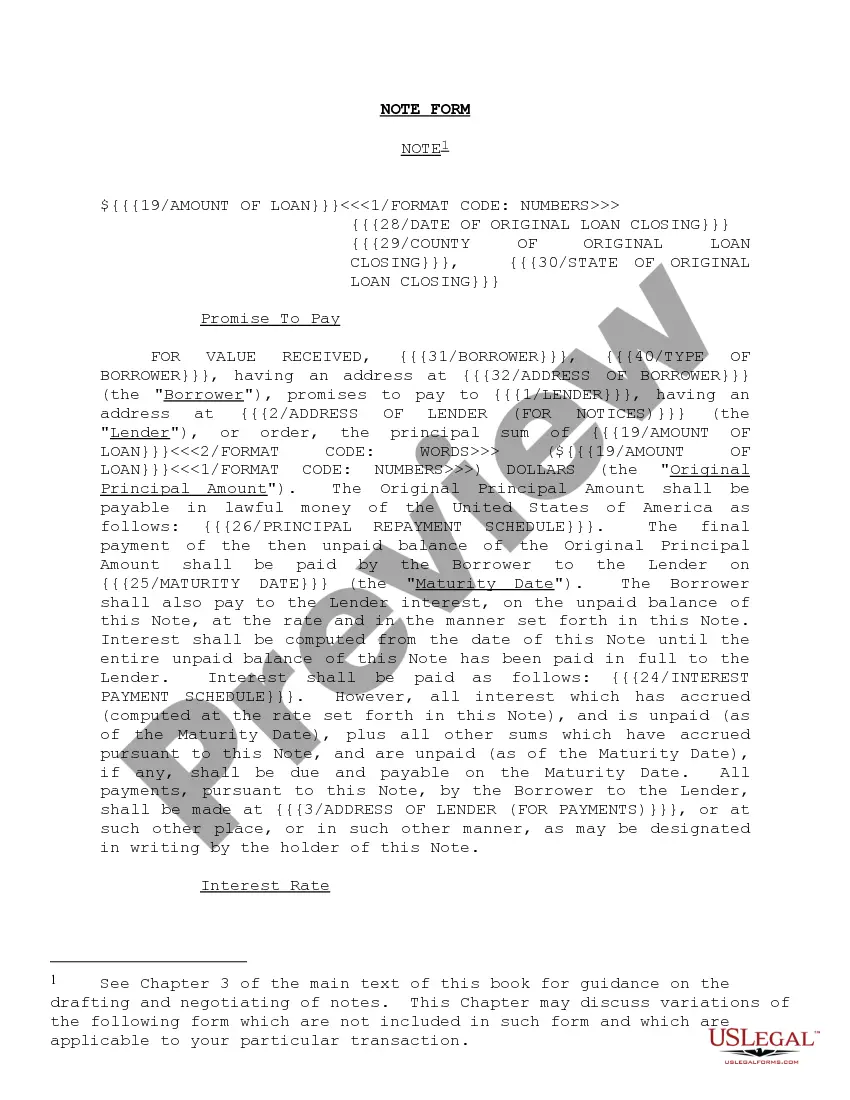

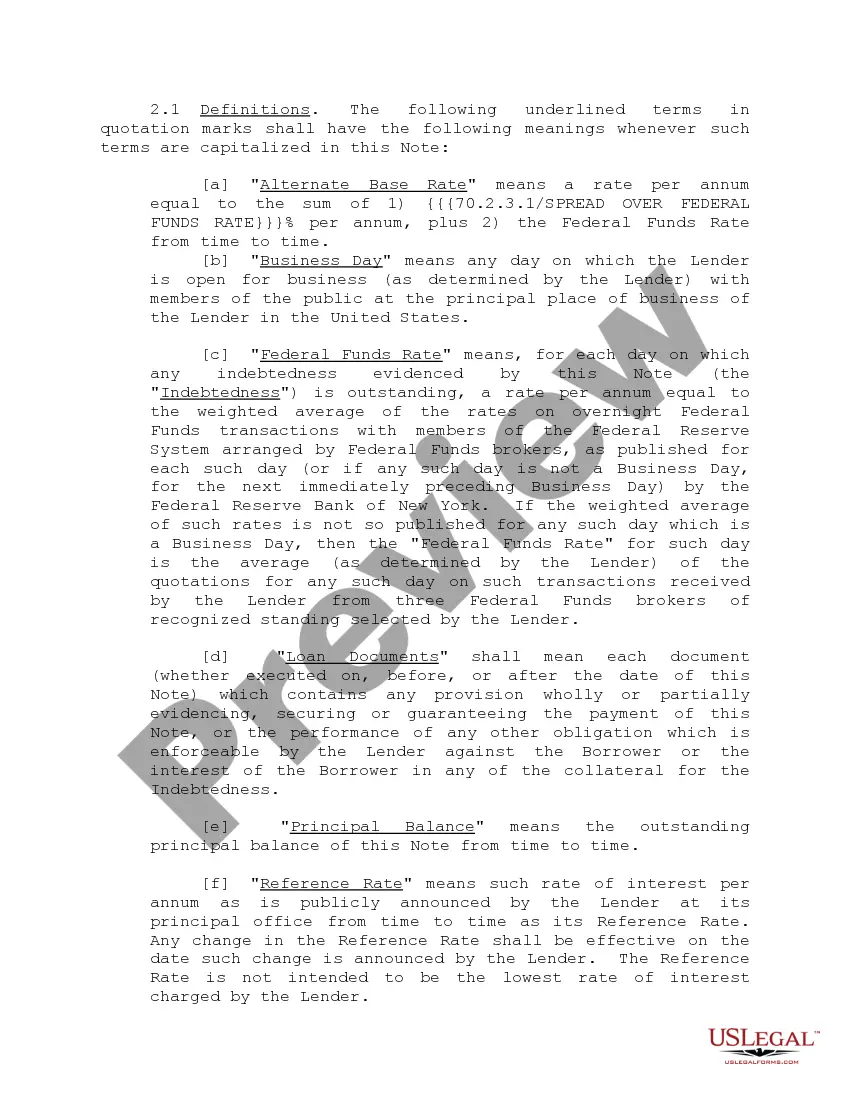

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Colorado Note Form and Variations

Description

How to fill out Note Form And Variations?

Have you been inside a situation where you need to have paperwork for sometimes enterprise or person functions virtually every time? There are tons of legal file templates available on the Internet, but getting ones you can trust isn`t effortless. US Legal Forms gives a huge number of kind templates, like the Colorado Note Form and Variations, which are created to satisfy state and federal specifications.

If you are presently informed about US Legal Forms website and also have a merchant account, just log in. Following that, you are able to download the Colorado Note Form and Variations web template.

If you do not come with an profile and wish to begin to use US Legal Forms, adopt these measures:

- Find the kind you require and make sure it is for your appropriate town/county.

- Use the Review button to check the form.

- Look at the description to actually have chosen the appropriate kind.

- In the event the kind isn`t what you`re trying to find, make use of the Look for area to get the kind that suits you and specifications.

- When you obtain the appropriate kind, simply click Buy now.

- Select the rates strategy you desire, complete the required details to make your bank account, and purchase your order utilizing your PayPal or credit card.

- Select a hassle-free data file formatting and download your backup.

Discover each of the file templates you have bought in the My Forms menu. You can aquire a more backup of Colorado Note Form and Variations any time, if needed. Just select the necessary kind to download or printing the file web template.

Use US Legal Forms, probably the most extensive selection of legal types, to save time and prevent blunders. The assistance gives appropriately made legal file templates which can be used for an array of functions. Generate a merchant account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

If the employee does still want additional Colorado withholding, the employee must complete form DR 0004. If the employee does not want additional withholding, the employee's Colorado withholding should be calculated using the default values from form DR 1098 based on the employee's form W-4.

A withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employee's paycheck. In practice, employees in the United States use Internal Revenue Service (IRS) Form W-4: Employee's Withholding Certificate to calculate and claim their withholding allowance.

A tax override supersedes the use of allowances to determine employee withholding. For example, an employee may request an override to increase withholding to avoid underpayment of taxes at year end. Note: Paychecks are sometimes used to make only non-taxable payments to employees, such as reimbursing expenses.

Coloradans' income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital status. If you work in Aurora, Denver, Glendale, Sheridan or Greenwood Village, you will also have to pay local taxes. These taxes are also flat rates.

In general, an employer must withhold Colorado income tax from all wages paid to any employee who is a Colorado resident, regardless of whether the employee performed services inside or outside of Colorado, or both.

You are not required to complete form DR 0004. For most taxpayers, completing the Colorado Employee Withholding Certificate (DR 0004(opens in new window)) may increase your take-home pay, reduce your Colorado withholding, and reduce your refund when you file your Colorado income tax return.

If an employee asks about adjusting their withholding, you are required to provide form DR 0004 to them. An employee is not required to complete form DR 0004.

This Certificate is Optional for Employees. If you do not complete this certificate, then your employer will calculate your Colorado withholding based on your IRS Form W-4.