Colorado Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

Are you currently in the place where you need to have documents for sometimes organization or personal reasons almost every day time? There are plenty of lawful record layouts available on the Internet, but getting types you can depend on is not easy. US Legal Forms offers a large number of form layouts, like the Colorado Personal Property - Schedule B - Form 6B - Post 2005, that are composed to satisfy federal and state requirements.

Should you be currently knowledgeable about US Legal Forms site and get a free account, just log in. Following that, it is possible to download the Colorado Personal Property - Schedule B - Form 6B - Post 2005 web template.

Unless you have an accounts and want to start using US Legal Forms, follow these steps:

- Get the form you require and make sure it is to the proper city/region.

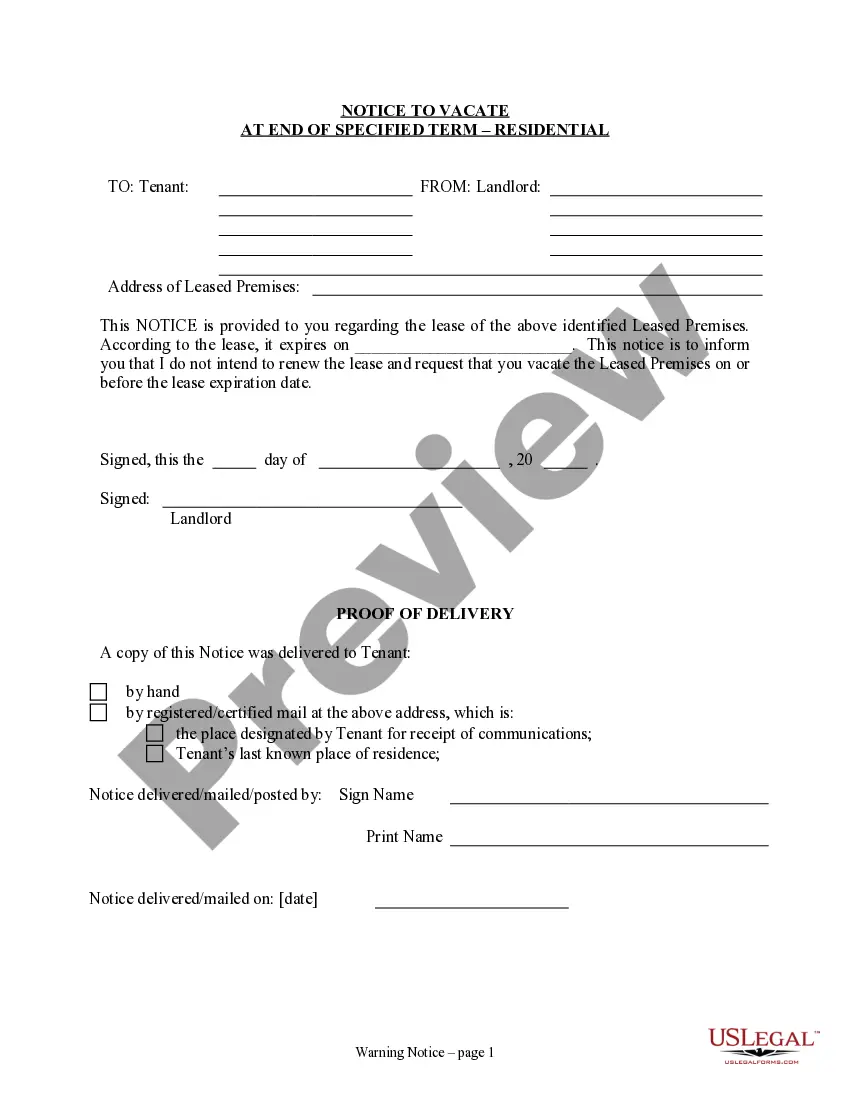

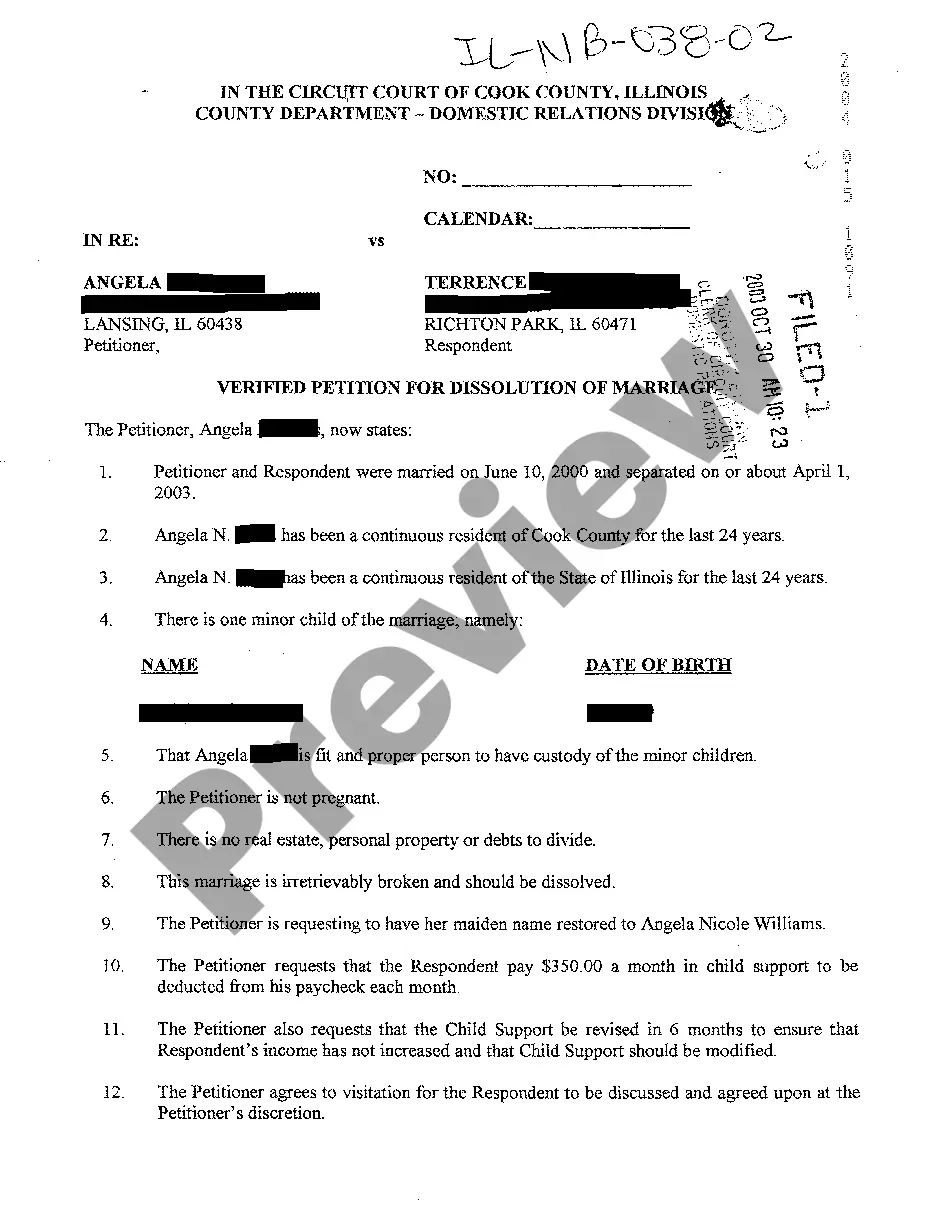

- Make use of the Preview switch to examine the form.

- Read the explanation to ensure that you have selected the appropriate form.

- When the form is not what you`re trying to find, make use of the Search area to obtain the form that fits your needs and requirements.

- Once you get the proper form, just click Buy now.

- Opt for the prices plan you want, fill out the specified details to produce your money, and purchase the transaction with your PayPal or Visa or Mastercard.

- Select a convenient document structure and download your backup.

Get each of the record layouts you have purchased in the My Forms menus. You may get a additional backup of Colorado Personal Property - Schedule B - Form 6B - Post 2005 anytime, if possible. Just click on the required form to download or printing the record web template.

Use US Legal Forms, probably the most considerable collection of lawful types, to save lots of efforts and prevent mistakes. The assistance offers appropriately created lawful record layouts which you can use for a variety of reasons. Produce a free account on US Legal Forms and commence creating your life easier.

Form popularity

FAQ

State Sales Tax Exempt Products & Services Food, including food sold through vending machines. ... Residential Energy Usage(opens in new window) - all gas, electricity, coal, wood and fuel oil. Medical Equipment & Medicine. Coins and Precious Metal Bullion. Farm Equipment. Seeds, Plants and Trees. Pesticides.

Colorado imposes sales tax on retail sales of tangible personal property. In general, the tax does not apply to sales of services, except for those services specifically taxed by law.

Colorado's sales tax is a transactional tax charged when a buyer purchases tangible personal property or benefits from certain taxable services in Colorado. The State of Colorado imposes a sales tax of 2.9% on retail sales transactions of 17 cents or more.

All personal property is taxable unless it is specifically exempt by law. Exemptions include, but are not limited to: inventories for resale, materials and supplies consumed, agricultural equipment used on the farm or ranch to produce agricultural products, ag and livestock products, and livestock.

All personal property is taxable in Colorado unless it is specifically exempted by law. Generally, assets cannot be "expensed" for ad valorem purposes and fully depreciated assets remain taxable. However, there are exemptions for certain types of personal property that may apply.

All personal property is taxable unless it is specifically exempt by law. Exemptions include, but are not limited to: inventories for resale, materials and supplies consumed, agricultural equipment used on the farm or ranch to produce agricultural products, ag and livestock products, and livestock.

The property owner must be at least 65 years old and have owned and occupied the property as his or her primary residence for the 10 years immediately preceding the assessment date.