Colorado Assignment of Security Agreement and Note with Recourse

Description

How to fill out Assignment Of Security Agreement And Note With Recourse?

If you need to finalize, retrieve, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s user-friendly and convenient search function to find the documents you require. Various templates for corporate and personal use are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Colorado Assignment of Security Agreement and Note with Recourse in a matter of clicks.

Every legal document template you purchase is yours indefinitely. You have access to each form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Complete and download, and print the Colorado Assignment of Security Agreement and Note with Recourse using US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- In case you are an existing US Legal Forms user, Log In to your account and click the Download button to obtain the Colorado Assignment of Security Agreement and Note with Recourse.

- You can also access forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

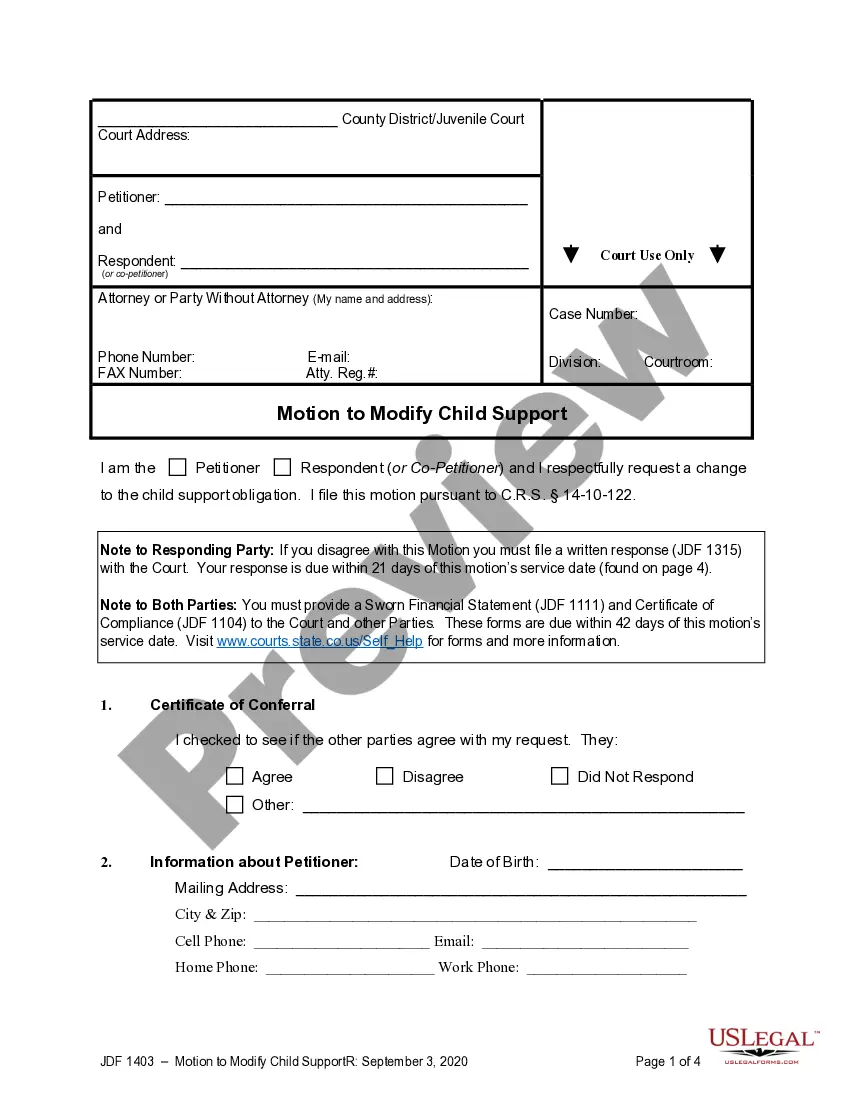

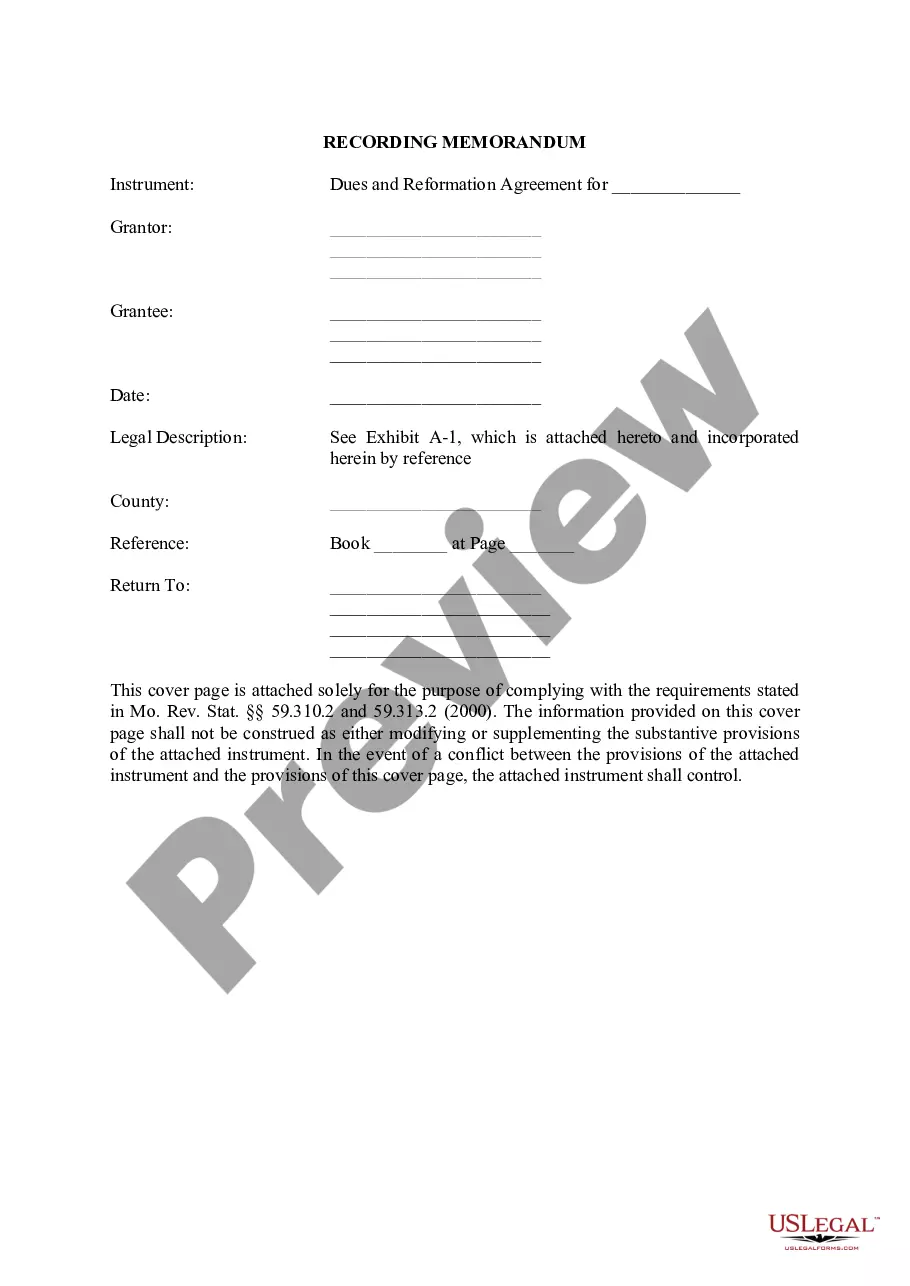

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Do not forget to check the summary.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have found the form you want, click the Download Now button. Choose the pricing plan you prefer and enter your details to sign up for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finish the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Colorado Assignment of Security Agreement and Note with Recourse.

Form popularity

FAQ

How to Enforce a Promissory NoteTypes of Property that can be used as collateral.Speak to them in person.Draft a Demand / Notice Letter.Write and send a Follow Up Letter.Enlisting a Professional Collection Agency.Filing a petition or complaint in court.Selling the Promissory Note.Final Tips.More items...?21-Jun-2016

Executing a note involves signing, dating and having your signature witnessed.Create the promissory note.Create date and signature lines for yourself and a witness.Sign the form in front of a witness.Give the note to the lending party.

The only way that a secured party may perfect its security interest in money is by possession. Instruments. A lender may perfect a security interest in an instrument either by filing or possession.

Promissory notes are a common type of financial instrument in loan transactions. As the payer of such a note, it's important to know that, unless a note expressly stipulates that it is not negotiable, promissory notes are negotiable instruments that can be transferred or assigned by the original payee to a third party.

What Is a Secured Note? A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.

In order for the security agreement to be valid, the borrower must usually have rights in the collateral at the time the agreement is executed. If a borrower pledges as collateral a car owned by a neighbor, and the neighbor does not know of and endorse this pledge, then the security agreement is ineffective.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.