Colorado Self-Employed Referee Or Umpire Employment Contract

Description

How to fill out Self-Employed Referee Or Umpire Employment Contract?

You can spend countless hours online trying to locate the proper legal document format that complies with the federal and state requirements you need. US Legal Forms offers a vast array of legal templates that are vetted by experts. It is easy to obtain or print the Colorado Self-Employed Referee Or Umpire Employment Contract from our service.

If you already have a US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the Colorado Self-Employed Referee Or Umpire Employment Contract. Every legal document format you acquire is yours permanently. To obtain an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

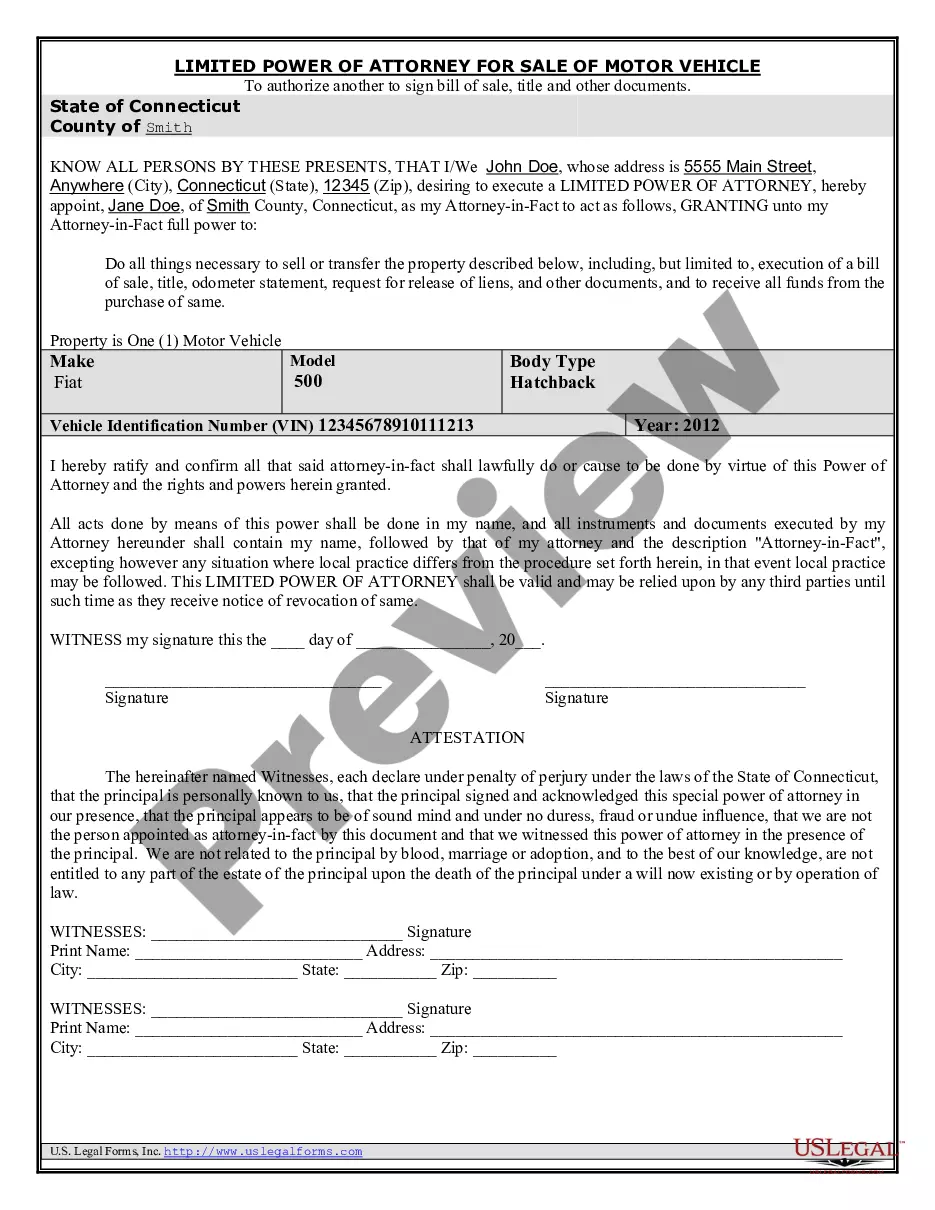

If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below: First, ensure that you have selected the appropriate document format for the region/city that you choose. Review the form description to confirm you have selected the correct form. If available, utilize the Review button to browse through the document format as well.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you wish to obtain another version of your form, utilize the Search field to find the format that meets your needs and requirements.

- Once you have identified the format you desire, click on Buy now to continue.

- Select the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal form.

- Choose the format of your document and download it to your device.

- Make changes to your document if necessary. You can complete, modify and sign and print the Colorado Self-Employed Referee Or Umpire Employment Contract.

- Download and print thousands of document templates using the US Legal Forms site, which offers the largest selection of legal forms. Use professional and state-specific templates to meet your business or personal needs.

Form popularity

FAQ

You can easily download a Colorado Self-Employed Referee Or Umpire Employment Contract from the US Legal Forms platform. This website offers a variety of customizable legal documents tailored to your needs, ensuring that you have the right contract for your specific situation. Simply search for the desired employment contract, make any necessary adjustments, and download it instantly. Using US Legal Forms simplifies the process, allowing you to focus on your officiating duties with confidence.

In Colorado, an independent contractor works for themselves and retains control over how they complete their tasks, while an employee works under the direction of an employer. This distinction is crucial for those entering into a Colorado Self-Employed Referee Or Umpire Employment Contract, as it determines tax responsibilities, benefits eligibility, and legal protections. Understanding this difference helps you navigate your rights and obligations effectively. When you engage in self-employment as a referee or umpire, knowing your status can help you make informed decisions regarding contracts and finances.

In Colorado, an independent contractor agreement does not need to be notarized to be legally binding. However, having a notarized document adds a layer of security and trust for both parties involved. If you are considering a Colorado Self-Employed Referee Or Umpire Employment Contract, it can be beneficial to ensure that all terms are clearly outlined and agreed upon. Therefore, whether or not to notarize may depend on your specific situation and the preferences of the parties.

Reporting referee income involves keeping detailed records of all your earnings and related expenses. You should track each game you officiate and note the fees received, which will help during tax season. It's essential to consult with a tax professional and use a Colorado Self-Employed Referee Or Umpire Employment Contract to ensure you have proper documentation for your income sources.

To be considered self-employed, you must work for yourself and own your business or trade. This includes managing your schedule, taking risks, and earning profits independently. If you are a referee operating without a traditional employer, you likely fit this definition, making it essential to have a Colorado Self-Employed Referee Or Umpire Employment Contract to outline your working relationship and terms.

Yes, employment contracts are enforceable in Colorado as long as they meet specific legal criteria. These contracts must include mutual consent, consideration, and a lawful purpose. For referees, creating a Colorado Self-Employed Referee Or Umpire Employment Contract ensures that both parties understand their rights, obligations, and the scope of the work involved.

Refereeing is typically viewed as self-employment when officials operate on a freelance basis. This structure allows referees to negotiate their terms and agreements with various sports organizations. Having a solid Colorado Self-Employed Referee Or Umpire Employment Contract can clarify the nature of this self-employment arrangement and provide legal assurance.

Yes, referees are generally considered self-employed if they work independently and are not contracted to a single employer. This means they can set their own hours and accept assignments as they choose. Being self-employed offers flexibility, but it is crucial to have a proper Colorado Self-Employed Referee Or Umpire Employment Contract to protect your rights and outline your responsibilities.

The income for referees in Colorado varies based on the level of competition, the frequency of games, and the sport. On average, you can expect to earn between $30 to $80 per game. For those with experience or officiating at higher levels, this amount can increase significantly. Understanding the financial aspects is essential, especially when drafting a Colorado Self-Employed Referee Or Umpire Employment Contract.

Yes, umpires are often designated as independent contractors, especially in various sports settings. This status allows them flexibility over their work arrangements while also establishing responsibilities through specific agreements. When crafting or reviewing a Colorado Self-Employed Referee or Umpire Employment Contract, it's important to clarify these conditions to avoid misunderstandings.