Colorado Check Requisition Worksheet

Description

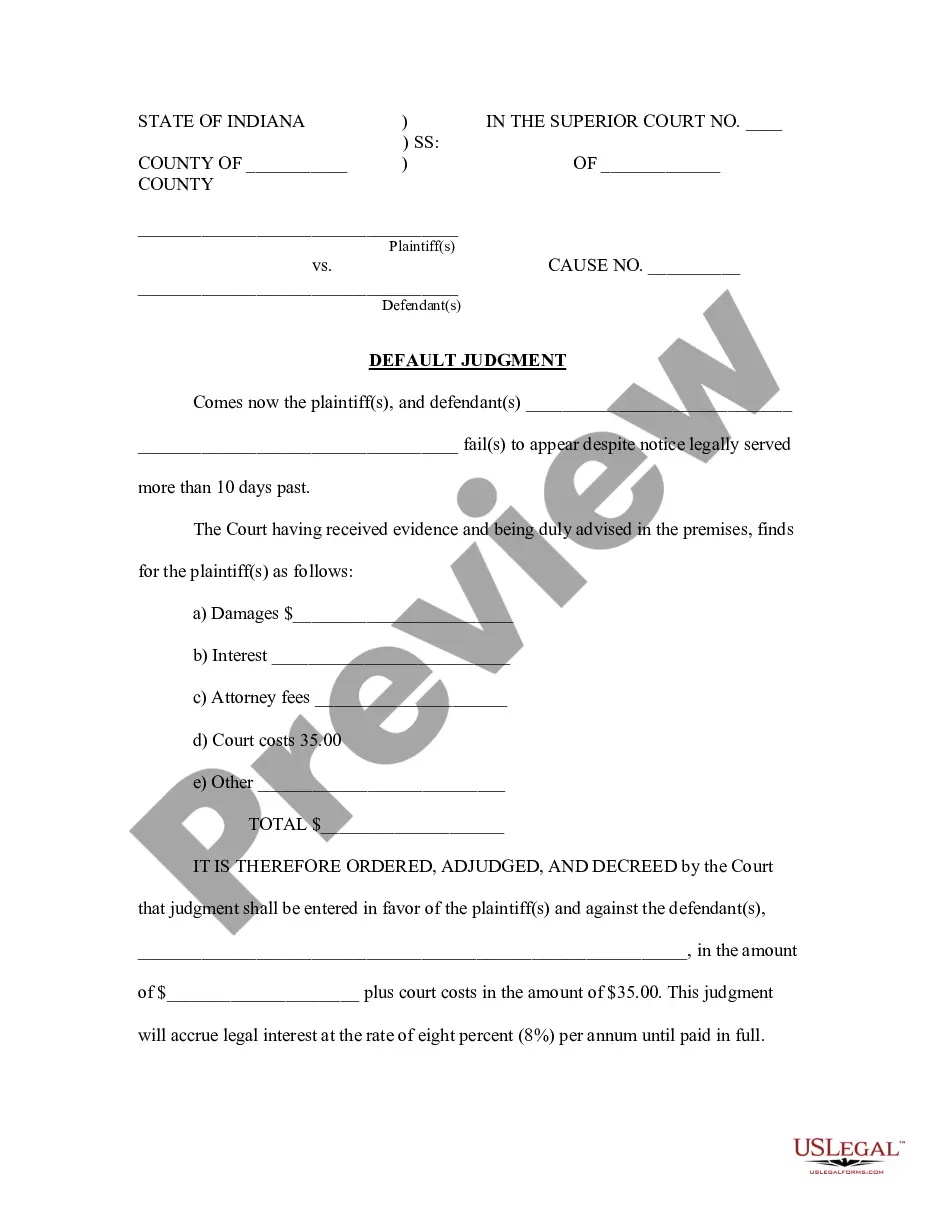

How to fill out Check Requisition Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the platform, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can locate the most current documents like the Colorado Check Requisition Worksheet within moments.

If you have a monthly subscription, Log In and download the Colorado Check Requisition Worksheet from your US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms within the My documents section of your account.

Choose the format and download the form to your device.

Make adjustments. Fill out, edit, print, and sign the downloaded Colorado Check Requisition Worksheet.

- Ensure you have selected the correct form for your city/state. Click the Preview button to examine the form's content.

- Review the form description to confirm you've chosen the appropriate document.

- If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does.

- Once satisfied with the form, affirm your choice by clicking the Download Now button.

- Then, select the pricing plan you wish and provide your details to register for the account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

Form popularity

FAQ

To submit an e-filer attachment in Colorado, you will generally use your e-filing software to attach necessary documents. Ensure you include the Colorado Check Requisition Worksheet if it's required for your filing situation. The software often provides prompts to help you upload attachments correctly. For more tailored guidance, uslegalforms offers resources that can simplify the e-filing process.

To be exempt from withholding, both of the following must be true:You owed no federal income tax in the prior tax year, and.You expect to owe no federal income tax in the current tax year.

Steps for filling out the DR 0563 Colorado Sales Tax Exemption CertificateStep 1 Begin by downloading the Colorado Sales Tax Exemption Certificate Form DR 0563.Step 2 Identify the business name and business address of the seller.Step 3 Identify the name and business address of the buyer.More items...?

Check or Money OrderMake the check or money order payable to the Colorado Department of Revenue.A check should never be sent to the Department of Revenue without a voucher form.Do not send a copy of the return.Write your Social Security number, the tax year and the words 'Form 104' on the check.

In general, whenever federal wage withholding is required for any Colorado wages, Colorado wage withholding is required as well. Wages that are exempt from federal wage withholding are generally also exempt from Colorado wage withholding.

Pay Online by Credit/Debit Card or E-CheckAccount Type - Most will select Individual Income Tax.ID Type - use your Colorado Account Number (CAN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN), OR.ID Number - Enter the digits of the identification number (no slashes or dashes)More items...

To apply for this certificate with Colorado, use the Application for Sales Tax Exemption for Colorado Organization (DR 0715). No fee is required for this exemption certificate and it does not expire. All valid non-profit state exemption certificates start with the numbers 98 or 098.

IndividualsInclude a copy of your notice, bill, or payment voucher.Make your check, money order, or cashier's check payable to Franchise Tax Board.Write either your FTB ID, SSN, or ITIN, and tax year on your payment.Mail to: Franchise Tax Board PO Box 942867. Sacramento CA 94267-0001.23 Sept 2021

Steps for filling out the 5000a Arizona Resale CertificateStep 1 Begin by downloading the Arizona Resale Certificate Form 5000A.Step 2 Identify the name, business address, and TPT License number of the buyer.Step 3 Indicate whether the certificate covers a single transaction or a blanket date range.More items...?18-Apr-2022

Make sure your check or money order includes the following information:Your name and address.Daytime phone number.Social Security number (the SSN shown first if it's a joint return) or employer identification number.Tax year.Related tax form or notice number.