill out the desired information to make your money, and purchase the transaction using your PayPal or bank card.

- Pick a convenient file formatting and down load your copy.

Get every one of the record themes you may have purchased in the My Forms menus. You may get a further copy of Colorado Assignment of Overriding Royalty Interest (No Proportionate Reduction) anytime, if required. Just go through the required kind to down load or printing the record design.

Use US Legal Forms, by far the most considerable assortment of lawful forms, in order to save efforts and stay away from faults. The services offers skillfully created lawful record themes that you can use for a range of functions. Make an account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement. Overriding Royalty Agreement: Definition & Sample contractscounsel.com ? overriding-royalty-a... contractscounsel.com ? overriding-royalty-a...

Non-Participating Royalty Interest (NPRI) Unlike a mineral interest owner, the NPRI owner does not have ?executive? rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Royalty Interest (RI) ? this type of mineral interest is obtained when an owner decides to lease their mineral interest to a company that plans to drill and operate a well on the land. Trust Tuesday: What are Mineral Rights? | First Western Bank & Trust firstwestern.bank ? 2021/01/26 ? trust-tuesd... firstwestern.bank ? 2021/01/26 ? trust-tuesd...

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces. Royalty Interest: What it Means, How it Works - Investopedia investopedia.com ? terms ? royalty-interest investopedia.com ? terms ? royalty-interest

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...