Colorado Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

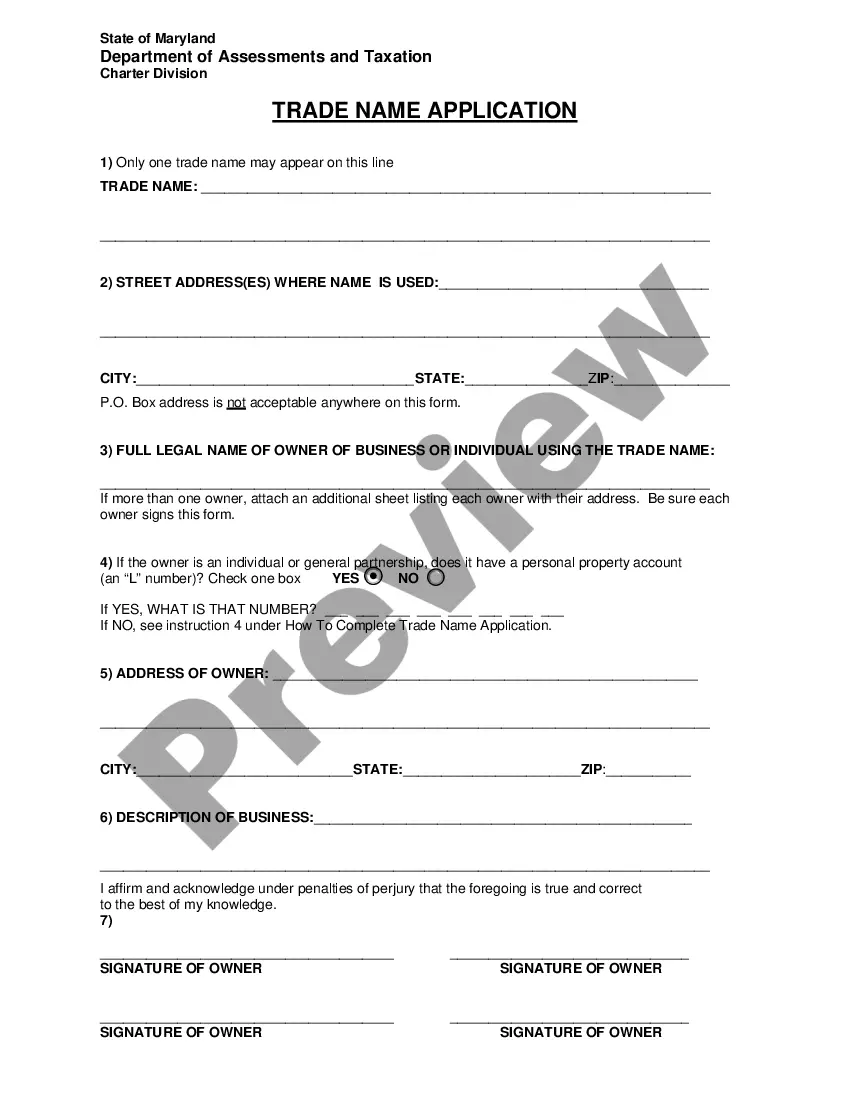

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

Finding the right legal document format could be a have a problem. Of course, there are a lot of templates accessible on the Internet, but how can you obtain the legal develop you will need? Utilize the US Legal Forms site. The services gives a large number of templates, including the Colorado Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest, which you can use for enterprise and personal requires. Each of the varieties are inspected by experts and satisfy state and federal requirements.

When you are already signed up, log in to your account and click on the Down load button to have the Colorado Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest. Utilize your account to check throughout the legal varieties you might have purchased formerly. Proceed to the My Forms tab of your own account and acquire another backup from the document you will need.

When you are a whole new user of US Legal Forms, listed here are easy guidelines that you should stick to:

- Initially, ensure you have chosen the proper develop for your personal city/state. You may look over the form using the Review button and read the form outline to make sure it will be the best for you.

- When the develop does not satisfy your expectations, use the Seach industry to find the proper develop.

- When you are positive that the form is proper, go through the Buy now button to have the develop.

- Choose the prices program you need and enter in the needed details. Make your account and pay money for an order utilizing your PayPal account or bank card.

- Select the data file structure and obtain the legal document format to your product.

- Total, edit and print out and indication the received Colorado Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest.

US Legal Forms is the largest local library of legal varieties in which you will find a variety of document templates. Utilize the service to obtain appropriately-manufactured files that stick to state requirements.

Form popularity

FAQ

Executive Mineral Interest (NEMI) is a type of mineral interest held by an individual or entity. But it does not give them the right to drill for and produce oil or gas. Instead, these interests are usually leased to other companies that have the right to explore and exploit the minerals found on the land. What is NonExecutive Mineral Interest? Pheasant Energy pheasantenergy.com ? nonexecutiveminer... pheasantenergy.com ? nonexecutiveminer...

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

A mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated. 12 Main Types of Mineral Interests and Royalties | Pheasant Energy pheasantenergy.com ? mineral-interests-types pheasantenergy.com ? mineral-interests-types

As ownership of land changes, NPRIs are commonly created and assigned to whoever the owners want. The amount of revenue the mineral and surface rights generate can make present and past owners want to share in the future resources of their royalty payments.

Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds. Non-Participating Royalty Interest (NPRI) - Calculations, Benefits, Taxes pheasantenergy.com ? non-participating-roy... pheasantenergy.com ? non-participating-roy...

Selling means that you can receive a large cash payment upfront, regardless of minerals found on your land. A company who leases your land may deplete the mineral supply substantially before returning the land back to you. Selling reduces overall risk of handling mineral rights. Benefits of Selling vs Leasing Mineral Rights auctionmineralrights.com ? articles ? benefit... auctionmineralrights.com ? articles ? benefit...

Non-Producing Mineral Rights ? Unleased When an oil and gas company decides they want to drill in an area, they must lease the property. If you are not receiving a royalty check each month and you have not signed a lease agreement, you have non-producing unleased mineral rights.