Colorado Sample Identity Theft Policy for FCRA and FACTA Compliance

Description

How to fill out Sample Identity Theft Policy For FCRA And FACTA Compliance?

Are you within a placement the place you need files for sometimes enterprise or specific purposes virtually every day time? There are plenty of authorized file themes available online, but discovering versions you can rely on isn`t simple. US Legal Forms gives a huge number of kind themes, such as the Colorado Sample Identity Theft Policy for FCRA and FACTA Compliance, which can be published in order to meet state and federal needs.

When you are already knowledgeable about US Legal Forms site and possess an account, basically log in. Following that, you can acquire the Colorado Sample Identity Theft Policy for FCRA and FACTA Compliance format.

Should you not have an account and need to begin using US Legal Forms, adopt these measures:

- Find the kind you want and ensure it is for your appropriate town/county.

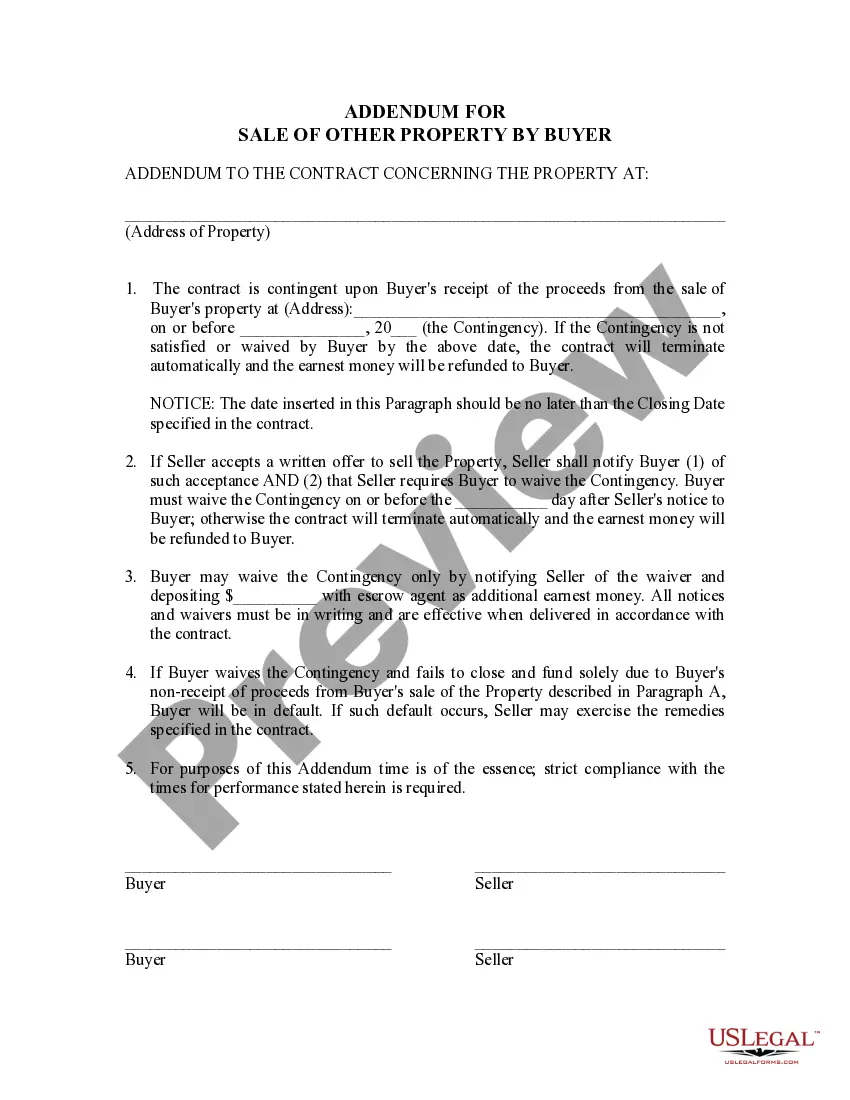

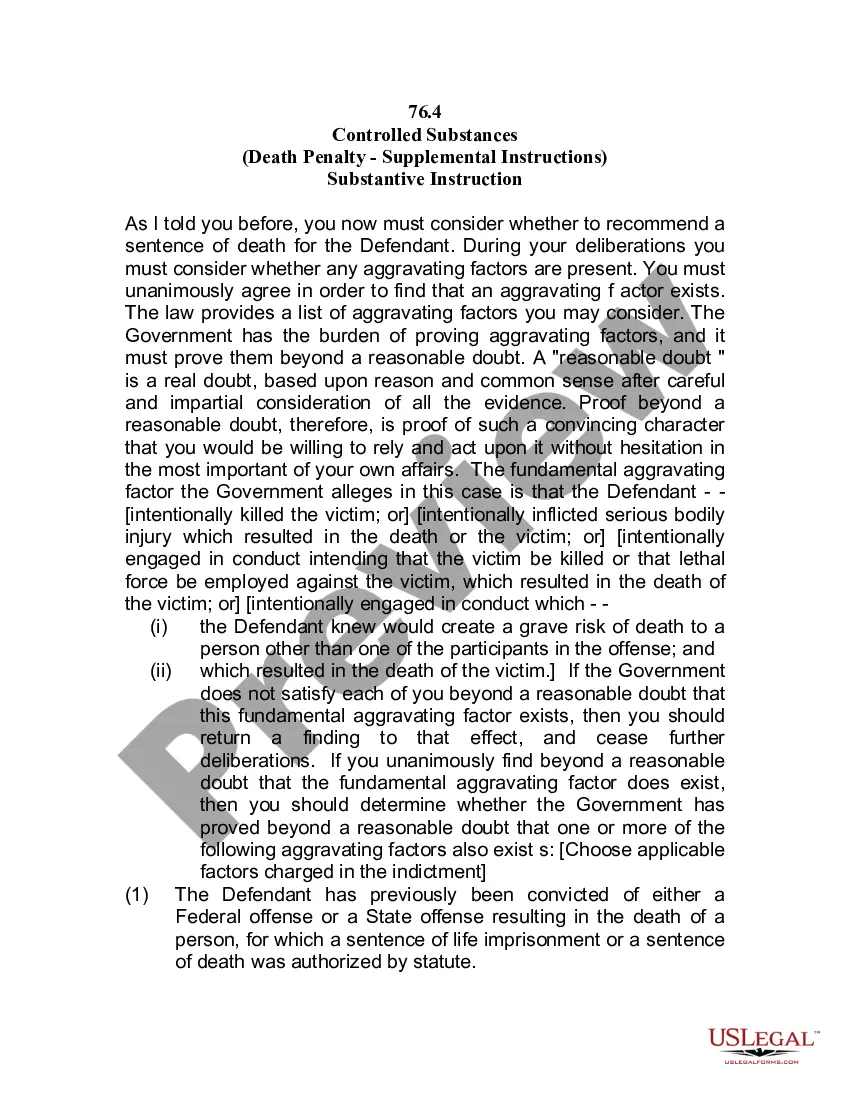

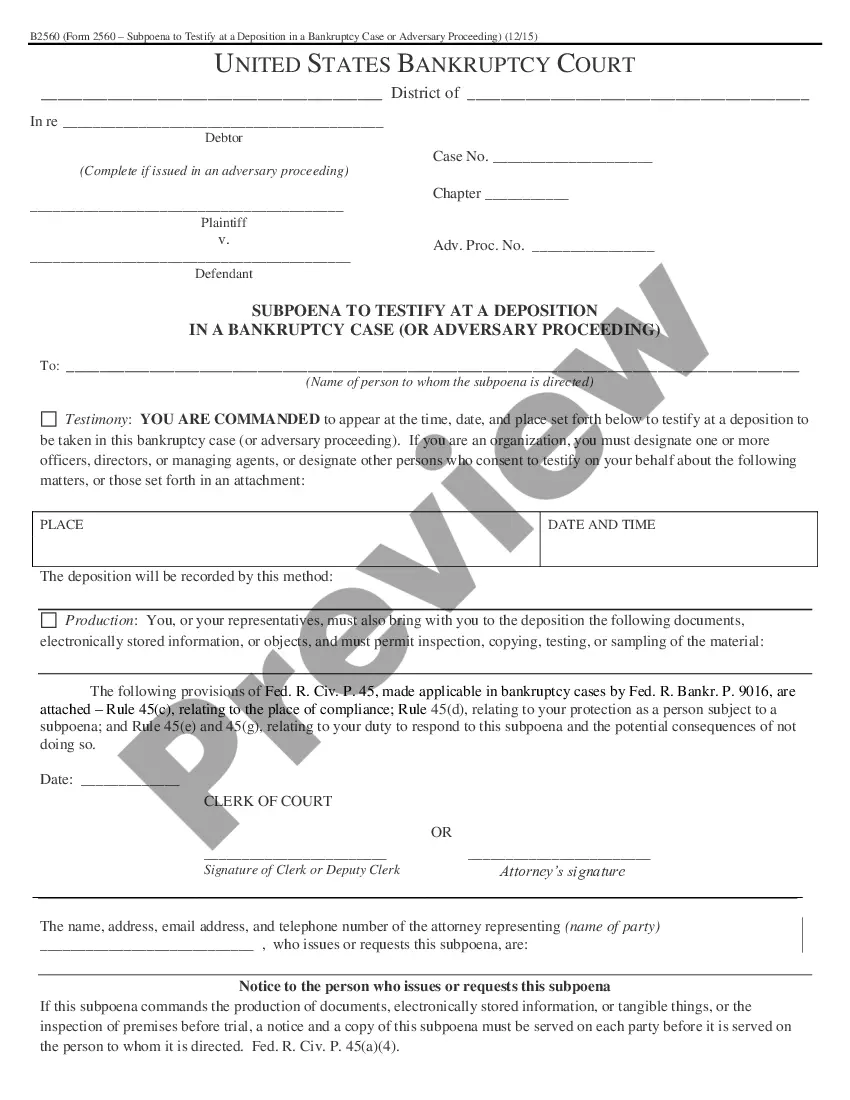

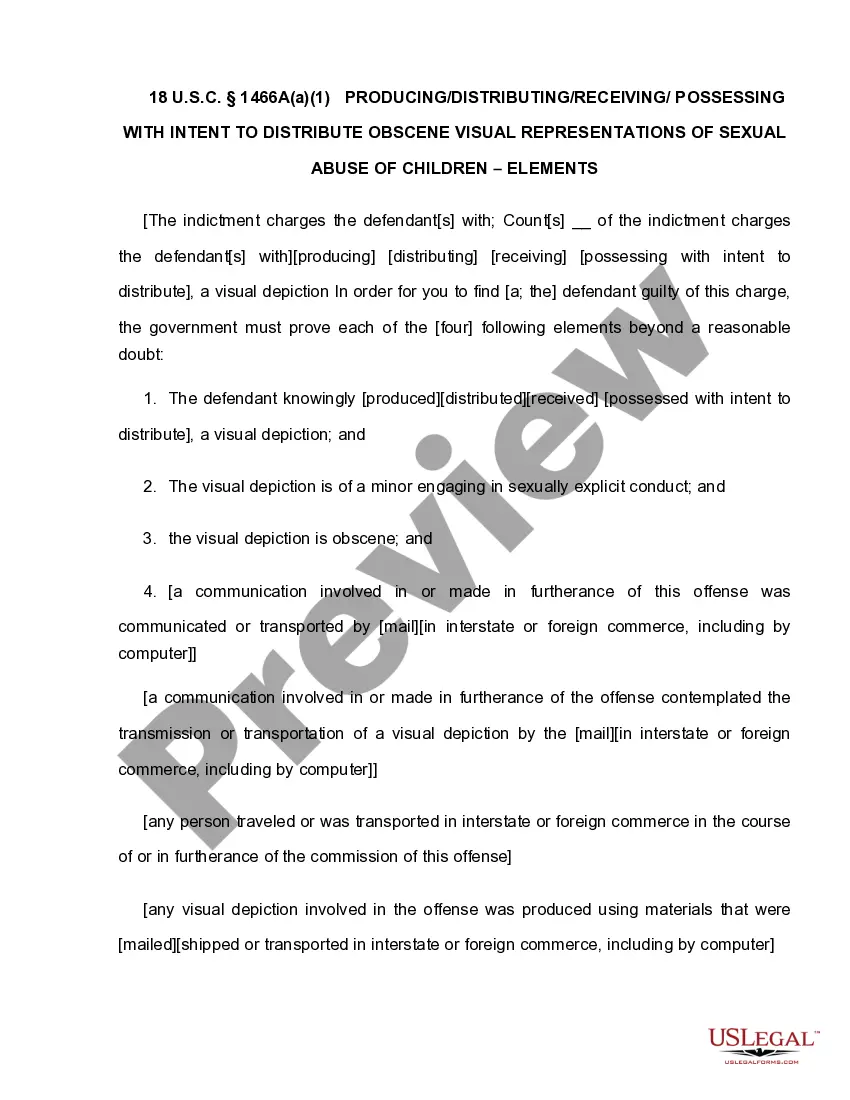

- Utilize the Review option to check the shape.

- Browse the information to ensure that you have selected the correct kind.

- If the kind isn`t what you`re looking for, utilize the Research area to obtain the kind that suits you and needs.

- Whenever you get the appropriate kind, just click Purchase now.

- Choose the prices strategy you want, complete the required info to produce your money, and pay money for an order making use of your PayPal or charge card.

- Pick a hassle-free data file file format and acquire your duplicate.

Get all of the file themes you possess bought in the My Forms food list. You may get a further duplicate of Colorado Sample Identity Theft Policy for FCRA and FACTA Compliance anytime, if necessary. Just select the essential kind to acquire or print out the file format.

Use US Legal Forms, the most extensive variety of authorized kinds, to save time and steer clear of blunders. The services gives appropriately made authorized file themes which you can use for a variety of purposes. Make an account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

Complying with the FCRA Tell the applicant or employee that you might use information in their consumer report for decisions related to their employment. ... Get written permission from the applicant or employee. ... Certify compliance to the company from which you are getting the applicant or employee's information.

Colorado law defines identity theft as using someone else's personal or financial identifying information, without permission, to make a payment or to obtain anything of value. Identity theft can be prosecuted as a class 4 felony punishable by 2 to 6 years in prison and up to $500,000.00 in fines.

The Red Flags Rule requires organizations to implement a written identity theft prevention program to help them identify any of the relevant ?red flags? that indicate identity theft in daily operations. The Rule also offers steps to help prevent the crime and to mitigate its damage.

A red flag is a pattern, practice, or activity that indicates a possibility of identity theft. These flags produce a three digit score (0-999) that calculates the customer's fraud risk through the credit report. A higher score indicates a lower risk of identity fraud.

Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers. What's a red flag? The FTC defines a red flag as a pattern, practice or specific activity that indicates the possible existence of identity theft.

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to ?red flags??patterns, practices or specific activities?that could indicate identity theft.

FACTA amends the Fair Credit Reporting Act (FCRA) to: help consumers combat identity theft; establish national standards for the regulation of consumer report information; assist consumers in controlling the type and amount of marketing solicitations they receive; and.

The Red Flags Rule requires that each "financial institution" or "creditor"?which includes most securities firms?implement a written program to detect, prevent and mitigate identity theft in connection with the opening or maintenance of "covered accounts." These include consumer accounts that permit multiple payments ...