Colorado Certificate of Amendment to Certificate of Trust of (Name of Trustor)

Description

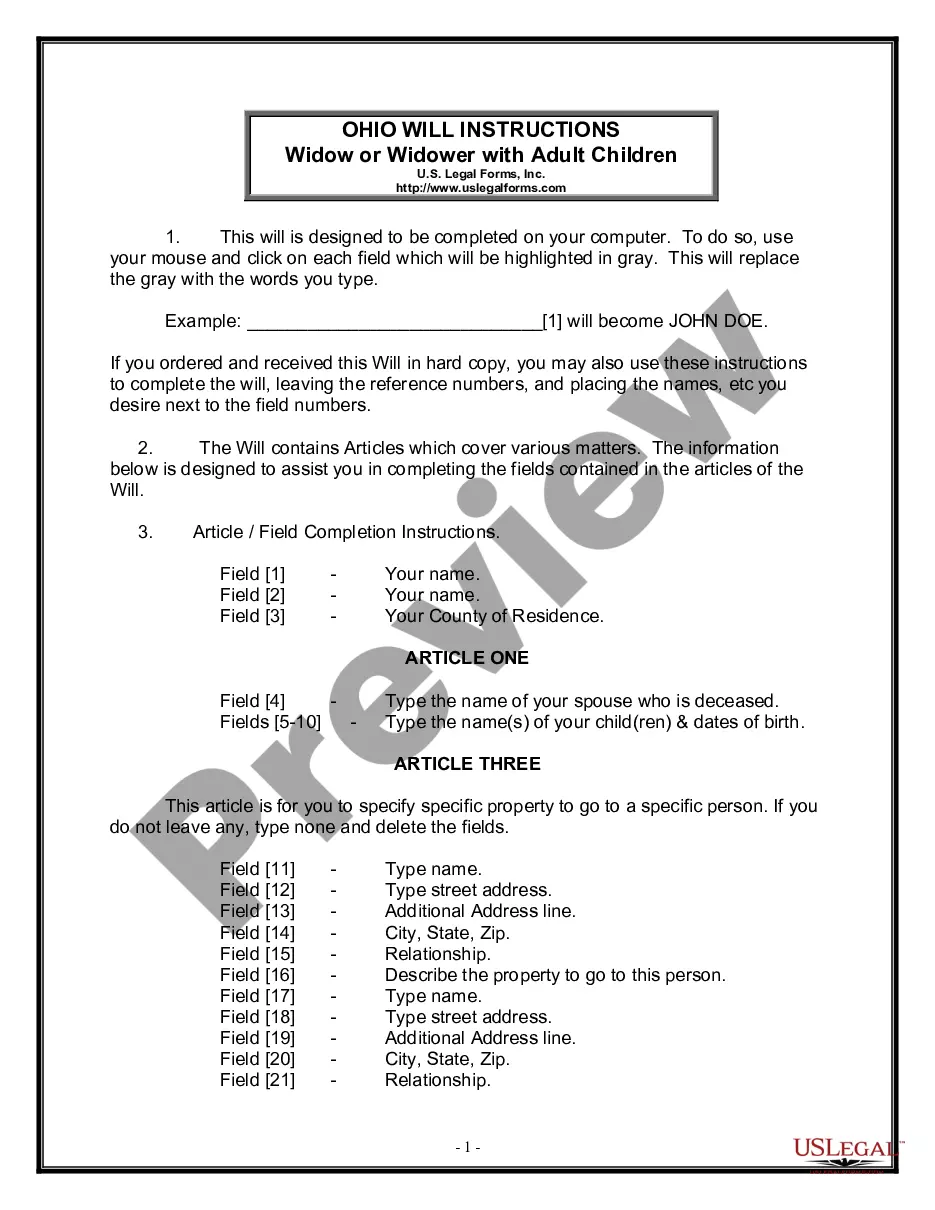

How to fill out Certificate Of Amendment To Certificate Of Trust Of (Name Of Trustor)?

US Legal Forms - one of the biggest libraries of legitimate forms in the States - delivers a wide range of legitimate record web templates it is possible to down load or printing. Utilizing the internet site, you can get thousands of forms for company and personal reasons, sorted by categories, states, or keywords.You can find the most up-to-date models of forms like the Colorado Certificate of Amendment to Certificate of Trust of (Name of Trustor) in seconds.

If you already have a monthly subscription, log in and down load Colorado Certificate of Amendment to Certificate of Trust of (Name of Trustor) in the US Legal Forms catalogue. The Acquire switch will appear on every form you see. You gain access to all previously delivered electronically forms within the My Forms tab of your own bank account.

In order to use US Legal Forms initially, allow me to share easy recommendations to help you get started out:

- Be sure to have picked out the correct form for the town/area. Click on the Preview switch to examine the form`s content material. Browse the form explanation to ensure that you have selected the right form.

- In case the form doesn`t satisfy your specifications, make use of the Search area on top of the screen to find the the one that does.

- Should you be content with the form, confirm your selection by visiting the Get now switch. Then, select the pricing prepare you prefer and offer your credentials to register for an bank account.

- Process the transaction. Make use of Visa or Mastercard or PayPal bank account to finish the transaction.

- Find the formatting and down load the form on your product.

- Make adjustments. Fill out, edit and printing and indication the delivered electronically Colorado Certificate of Amendment to Certificate of Trust of (Name of Trustor).

Each web template you included with your bank account does not have an expiration particular date and is also the one you have forever. So, in order to down load or printing yet another version, just go to the My Forms area and click on about the form you want.

Get access to the Colorado Certificate of Amendment to Certificate of Trust of (Name of Trustor) with US Legal Forms, the most substantial catalogue of legitimate record web templates. Use thousands of skilled and express-specific web templates that fulfill your business or personal demands and specifications.

Form popularity

FAQ

Revising the terms of a trust is known as ?amending? the trust. An amendment is generally appropriate when there are only a few minor changes to make, like rewording a certain paragraph, changing the successor trustee, or modifying beneficiaries.

How do I transfer assets from sole proprietor to LLC? You can use the assets from the proprietorship to purchase ownership in the LLC (capital contribution) Your LLC can purchase the assets from your proprietorship. You can use a transfer document (depending on the type of asset) How to Change a Sole Proprietorship to an LLC - MarketWatch MarketWatch ? ... ? Guides ? Business MarketWatch ? ... ? Guides ? Business

Stacy, what it means for a trust to be irrevocable is that the grantor or the person who created it cannot amend or revoke the trust.

Generally, businesses need a new EIN when their ownership or structure has changed. Although changing the name of your business does not require you to obtain a new EIN, you may wish to visit the Business Name Change page to find out what actions are required if you change the name of your business. Do You Need a New EIN? | Internal Revenue Service irs.gov ? small-businesses-self-employed ? d... irs.gov ? small-businesses-self-employed ? d...

To form a private limited company from a sole proprietorship, the procedure is to first form the private limited company and then take over the sole proprietorship through a Memorandum Of Association (MoA) and transfer all benefits and liabilities to the limited company. Conversion of Proprietorship to Private Limited Company - ClearTax cleartax.in ? convert-proprietorship-to-private-lim... cleartax.in ? convert-proprietorship-to-private-lim...

How to transition a sole proprietorship to an LLC Step 1: Consider professional assistance. ... Step 2: Choose a name for your LLC. ... Step 3: Designate a registered agent. ... Step 4: File the articles of organization. ... Step 5: Register with the IRS. ... Step 6: Re-apply for licenses for your new LLC structure.

In the trust deed where there is no mention about amendment, the amendment has to be done with the permission of a civil court. Even the Civil Courts do not have unlimited powers of amendment. The Civil Courts permit amendment under the doctrine of Cy pres, which means the original intent of the settlor should prevail.

Generally speaking, the process requires filing the same paperwork as anyone else creating a new LLC. You may have to cancel your sole proprietorship's trade name or Doing Business As (DBA) before you can form an LLC. You may or may not be able to keep your same name depending on state naming laws. Can you change a sole proprietorship to an LLC? - .com ? articles ? can-you-change-... .com ? articles ? can-you-change-...

?Amended? means that the document has ?changed?? that someone has revised the document. ?Restated? means ?presented in its entirety?, ? as a single, complete document. ingly, ?amended and restated? means a complete document into which one or more changes have been incorporated.

A trust amendment is a legal document that changes specific provisions of a revocable living trust but leaves all of the other provisions unchanged, while a restatement of a trust?which is also known as a complete restatement or an amendment and complete restatement?completely replaces and supersedes all of the ...