Colorado Nursing Agreement - Self-Employed Independent Contractor

Description

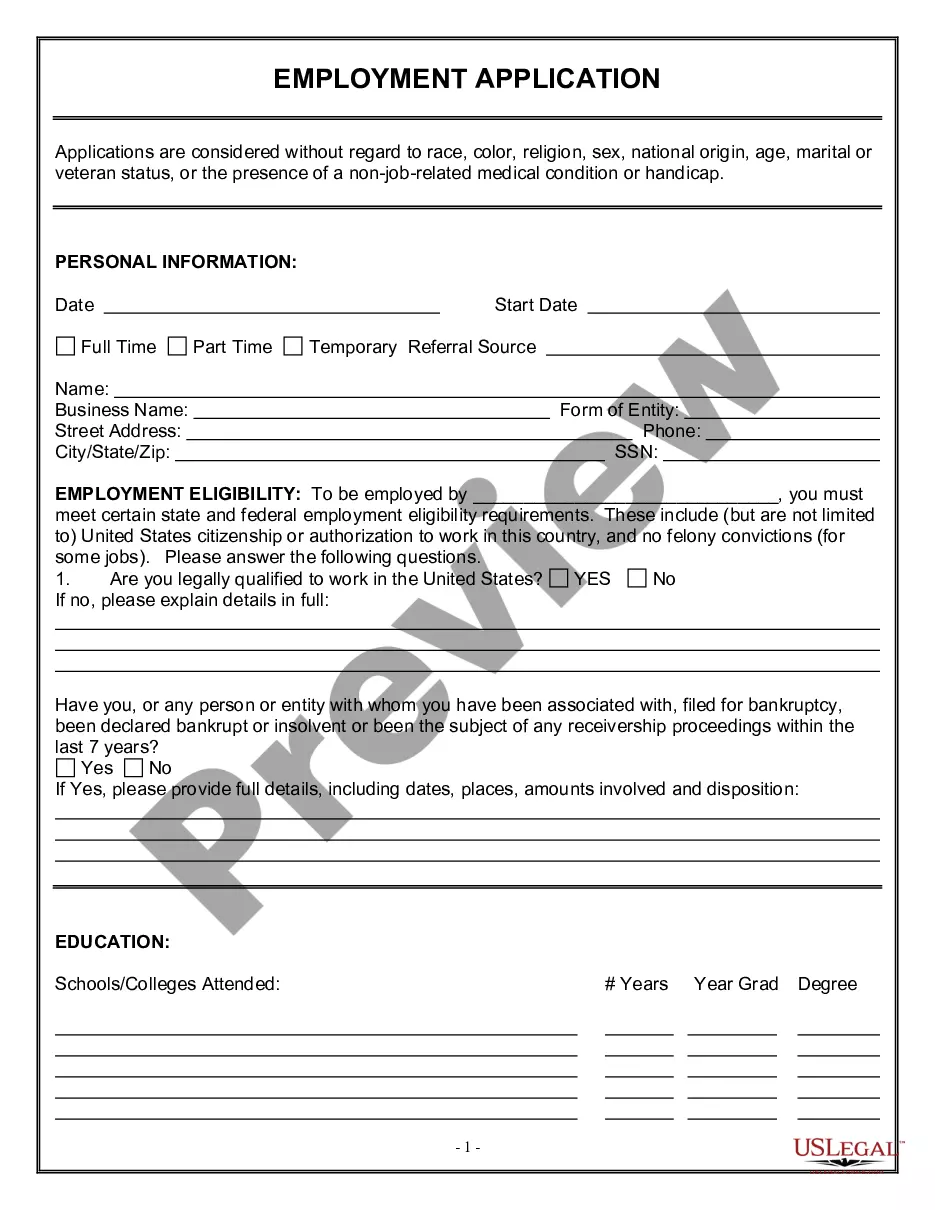

How to fill out Nursing Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most significant libraries of lawful varieties in America - provides a wide array of lawful file themes you are able to acquire or produce. While using web site, you can get 1000s of varieties for enterprise and individual purposes, sorted by groups, says, or keywords.You will discover the newest models of varieties much like the Colorado Nursing Agreement - Self-Employed Independent Contractor within minutes.

If you currently have a monthly subscription, log in and acquire Colorado Nursing Agreement - Self-Employed Independent Contractor through the US Legal Forms catalogue. The Down load button can look on each and every form you view. You have access to all earlier acquired varieties inside the My Forms tab of your accounts.

If you want to use US Legal Forms initially, listed here are simple instructions to help you started out:

- Be sure to have chosen the correct form to your metropolis/county. Click the Preview button to analyze the form`s content material. Read the form outline to actually have chosen the proper form.

- When the form does not suit your specifications, use the Research industry near the top of the screen to find the one which does.

- Should you be content with the form, verify your selection by clicking on the Buy now button. Then, choose the pricing strategy you want and offer your qualifications to register for an accounts.

- Method the purchase. Make use of credit card or PayPal accounts to perform the purchase.

- Choose the file format and acquire the form on the system.

- Make changes. Fill out, modify and produce and sign the acquired Colorado Nursing Agreement - Self-Employed Independent Contractor.

Every web template you added to your money does not have an expiration time which is yours for a long time. So, if you would like acquire or produce another duplicate, just go to the My Forms area and click on around the form you will need.

Gain access to the Colorado Nursing Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most substantial catalogue of lawful file themes. Use 1000s of specialist and condition-specific themes that fulfill your small business or individual needs and specifications.

Form popularity

FAQ

Persons who follow a trade, business or professions such as lawyers, accountants or construction contractors who offer their services to the general public are usually considered independent contractors.

The state now requires that anyone filing a 1099 either has an LLC associated with their operations as a contractor or that they fully incorporate their business.

Under Colorado Law, an individual is presumed to be in covered employment unless and until it is shown that the individual is free from control and direction in the performance of services, both under contract and in fact, and that the individual is customarily engaged in an independent trade, occupation, profession or

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

Pandemic Unemployment Assistance Are (or were) self-employed, an independent contractor, a gig worker, or other non-traditional worker with no W-2 wages. Are not eligible to receive regular unemployment benefits in any state.

Among those who can apply for the benefits are the self-employed, independent contractors and gig workers, like Uber and Lyft drivers, and also anyone who's out of work because of COVID-19.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.