Colorado Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company

Description

How to fill out Standstill Agreement Of Grossmans, Inc. - Internal Agreement Regarding Shareholders Of Single Company?

US Legal Forms - one of the biggest libraries of legal kinds in America - delivers an array of legal document themes you are able to download or printing. Making use of the website, you may get a huge number of kinds for enterprise and person functions, categorized by types, says, or keywords.You will discover the latest models of kinds just like the Colorado Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company in seconds.

If you currently have a membership, log in and download Colorado Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company in the US Legal Forms catalogue. The Down load key can look on each and every develop you see. You gain access to all in the past delivered electronically kinds within the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, here are straightforward recommendations to obtain started:

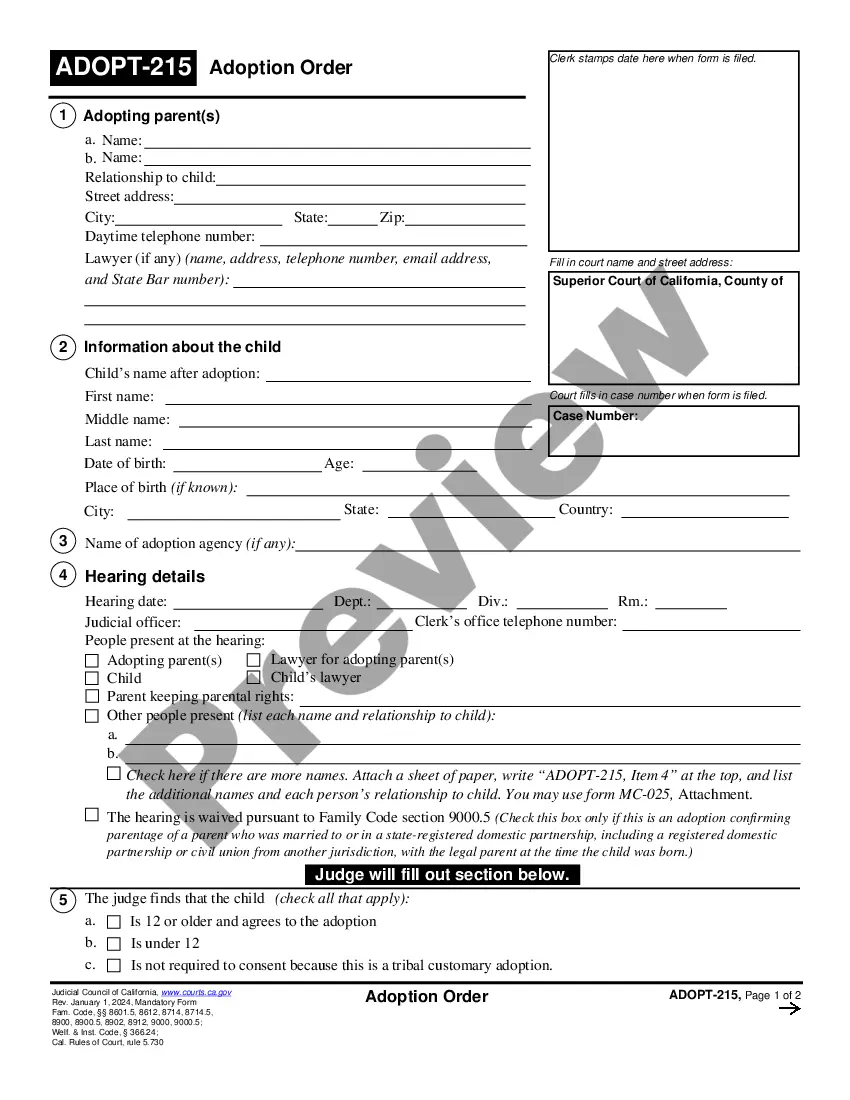

- Ensure you have chosen the proper develop for your personal metropolis/region. Click the Review key to analyze the form`s content material. Read the develop explanation to ensure that you have chosen the right develop.

- When the develop does not fit your demands, utilize the Look for area on top of the display screen to obtain the one who does.

- If you are happy with the shape, validate your selection by clicking the Acquire now key. Then, opt for the rates program you favor and offer your credentials to sign up for the profile.

- Process the financial transaction. Make use of your bank card or PayPal profile to finish the financial transaction.

- Pick the file format and download the shape in your device.

- Make adjustments. Load, change and printing and signal the delivered electronically Colorado Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company.

Each design you put into your bank account lacks an expiration particular date and is yours forever. So, if you want to download or printing an additional version, just visit the My Forms section and click on on the develop you require.

Obtain access to the Colorado Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company with US Legal Forms, probably the most substantial catalogue of legal document themes. Use a huge number of expert and state-certain themes that satisfy your business or person requirements and demands.

Form popularity

FAQ

An agreement in which a hostile bidder agrees to limit its holdings in a target company. A standstill agreement stops the takeover bid from progressing for a period of time.

A standstill agreement is a contract that contains provisions that govern how a bidder of a company can purchase, dispose of, or vote stock of the target company. A standstill agreement can effectively stall or stop the process of a hostile takeover if the parties cannot negotiate a friendly deal.

A standstill agreement is a contract that contains provisions that govern how a bidder of a company can purchase, dispose of, or vote stock of the target company. A standstill agreement can effectively stall or stop the process of a hostile takeover if the parties cannot negotiate a friendly deal.

A standstill provision prevents the party receiving confidential information of a company from engaging in a hostile acquisition transaction or taking steps towards a hostile acquisition transaction for a period (often one to three years) or, if applicable, for so long as the recipient party holds at least a certain ...