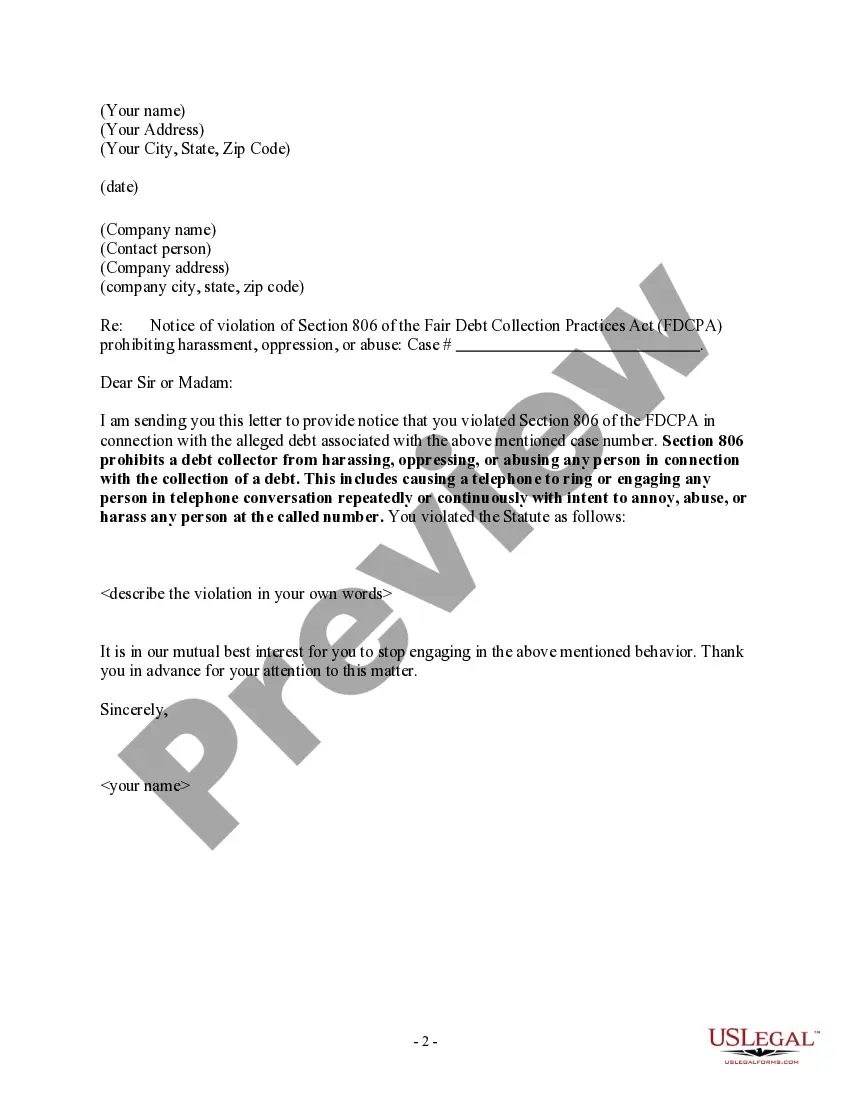

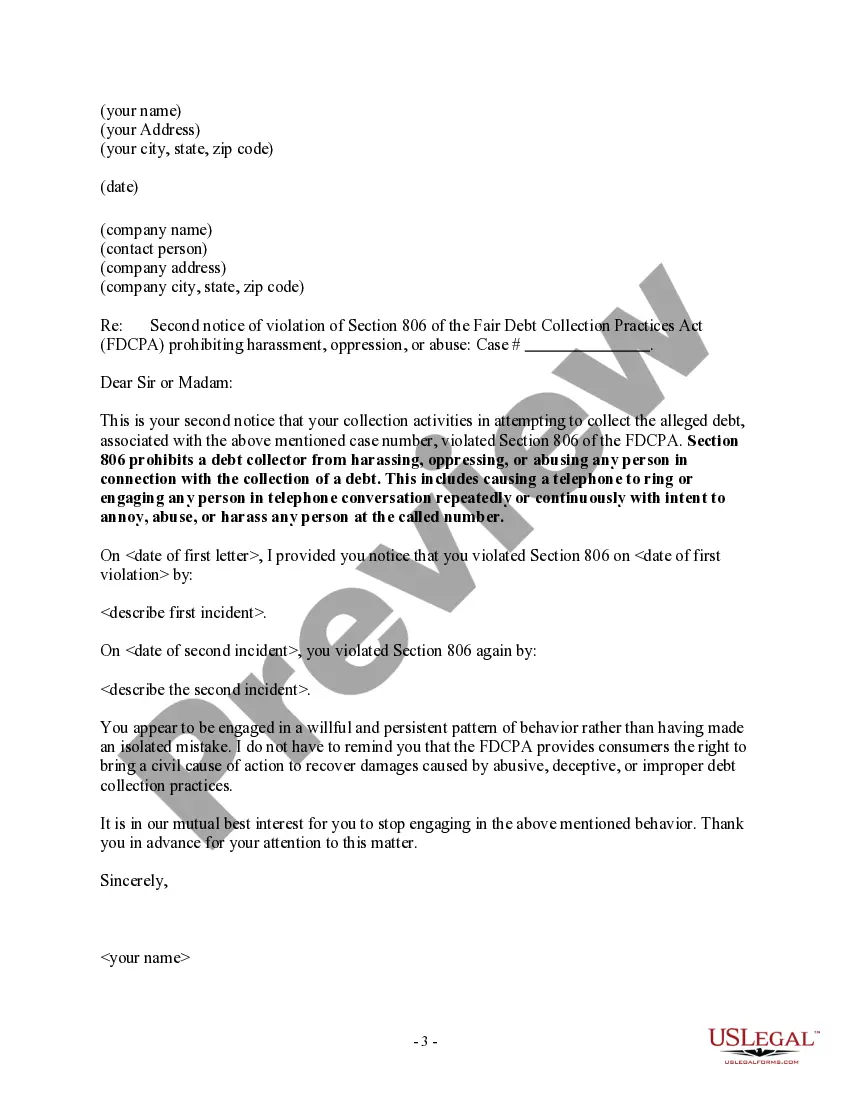

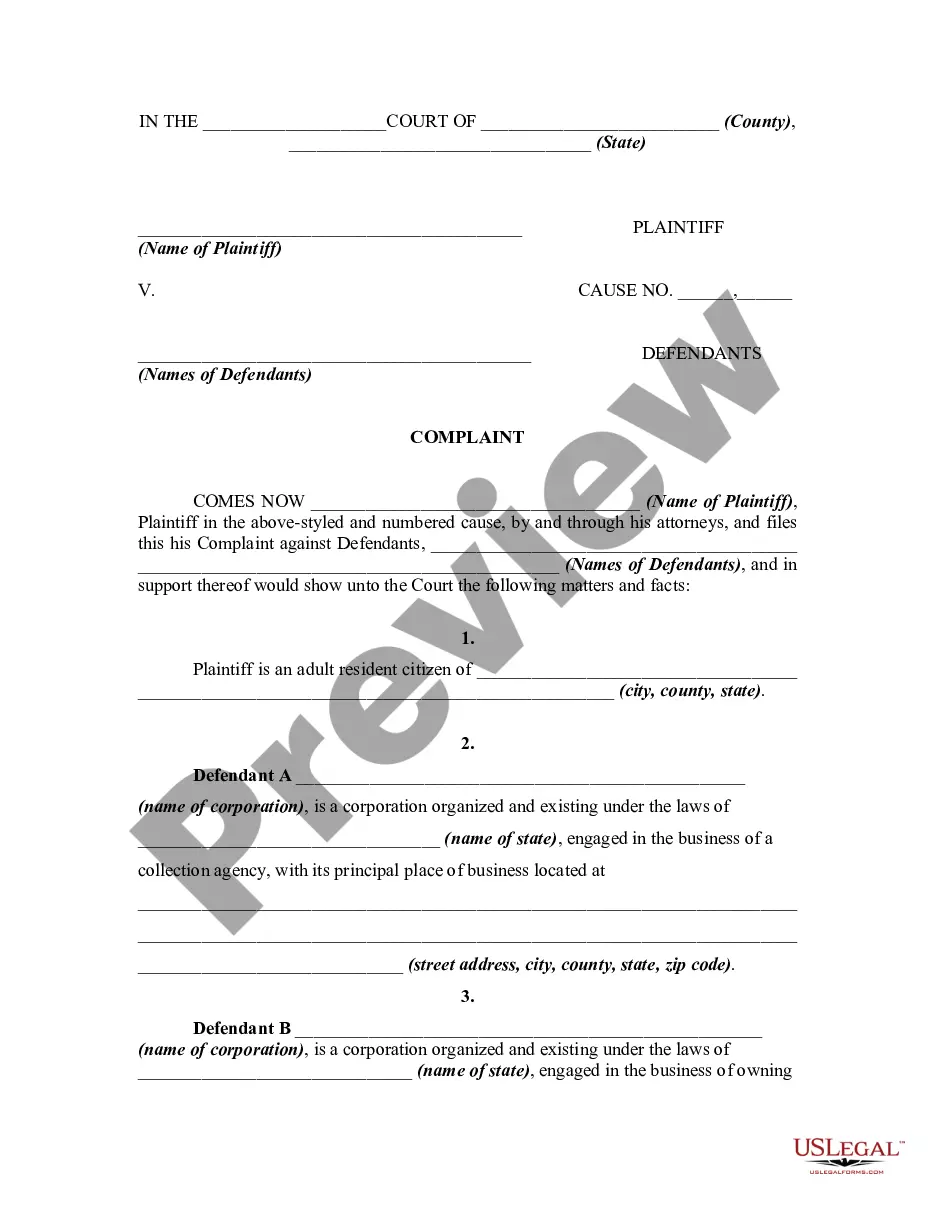

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously with intent to annoy, abuse, or harass any person at the called number.

Colorado Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls

Description

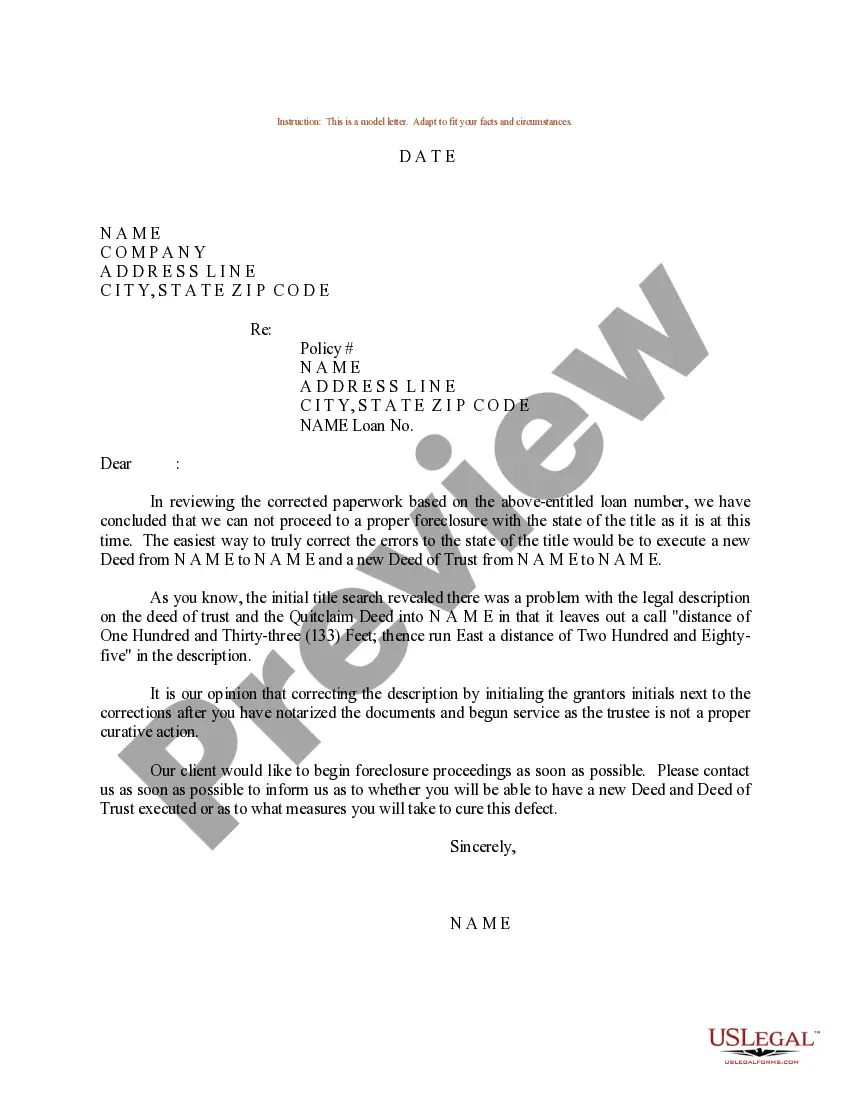

How to fill out Notice To Debt Collector - Unlawful Repeated Or Continuous Telephone Calls?

Selecting the optimal legal document format can be a challenge.

Certainly, there are numerous templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, such as the Colorado Notice to Debt Collector - Illegal Repeated or Continuous Phone Calls, which can be utilized for both business and personal purposes.

You can preview the form and read the form description to confirm it is suitable for you.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log Into your account and click the Obtain button to access the Colorado Notice to Debt Collector - Illegal Repeated or Continuous Phone Calls.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Alberta and Nova Scotia have a similar "three strikes" rule limiting the amount of contact from collectors within a seven-day consecutive period.

How often do I have to get these calls to make it harassment? Just one unwelcome call can be harassing; but usually your local phone company will not take action unless the calls are frequent.

If you have two outstanding debts, then your debt collector can call you once per debt, resulting in two calls per day max. If a debt collector calls you more than one time per debt each day, this is harassment, and it is illegal.

The FDCPA prohibits debt collectors from calling you repeatedly, using profane language, making threats, or otherwise harassing you. If a debt collector is constantly calling you and causing you stress, sending a cease and desist letter can stop the collector from harassing you.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.