Colorado Direction For Payment of Royalty to Trustee by Royalty Owners

Description

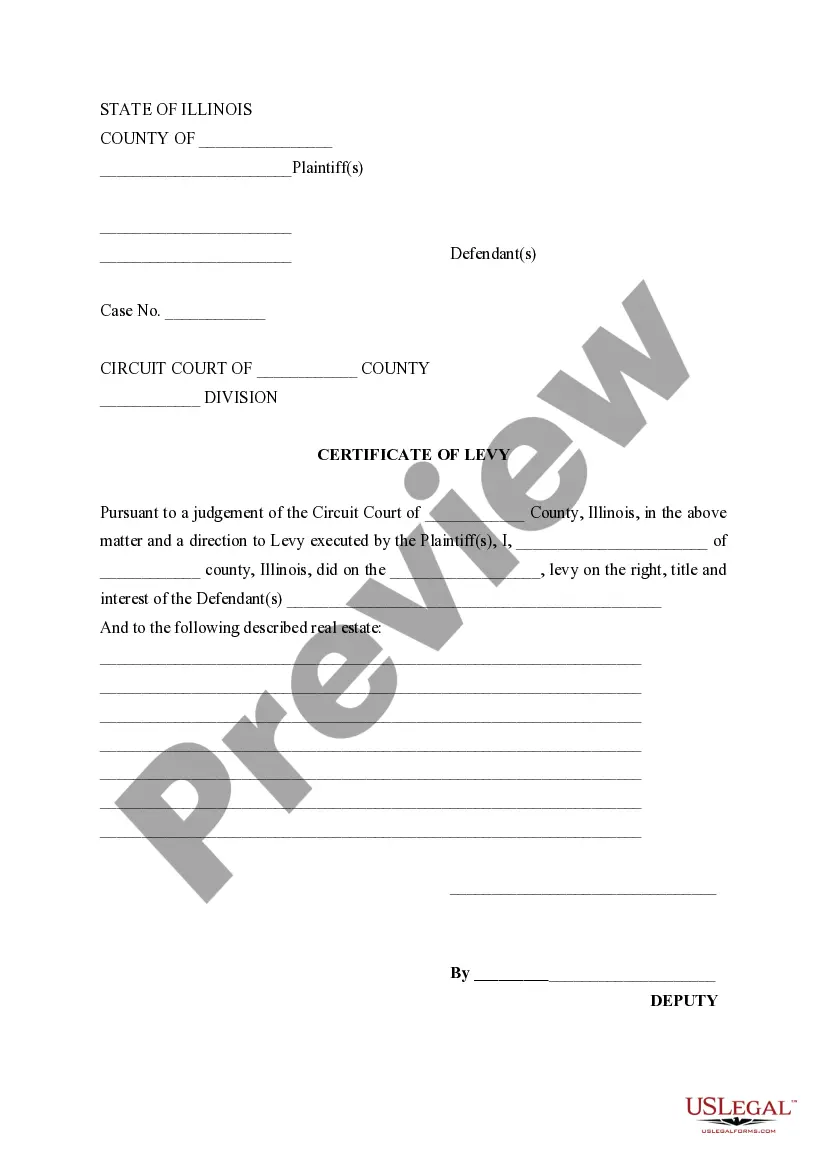

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

Are you presently in the placement in which you will need paperwork for sometimes organization or individual uses nearly every day time? There are a lot of authorized record templates available on the net, but finding ones you can rely on is not easy. US Legal Forms gives thousands of type templates, much like the Colorado Direction For Payment of Royalty to Trustee by Royalty Owners, that are written to meet state and federal requirements.

Should you be previously familiar with US Legal Forms website and have an account, simply log in. Afterward, you can down load the Colorado Direction For Payment of Royalty to Trustee by Royalty Owners format.

Should you not offer an bank account and wish to begin to use US Legal Forms, follow these steps:

- Discover the type you want and make sure it is for that right city/area.

- Take advantage of the Review button to analyze the form.

- Browse the information to actually have selected the right type.

- In the event the type is not what you`re looking for, use the Research field to get the type that meets your requirements and requirements.

- Whenever you obtain the right type, click Acquire now.

- Pick the rates prepare you would like, fill out the required info to generate your account, and buy your order with your PayPal or credit card.

- Choose a hassle-free data file format and down load your backup.

Discover all the record templates you might have purchased in the My Forms food list. You may get a more backup of Colorado Direction For Payment of Royalty to Trustee by Royalty Owners whenever, if required. Just click on the necessary type to down load or print out the record format.

Use US Legal Forms, one of the most considerable selection of authorized varieties, to conserve some time and avoid errors. The service gives appropriately made authorized record templates which can be used for a range of uses. Produce an account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

$0 to $250/acre Non-Producing Mineral Rights Value in Colorado Mineral buyers try to avoid these types of properties. You can expect to sell non-producing mineral rights for under $1,000/acre. The value typically falls in the $0 to $250/acre range. Mineral Rights Value in Colorado - Estimate Value with our Free Guide usmineralexchange.com ? blog ? mineral-ri... usmineralexchange.com ? blog ? mineral-ri...

The State Land Board owns approximately 1.2 million acres of mineral estate where the surface estate above is owned by another party (?split? or ?severed? estate). Under Colorado law, the mineral estate owner is granted rights to access their mineral ownership, even if the surface is owned by another party. Oil & Gas - Colorado State Land Board colorado.gov ? lease ? oil-gas colorado.gov ? lease ? oil-gas

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

Landowner's royalty is a type of payment made to the owner of a piece of land for the use of its resources, such as oil, gas, or minerals. This is similar to a royalty payment made to an author or inventor for the use of their intellectual property.

Understanding Mineral Rights in Colorado The answer would be NO, not automatically. Their next question is ?I bought the property and the deed says I am receiving all right, title, and interest of the seller.? If the seller owned the minerals, then the minerals were also conveyed to you along with the surface.

Inheriting Oil and Gas Royalties: The Transfer Process This process is somewhat similar to inheriting real estate, but with some specific nuances. Will and Probate Process: If the deceased left a will, the mineral rights will be transferred ing to their wishes.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir. How are Mineral Rights Passed Down? - Lovell, Isern & Farabough, LLP. lovell-law.net ? blog ? business-litigation lovell-law.net ? blog ? business-litigation

Since mineral rights can be sold separately from the land itself, even if you own the land, someone else may hold ownership of what's below it. And because of the intrinsic value of what's below the surface, the land itself may come with a price tag much higher than otherwise seen in the area. Mineral Rights: The Hitch That Can Halt a Sale - LANDTHINK landthink.com ? mineral-rights-the-hitch-tha... landthink.com ? mineral-rights-the-hitch-tha...