Colorado Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

Finding the right lawful file template can be a battle. Needless to say, there are a lot of templates accessible on the Internet, but how can you find the lawful kind you will need? Use the US Legal Forms web site. The assistance delivers thousands of templates, including the Colorado Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property, that can be used for business and private needs. All of the varieties are inspected by professionals and satisfy federal and state requirements.

Should you be presently listed, log in to the accounts and then click the Download key to find the Colorado Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property. Make use of accounts to look from the lawful varieties you have ordered previously. Check out the My Forms tab of your own accounts and get an additional copy in the file you will need.

Should you be a fresh end user of US Legal Forms, listed here are basic directions that you can stick to:

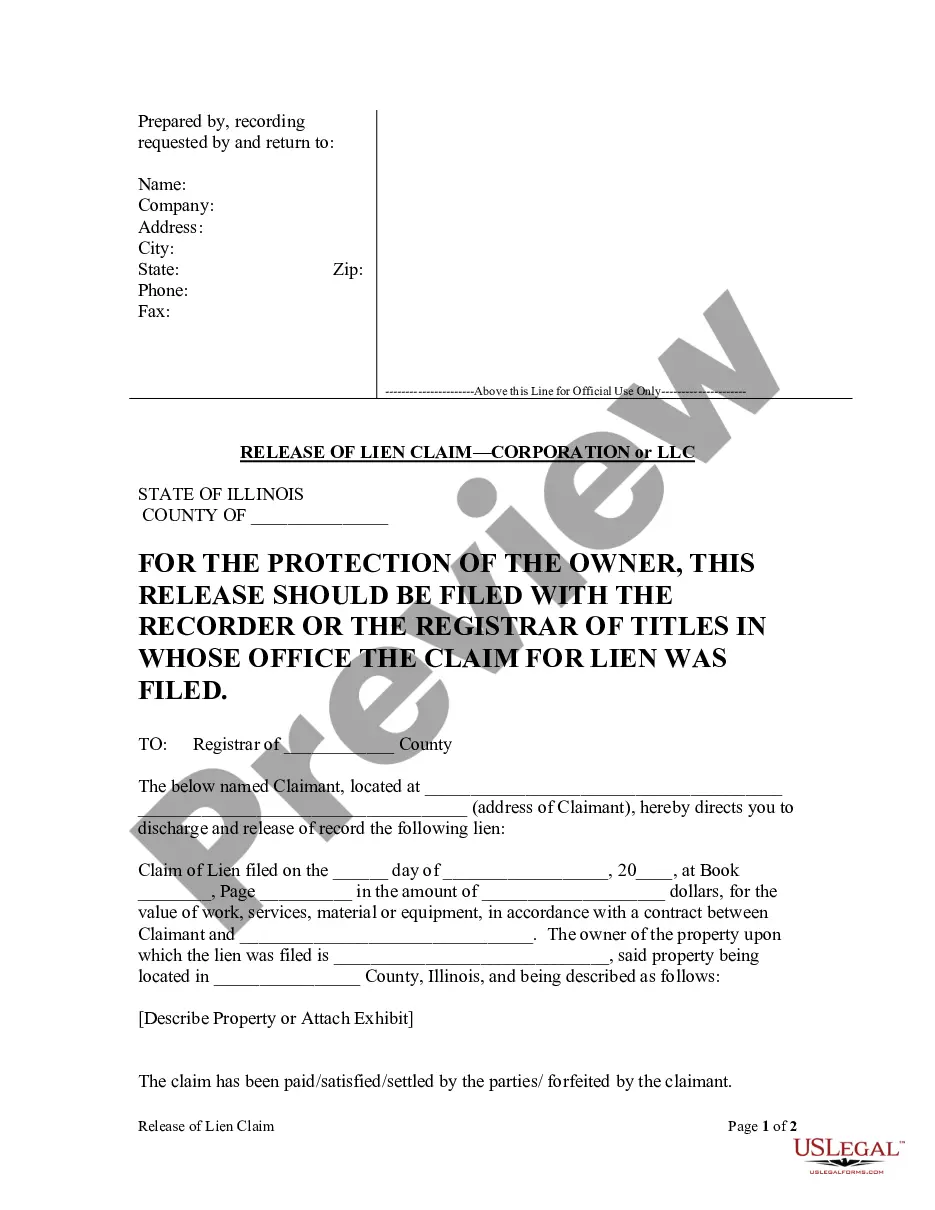

- First, ensure you have chosen the correct kind for your town/state. You may look through the shape using the Preview key and look at the shape outline to ensure it will be the right one for you.

- In case the kind is not going to satisfy your needs, use the Seach area to get the proper kind.

- Once you are positive that the shape is acceptable, go through the Purchase now key to find the kind.

- Choose the costs plan you would like and enter the essential information. Design your accounts and purchase your order using your PayPal accounts or charge card.

- Select the data file formatting and down load the lawful file template to the system.

- Complete, revise and produce and signal the received Colorado Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property.

US Legal Forms will be the greatest collection of lawful varieties for which you can see different file templates. Use the company to down load professionally-made documents that stick to condition requirements.

Form popularity

FAQ

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

This means that all heirs do not have to agree on what to do with the property in order for it to be sold. If even one co-owner wants to sell the property, a partition action will force the sale of the inherited property. An experienced partition attorney can ensure the best outcome for co-owners who disagree.

What is Interstate Succession? In Colorado, if you die without a will, your assets are distributed to your closest relatives under the Colorado interstate succession laws. In various states, the interstate succession process occurs when someone without a valid will or other legal declaration passes away.

When the deceased is survived by only a spouse (no children or parents), the surviving spouse inherits the entire probate estate. The same applies when the decedent (person who died) is survived by a spouse and children, but only if all of the children are also the children of the surviving spouse.

Unless the will explicitly states otherwise, inheriting a house with siblings means that ownership of the property is distributed equally. The siblings can negotiate whether the house will be sold and the profits divided, whether one will buy out the others' shares, or whether ownership will continue to be shared.

There is no need for all heirs to agree to sell a property if it is still in probate. The heirs need to petition the court for approval to sell the property. If they file a suit for partition, the court can order a property sale.

Per Colorado Revised Statutes, the legal next-of-kin is designated to the following person(s) and progresses in the following order: Personal representative or special administrator of the deceased individual's estate. The surviving spouse of the deceased, if not legally separated.

Heirs must survive the decedent by at least 120 hours. Decedent's brothers and sisters (and descendants of any pre-deceased brothers and sisters) are the heirs. And If no descendants survive the decedent, surviving parents are also heirs, unless the decedent is survived by a designated beneficiary.

How do I legally disclaim my inheritance? be in writing; declare who the disclaimer is; describe the interest (property) disclaimed, signed by the disclaimer; and. delivered to the personal representative, or trustee of the estate; or. filed with the court proceeding over the estate.