Colorado Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

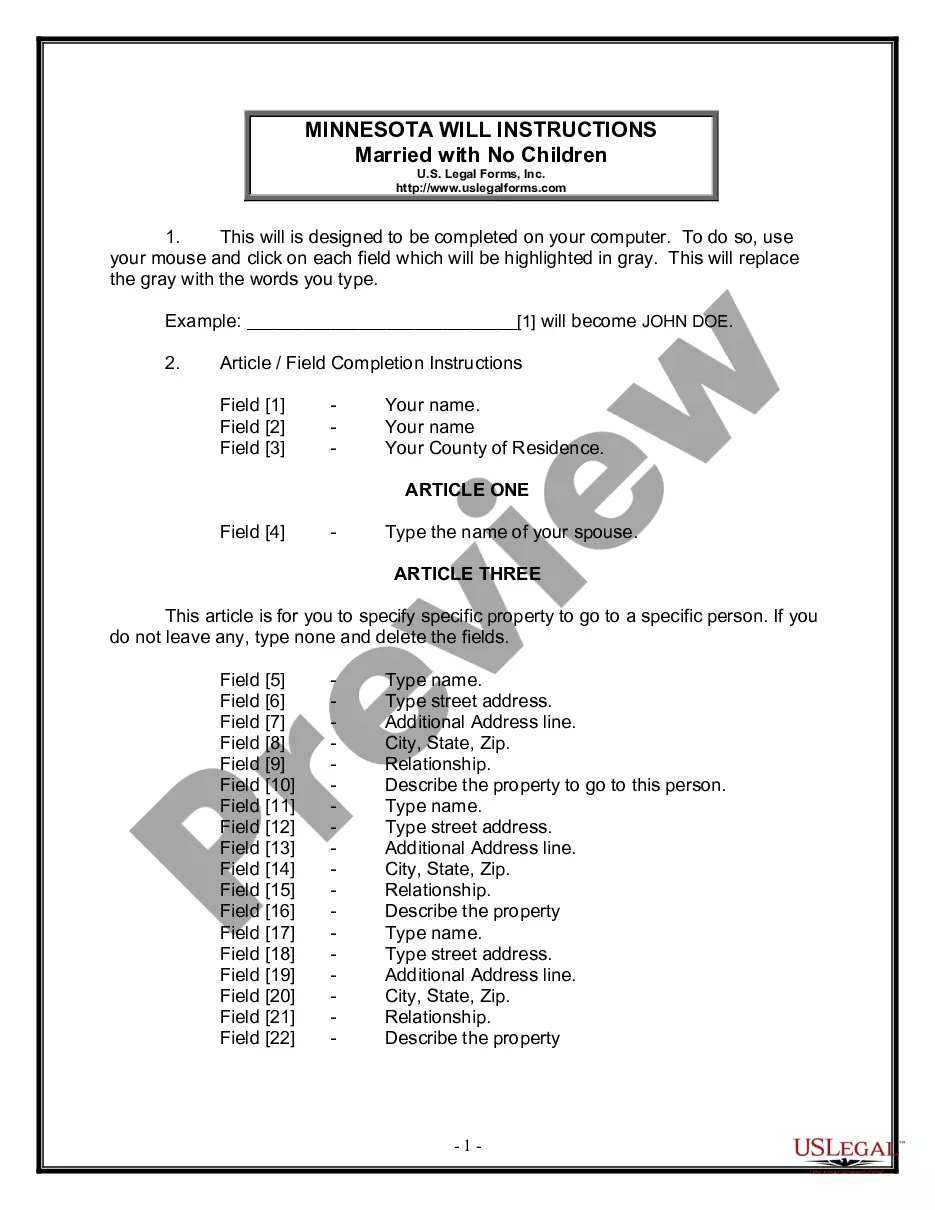

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

If you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the biggest assortment of legal forms, available online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you want, click on the Get now option. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to carry out the transaction.

- Use US Legal Forms to obtain the Colorado Bill of Sale of Personal Property - Reservation of Life Estate in Seller with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download option to find the Colorado Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/region.

- Step 2. Use the Preview feature to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other versions of the legal form design.

Form popularity

FAQ

The person in whose favour a life interest is created can be considered a life tenant. Such person can enjoy the property as the owner but he cannot transfer it to someone else. Like every legal instrument, a life interest also has certain benefits and drawbacks.

The legal term "pur autre vie" means "for the life of another" in French and when used in property law refers to a life estate that a grantor bestows on another person, known as a life tenant, who can hold and use an estate, often a family residence, during the life of third person.

A person with life interest generally (as we have not perused the Will) does not have the right to sell, transfer or alienate the property to the detriment of the absolute owner, which in your case is the son, i.e., you. It is a limited right to enjoy the property up to the death of the life holder.

Can Someone With a Life Estate Sell the Property? A life tenant cannot sell the property or take out a mortgage loan against it without the agreement of the remainderman. The reverse is also true: The remainderman cannot sell or mortgage the property during the lifetime of the life tenant.

For example, if Bob is given use of the family house for as long as his mother lives, he has possession of the house pur autre vie.

If you have created a life estate and are looking to remove someone from it, you cannot do so without consent from all parties unless you have a clause or document known as a power of appointment. These powers may be written within the deed or attached to it.

The property belongs to you jointly and on the death of one spouse it automatically passes to the survivor. You cannot leave jointly owned property in your will. To create a life interest under your will you need to hold the property as tenants in common.

Pur autre vie (per o-truh vee) is a French legal phrase which means for another's life. This phrase is durational in meaning as it is another's life, not that of the possessor, that is used to measure the amount of time someone has a right to possess real property.

Also, upon a sale of the property, a part of the sale price attributable to the Life Estate is considered an asset of the Life Estate owner and therefore, it can disqualify a person if they are receiving medicaid benefits and is reachable by the state.

A Bill of Sale typically includes:The full names and contact information of the buyer and seller.A statement that transfers ownership of the item from the seller to the buyer.A complete description of the item being purchased.A clause indicating the item is sold "as-is"The item's price (including sales tax)More items...