Iowa Proposal to Approve Adoption of Employees' Stock Option Plan

Description

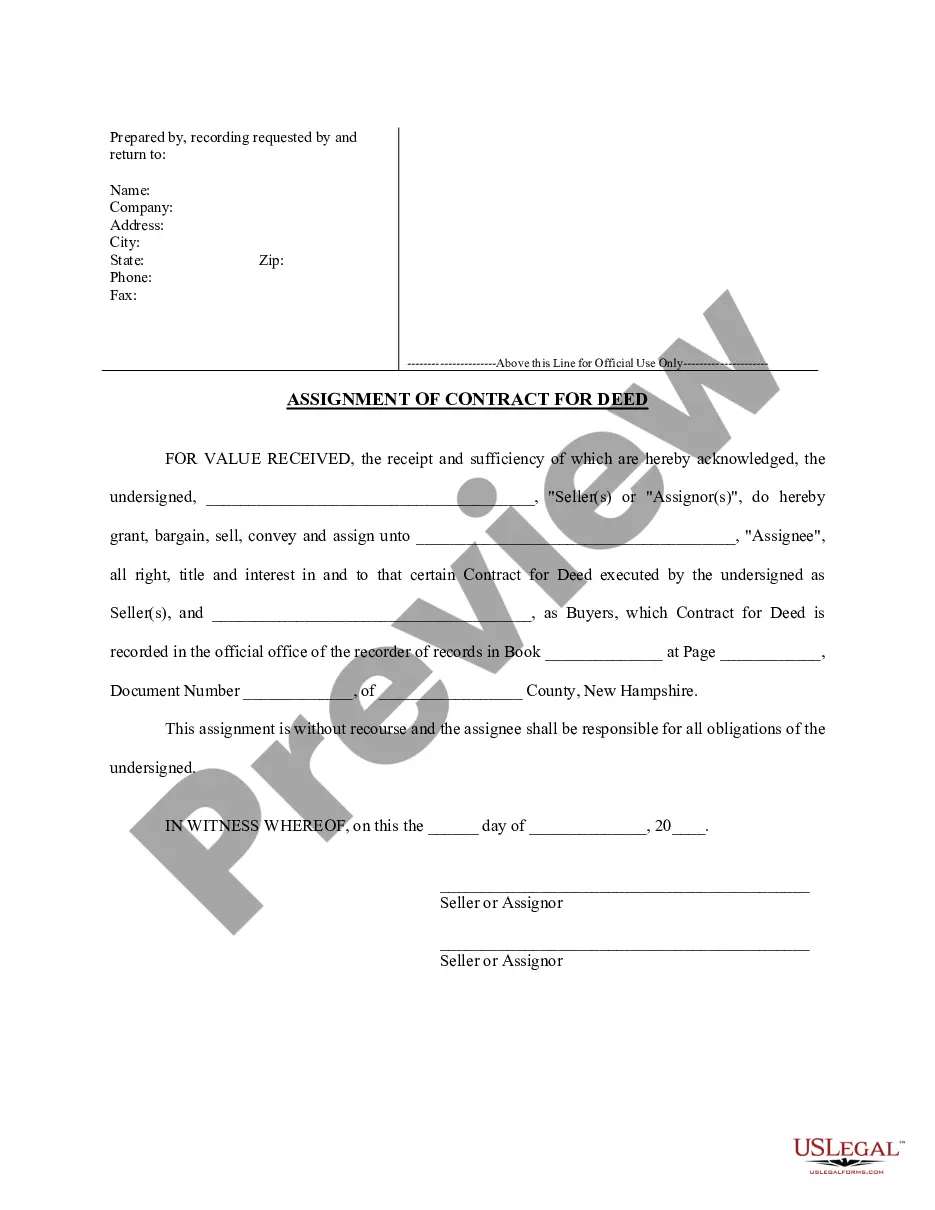

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

If you want to total, download, or print out authorized document layouts, use US Legal Forms, the most important assortment of authorized varieties, that can be found on the web. Make use of the site`s easy and convenient look for to obtain the files you want. Different layouts for company and individual uses are categorized by categories and claims, or search phrases. Use US Legal Forms to obtain the Iowa Proposal to Approve Adoption of Employees' Stock Option Plan in just a few click throughs.

Should you be previously a US Legal Forms buyer, log in in your bank account and then click the Acquire option to get the Iowa Proposal to Approve Adoption of Employees' Stock Option Plan. You can even gain access to varieties you in the past downloaded from the My Forms tab of your own bank account.

If you are using US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for the right town/nation.

- Step 2. Use the Review option to check out the form`s content material. Do not forget to learn the information.

- Step 3. Should you be unsatisfied using the type, take advantage of the Look for discipline towards the top of the monitor to locate other types from the authorized type web template.

- Step 4. Once you have located the shape you want, click the Buy now option. Select the costs prepare you prefer and add your qualifications to sign up to have an bank account.

- Step 5. Approach the financial transaction. You may use your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Select the file format from the authorized type and download it on your device.

- Step 7. Total, change and print out or indicator the Iowa Proposal to Approve Adoption of Employees' Stock Option Plan.

Each and every authorized document web template you purchase is yours eternally. You may have acces to each and every type you downloaded inside your acccount. Click the My Forms section and select a type to print out or download yet again.

Contend and download, and print out the Iowa Proposal to Approve Adoption of Employees' Stock Option Plan with US Legal Forms. There are thousands of skilled and status-particular varieties you can use for your company or individual needs.

Form popularity

FAQ

In approximately seven States and Puerto Rico, prospective parents must be at least age 18 to be eligible to adopt. 4 Three States (Colorado, Delaware, and Oklahoma) and American Samoa set the age at 21; and Georgia and Idaho specify age 25. Who May Adopt, Be Adopted, or Place a Child for Adoption? Child Welfare Information Gateway (.gov) ? pubpdfs ? parties Child Welfare Information Gateway (.gov) ? pubpdfs ? parties PDF

If you are adopting an adult, you need to file the adoption petition with the state court located in the county where the adult who is being adopted lives (or is domiciled). If you are adopting a minor, you can file the adoption petition in the county where you live or where the child lives. Iowa Code section 600.3. The Adoption Process in Iowa - People's Law Library of Iowa People's Law Library of Iowa ? family-law ? adopti... People's Law Library of Iowa ? family-law ? adopti...

Any adult over the age of 18 is eligible to adopt a child in Iowa. There is no legal adoption age limit in Iowa, although adoption professionals may take prospective adoptive parents' ages into account when they apply for a certain kind of adoption process.

If you've been convicted of a felony that involves any kind of abuse, assault or domestic violence, it is highly unlikely that the state of Iowa would allow you to adopt a child. Requirements to Adopt a Child in Iowa - American Adoptions American Adoptions ? iowa-adoption American Adoptions ? iowa-adoption

Here is the average adoption cost for three popular adoption processes: Private Domestic Infant Adoption: $37,000. International Adoption: $42,000. Foster Care Adoption: $2,622. How Much Does Adoption Cost in Iowa? - Nelson Law Firm nlfiowa.com ? other-adoption-info ? adoption-costs nlfiowa.com ? other-adoption-info ? adoption-costs