Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Are you presently in a role where you require documents for frequent business or personal use almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't straightforward.

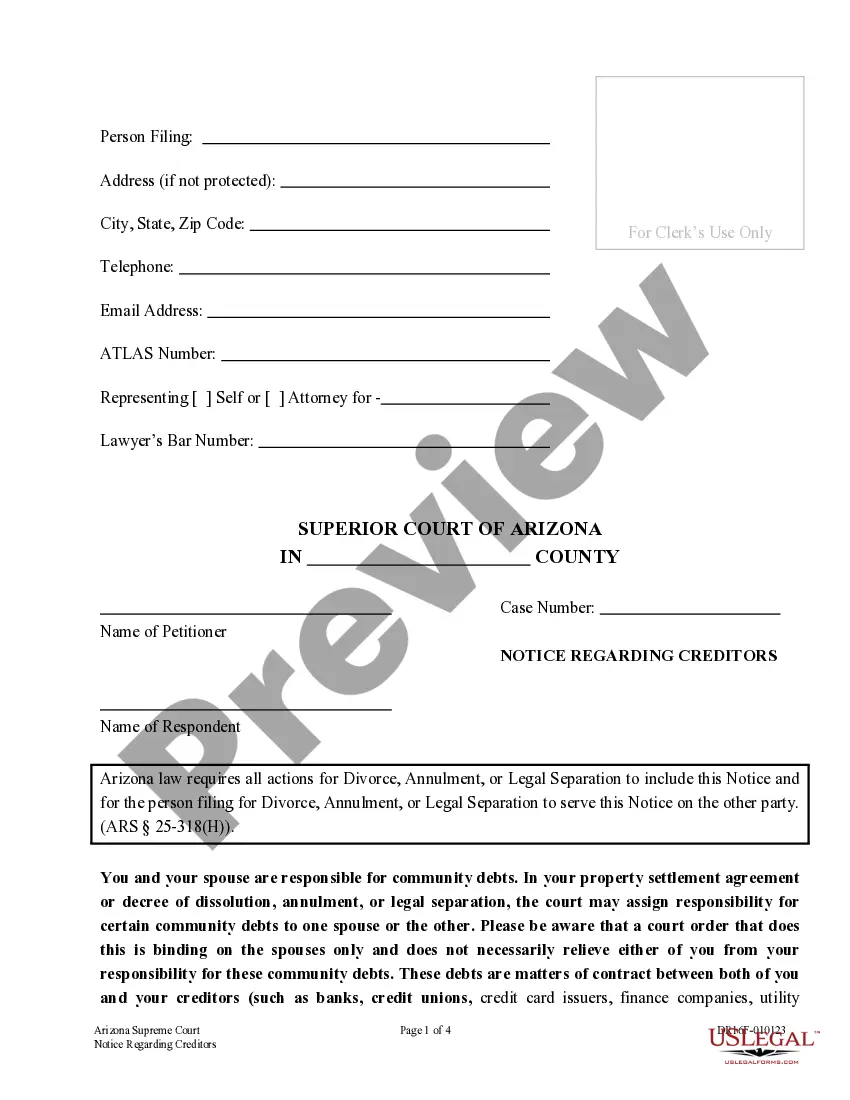

US Legal Forms provides thousands of document templates, including the Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form, which can be completed to satisfy federal and state regulations.

When you find the appropriate document, click on Buy now.

Select the pricing plan you want, enter the necessary information to create your account, and make the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for your correct state/region.

- Use the Preview button to review the document.

- Read the description to confirm you have selected the correct document.

- If the document isn't what you're looking for, use the Search field to locate the document that fits your needs and requirements.

Form popularity

FAQ

A strong hardship letter clearly explains your current financial situation and the reasons you are seeking a loan modification. Include specific details about factors that have impacted your income, such as job loss or medical emergencies, while emphasizing your commitment to keeping your home. By following the Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can structure your letter to address all necessary points effectively. A well-crafted hardship letter can make a positive difference in the outcome of your loan modification request.

To complete the loan modification process effectively, you'll need specific documents to support your request. Typically, you should gather your current loan documents, proof of income, tax returns, recent bank statements, and a hardship letter. For detailed guidelines, refer to the Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form available at US Legal Forms. Ensuring you have these documents ready can significantly streamline your application process.

A hardship letter for a mortgage is a written explanation of your financial difficulties and the reasons you are unable to make your mortgage payments. This letter is often included with your Request for Loan Modification and Affidavit RMA Form. To craft an effective hardship letter, be clear and honest about your situation, demonstrating your eligibility for assistance.

In real estate, RMA stands for 'Request for Mortgage Assistance', a term that highlights the borrower’s need for help with their mortgage payments. This concept is fundamentally tied to the loan modification process. Using the Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form can guide you through seeking assistance effectively.

The full form of RMA is 'Request for Mortgage Assistance'. This form is pivotal for homeowners looking to change their mortgage terms due to financial hardship. By following the Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form, borrowers can navigate this essential process with ease.

The process for a loan modification typically starts with submitting a completed Request for Loan Modification and Affidavit RMA Form to your lender. After this, lenders will review your financial information and may ask for additional documentation. Staying organized during this process can significantly enhance your chances of securing favorable modifications.

RMA in mortgage refers to the Request for Mortgage Assistance process. It is designed to help borrowers who face financial difficulties by providing them with solutions like loan modifications. By utilizing the Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form, mortgage holders can effectively communicate their financial situation to lenders.

The RMA mortgage form is a document that homeowners submit to their lender to request assistance with their mortgage. It serves as a formal request for a loan modification or other options to improve the terms of a mortgage. Understanding how to fill out the Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form is essential for receiving the help you need.

The full form of RMA in mortgage is 'Request for Mortgage Assistance'. This term is common in the context of seeking modifications on a mortgage. To properly complete the Request for Loan Modification and Affidavit RMA Form, you must understand the significance of this acronym and its role in the process.

A loan modification form is a legal document used to change the terms of a loan agreement between a borrower and a lender. The Colorado Instructions for Completing Request for Loan Modification and Affidavit RMA Form provide clear guidance on filling out this important document. Completing this form allows borrowers to request adjustments to their loan, which may include changes in interest rates or payment schedules. Using a reliable service like US Legal Forms can help you complete this process efficiently.