US Legal Forms - among the largest libraries of authorized varieties in the United States - gives an array of authorized record templates you can download or produce. Using the website, you can get a large number of varieties for enterprise and personal purposes, categorized by types, states, or key phrases.You can get the most recent models of varieties just like the Colorado Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law within minutes.

If you already possess a subscription, log in and download Colorado Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law from your US Legal Forms local library. The Down load option will appear on each and every type you look at. You have accessibility to all in the past saved varieties inside the My Forms tab of your own bank account.

If you wish to use US Legal Forms the very first time, allow me to share basic guidelines to help you get started out:

- Make sure you have selected the correct type to your city/county. Go through the Preview option to check the form`s articles. Look at the type outline to ensure that you have chosen the appropriate type.

- In the event the type does not satisfy your specifications, take advantage of the Search field on top of the display screen to find the one who does.

- Should you be pleased with the form, confirm your selection by visiting the Purchase now option. Then, pick the rates program you want and provide your accreditations to register for an bank account.

- Method the financial transaction. Make use of your charge card or PayPal bank account to finish the financial transaction.

- Select the structure and download the form on your own system.

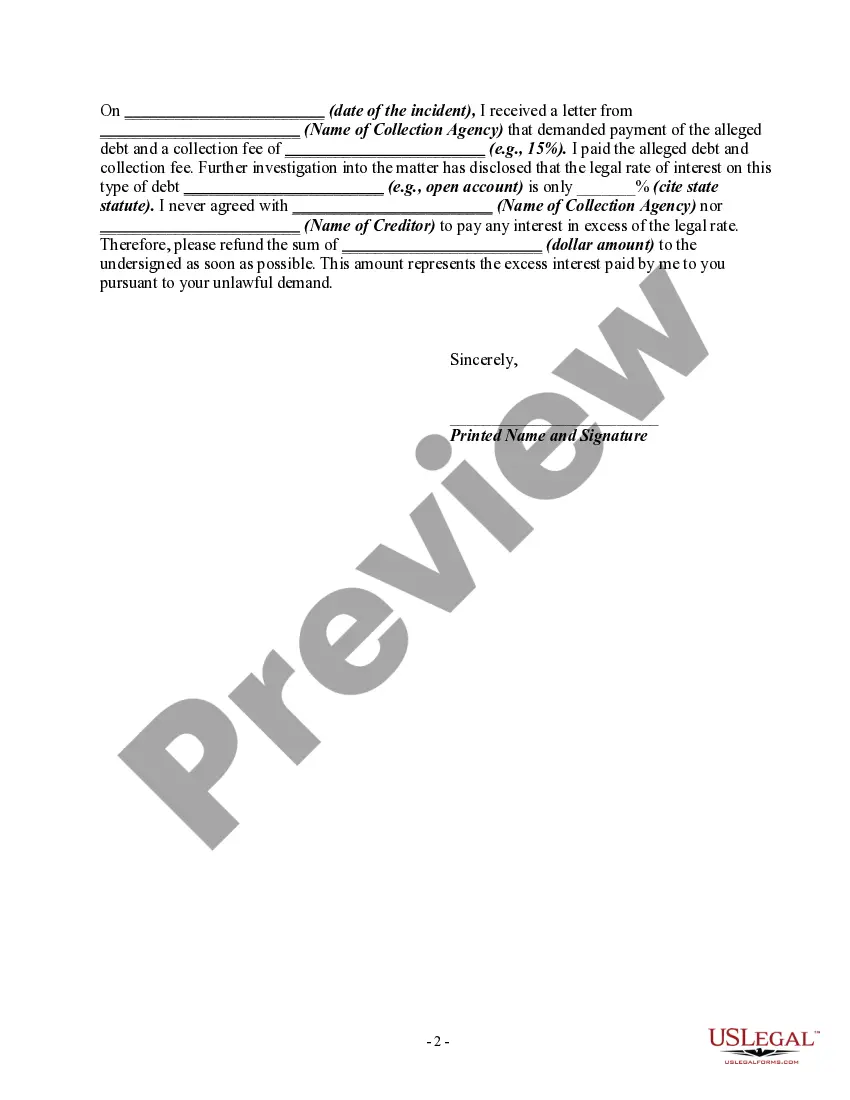

- Make modifications. Fill up, edit and produce and indicator the saved Colorado Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law.

Every web template you added to your money lacks an expiry day and is your own for a long time. So, if you want to download or produce yet another version, just go to the My Forms area and then click around the type you need.

Obtain access to the Colorado Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law with US Legal Forms, by far the most considerable local library of authorized record templates. Use a large number of expert and status-certain templates that meet your business or personal demands and specifications.

(2) identify collection practices of creditors and debt collectors experienced byauthorized by the agreement creating the debt or permitted by law; and. The law: Collectors are not allowed to call repeatedly just to harass you. However, there is no specific number of calls specified in the FDCPA ...Unfair and unreasonable debt collection practices by debt collectors,The California statute applies to the debt collection activity of both original ...49 pagesMissing: Colorado ? Must include: Colorado

unfair and unreasonable debt collection practices by debt collectors,The California statute applies to the debt collection activity of both original ... The Fair Debt Collection Practices Act is a federal law that governs practices by third-party debt collectors ? those who buy a delinquent debt from an ... Under the CARES Act, a servicer of federally backed mortgage loan mayand that bar debt collectors from bringing collection lawsuits. from unscrupulous collectors, whether or not there is a valid debt. The FDCPA broadly prohibits unfair or unconscionable collection methods; ... If you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they ... When you purchase a property in a community with a homeowners' association, you're also acquiring the obligation to pay regular assessments. By RA Monteith · 1996 · Cited by 2 ? It has been accepted for inclusion in Land & Water Law Review by an authorized editor of Law Archive of Wyoming. Scholarship. Page 2. Collecting Debt in Wyoming ... It is legal for a debt collector to call your family or friends,Fair Debt Collection Practices Act (FDCPA); When Can Debt Collectors ...