Colorado Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

You can spend time online looking for the legal document template that fulfills the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can obtain or create the Colorado Pay in Lieu of Notice Guidelines from my services.

If available, use the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Colorado Pay in Lieu of Notice Guidelines.

- Each legal document template you purchase is yours indefinitely.

- To acquire another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred state/region.

- Check the form description to make sure you have chosen the right form.

Form popularity

FAQ

Yes, payment in lieu of notice can attract superannuation contributions, depending on the regulations in force. According to the Colorado Pay in Lieu of Notice Guidelines, employers must uphold their obligation regarding superannuation when making these payments. For precise calculations and compliance, it's wise to consult resources like UsLegalForms for comprehensive guidelines.

Payment in lieu of leave refers to compensation given to an employee instead of allowing them to take their leave. This payment is common when an employee cannot take their remaining leave or is leaving the organization before the leave can be utilized. Familiarizing yourself with the Colorado Pay in Lieu of Notice Guidelines will help you understand the rights and responsibilities surrounding such payments.

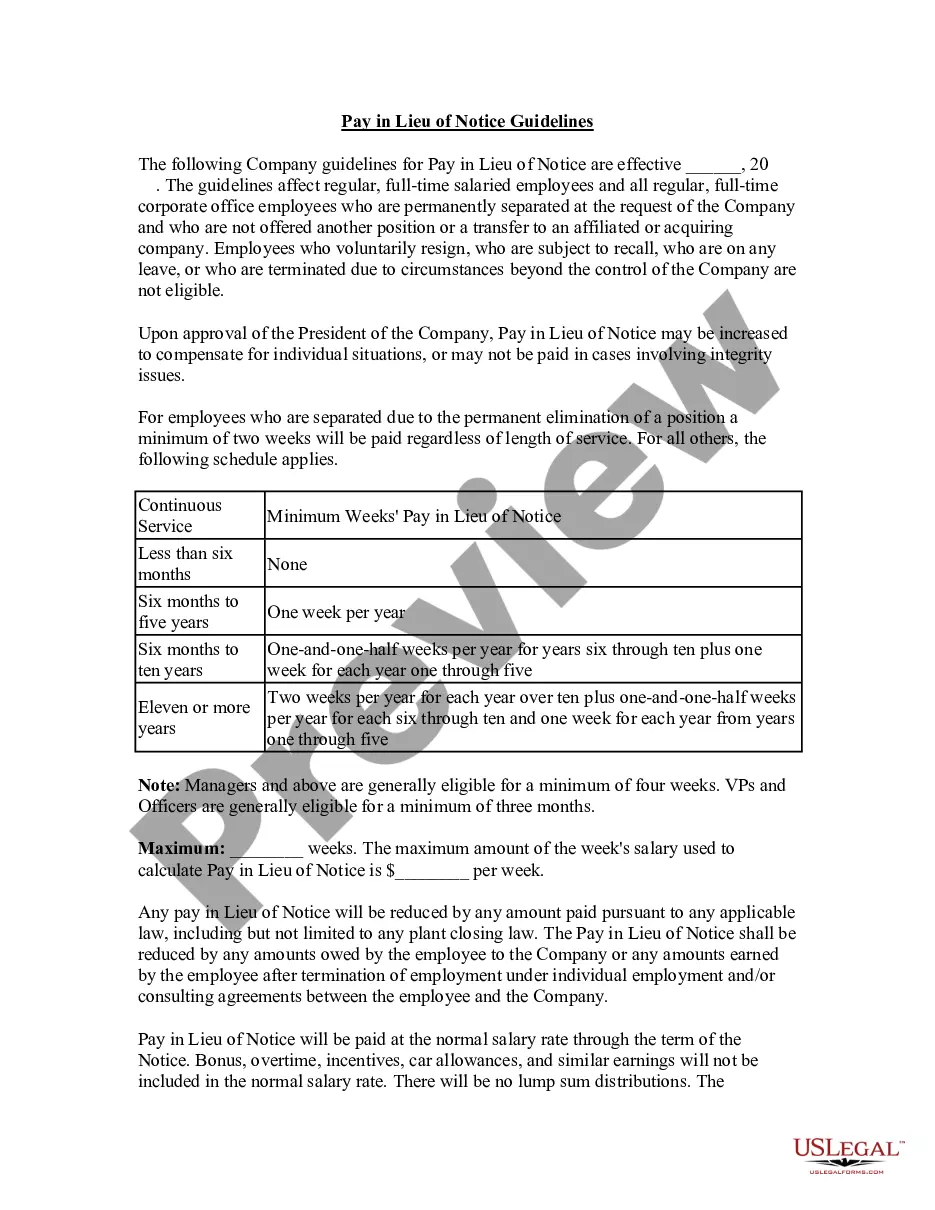

To calculate payment in lieu of notice, determine the employee's regular pay and the notice period duration. Multiply the daily wage by the number of days that notice was not provided. This calculation adheres to the Colorado Pay in Lieu of Notice Guidelines and ensures accurate compensation while protecting both employer and employee interests.

To fill out the Colorado W4, start by entering your personal information, such as your name and social security number. Next, follow the guidelines provided in the form to determine your withholding allowances. Ensure you understand how your allowances affect your pay in relation to the Colorado Pay in Lieu of Notice Guidelines. If you need additional help, consider visiting UsLegalForms for step-by-step assistance.

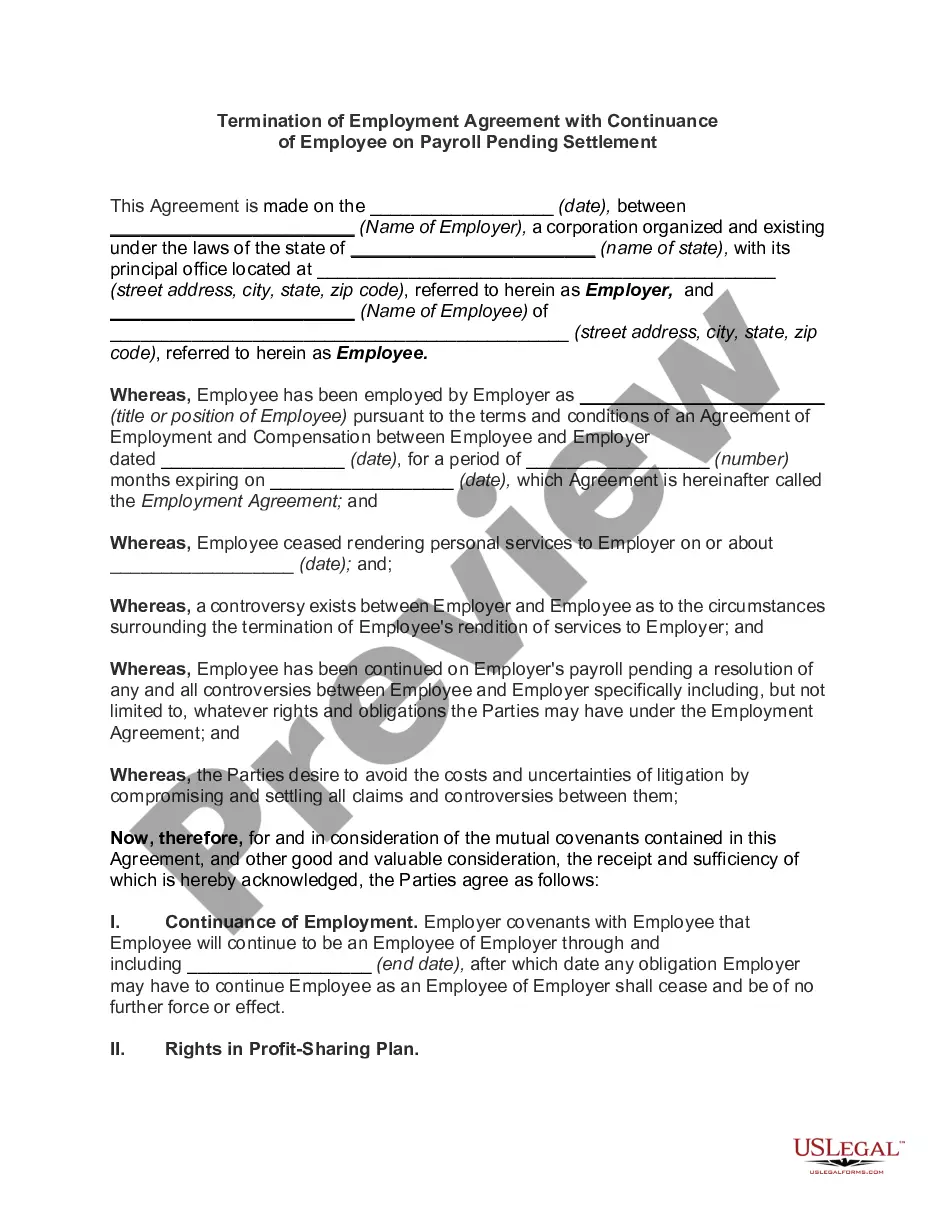

Payment in lieu of notice is a process where an employer compensates an employee instead of providing the required notice period before termination. According to the Colorado Pay in Lieu of Notice Guidelines, this payment ensures the employee receives fair compensation for their sudden job loss. These guidelines help clarify when and how this compensation should be provided, protecting the rights of both employees and employers. If you need further assistance in understanding these guidelines or require documentation, consider exploring the resources available on the USLegalForms platform.

Colorado law requires employers to provide final payment to employees who have been terminated, usually within a specific timeframe. This payment should include any wages owed, including payment in lieu of notice as per the Colorado Pay in Lieu of Notice Guidelines. Employers must ensure that all financial obligations are met to avoid potential legal issues. For further assistance and proper documentation, consider utilizing US Legal Forms.

Payment to you in lieu of notice means receiving financial compensation instead of serving a notice period when your employment ends. This aligns with the Colorado Pay in Lieu of Notice Guidelines and aims to ensure that employees receive remuneration during a transition. This payment typically equals your regular salary for the notice period you should have worked. Knowing this can ease the financial strain of unexpected job changes.

Processing payment in lieu of notice involves calculating the amount due based on the employee’s regular wages. It is essential to follow the Colorado Pay in Lieu of Notice Guidelines to ensure compliance with state requirements. Start by determining the notice period outlined in the employment contract and then multiply the daily wage by the number of days in that period. Using the US Legal Forms platform can help you access the necessary forms and guidelines to streamline this process and ensure accurate calculations.