Colorado Unrestricted Charitable Contribution of Cash

Description

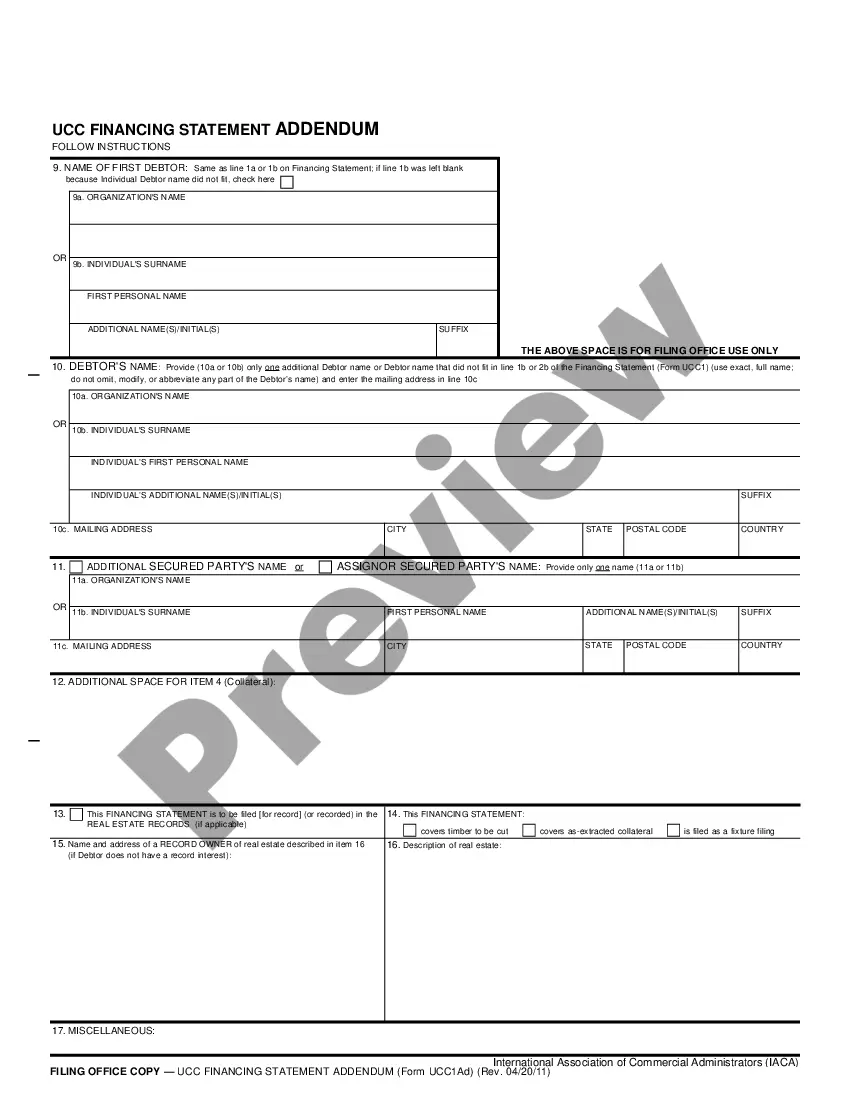

How to fill out Unrestricted Charitable Contribution Of Cash?

US Legal Forms - one of the largest collections of legal templates in the USA - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the most recent versions of forms like the Colorado Unrestricted Charitable Contribution of Cash in moments.

If you already have a membership, Log In and download Colorado Unrestricted Charitable Contribution of Cash from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Select the format and download the form to your device.

Make edits. Complete, modify and print and sign the downloaded Colorado Unrestricted Charitable Contribution of Cash.

- Make sure you have chose the correct form for your city/county. Click the Preview button to review the form’s content.

- Check the form description to ensure you have selected the appropriate form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

- Process the purchase. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

A deductible charitable contribution under the Colorado Unrestricted Charitable Contribution of Cash includes cash donations made directly to qualified organizations, such as non-profits or charities recognized by the IRS. You can also contribute funds to certain foundations and educational institutions. It's important to maintain proper documentation for your contributions, as this can help ensure that your donations are recognized for tax deductions. Utilizing the uslegalforms platform can streamline the process by providing clarity on qualifying organizations and necessary documentation.

Yes, you can deduct charitable contributions in Colorado as long as you meet the eligibility requirements for deductions. This includes maintaining accurate records and itemizing your deductions properly on your tax return. A Colorado Unrestricted Charitable Contribution of Cash not only aids non-profits but also enhances your potential tax advantages.

Colorado does permit itemized deductions, which can include charitable contributions among other deductions. By itemizing your IRS tax return, you can optimize your tax situation depending on your financial circumstances. If you are considering a Colorado Unrestricted Charitable Contribution of Cash, it can significantly benefit you in your overall itemized deductions.

Yes, Colorado does allow deductions for charitable contributions, aligning with federal guidelines. This means that when you contribute to qualifying charities, you can often reduce both your federal and state taxable income. A Colorado Unrestricted Charitable Contribution of Cash can further enhance your financial advantages while supporting local and national causes.

Yes, you can claim charitable deductions if you itemize your taxes and meet the necessary criteria set by the IRS. This includes maintaining documentation of your donations, including cash contributions. When you engage in a Colorado Unrestricted Charitable Contribution of Cash, you take an essential step toward reducing your taxable income while helping charitable efforts.

To deduct charitable contributions, you need to itemize your deductions on Schedule A of your tax return. Gather all receipts and documentation for your donations to ensure proper reporting. Whether you are making small or significant contributions, a Colorado Unrestricted Charitable Contribution of Cash can be an effective way to bolster your deductions and support your favorite organizations.

The maximum you can write off for charitable donations generally depends on your adjusted gross income and the type of organization you donate to. For cash donations to qualified charities, you may be able to deduct up to 60% of your adjusted gross income. This allows you to maximize your benefits while supporting causes important to you, such as through a Colorado Unrestricted Charitable Contribution of Cash.

Yes, you can claim charitable contributions, including Colorado Unrestricted Charitable Contribution of Cash, on your tax return. To qualify, ensure that the donation meets IRS guidelines and that you have the proper documentation. This generally includes receipts from the charitable organization, which prove that you made the contribution. Using a platform like USLegalForms can help you navigate the requirements, ensuring you have all necessary forms and documentation ready for your claim.

Yes, you can take a deduction for charitable contributions made to qualified organizations. A Colorado Unrestricted Charitable Contribution of Cash is typically eligible for this deduction. It is crucial to adhere to IRS regulations, so keep track of your donations and their amounts to substantiate your claims. If you need help navigating the deduction process, consider using US Legal Forms for a straightforward approach.

To claim charitable contributions, you need to itemize these on your federal tax return. For a Colorado Unrestricted Charitable Contribution of Cash, use Schedule A to report your donations. Ensure you have proper documentation, like receipts from the charities, as the IRS requires verification for these contributions. If you’re unsure about the process, US Legal Forms offers resources to guide you through the necessary steps.