Colorado Personal Financial Information Organizer

Description

How to fill out Personal Financial Information Organizer?

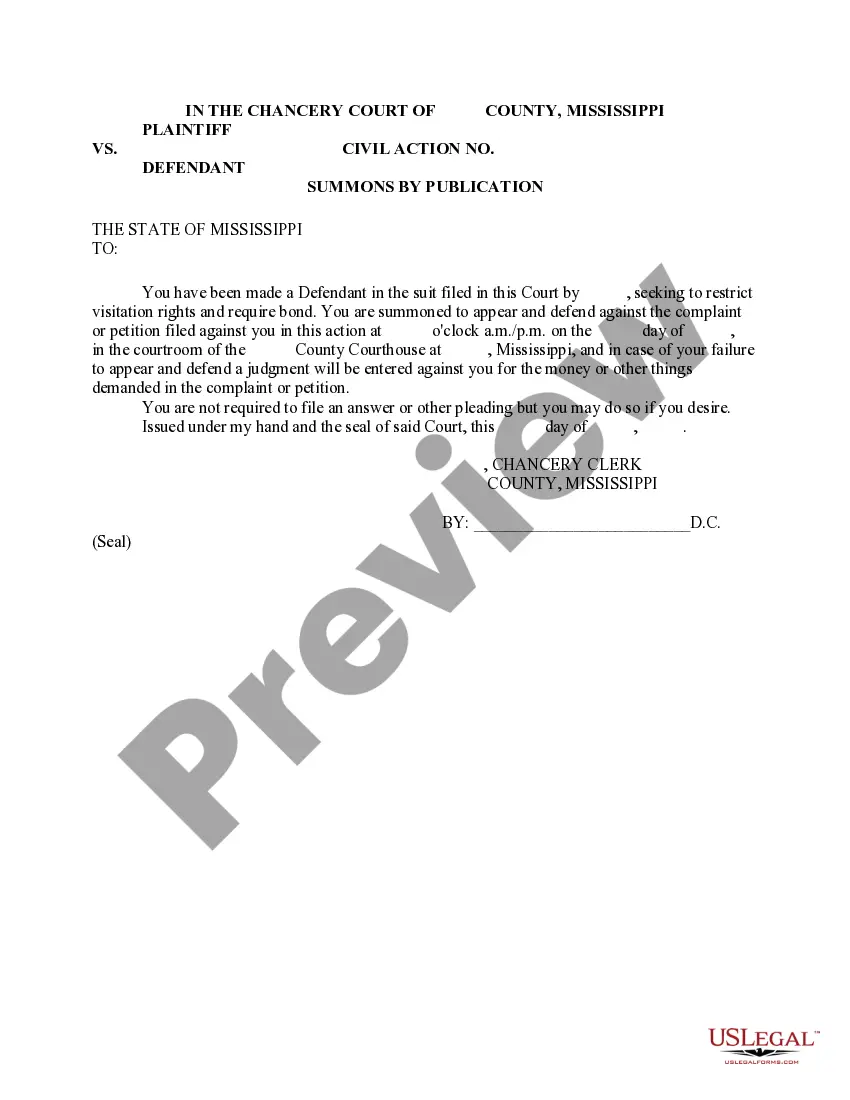

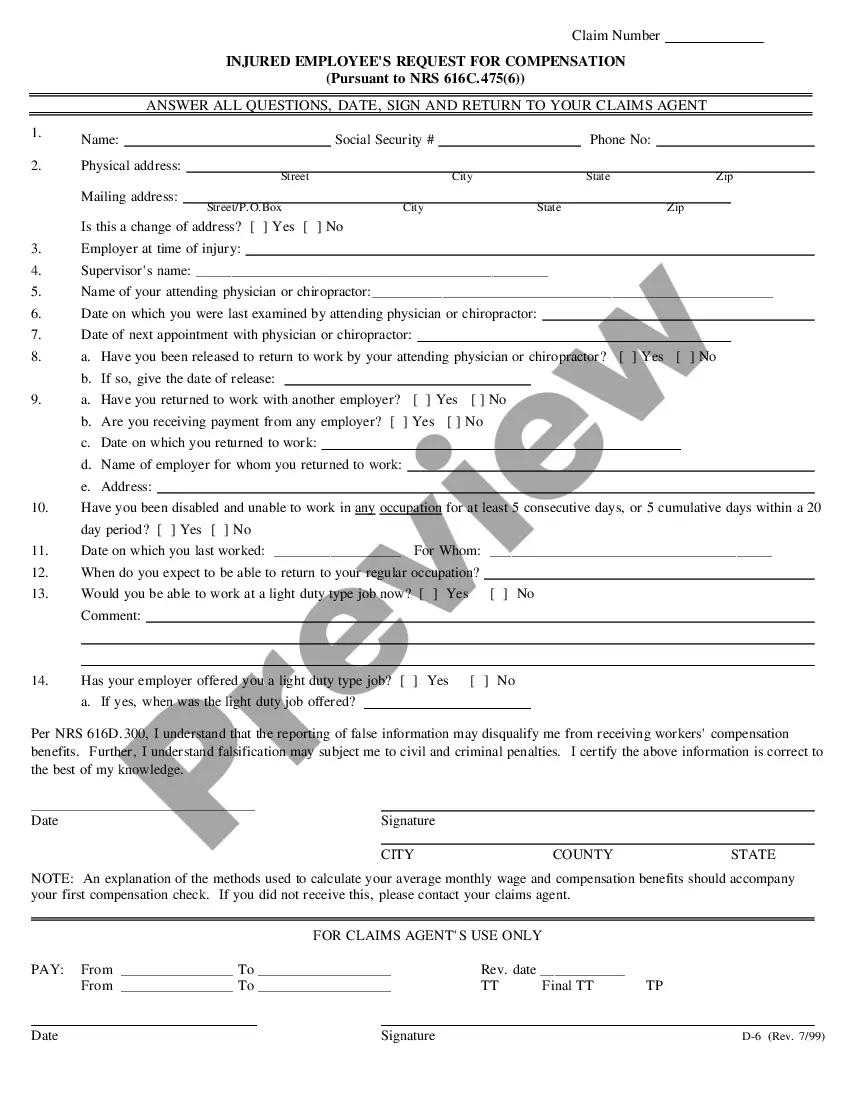

You can allocate time online looking for the valid document template that meets the federal and state standards you need.

US Legal Forms provides a wide array of official forms that are reviewed by professionals.

You can download or print the Colorado Personal Financial Information Organizer from their platform.

To locate another version of the form, utilize the Search field to find the template that fits your needs and requirements.

- If you currently have a US Legal Forms account, you can Log In and click on the Download button.

- Afterward, you can fill out, modify, print, or sign the Colorado Personal Financial Information Organizer.

- Every official document template you obtain is yours permanently.

- To receive another copy of any purchased form, visit the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- First, confirm that you have selected the correct document template for the area/city of your choice.

- Review the form description to ensure you have chosen the right one.

Form popularity

FAQ

Period of Limitations that apply to income tax returns Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.

Your financial records include everything you do related to money. So, your bank statements, receipts, money transfers, investments, withdrawals, paychecks, mortgages, loans, stocks, mutual funds, and insurance policies are all considered part of your financial records.

Important papers to save forever include:Birth certificates.Social Security cards.Marriage certificates.Adoption papers.Death certificates.Passports.Wills and living wills.Powers of attorney.More items...?

The IRS requires you to keep a number of records for a certain amount of time (e.g., tax records)....Business records to trackAccounting records.Bank statements.Business loans.Legal documents.Permits and licenses.Insurance documents.28-Oct-2021

KEEP 3 TO 7 YEARS Knowing that, a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receiptsfor three to seven years.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

Pick Your Storage for organizing your personal informationBinders Can require multiple binders to store all of your information.File Box Perfect for portability and reigning in paper clutter.File Cabinet Holds a lot of paperwork but is not portable in emergencies.

So here are some simple guidelines to follow when dealing with your personal or financial statements and paperwork:See What You Have.Set Up Your Filing System.Reconcile And File Receipts.Protect Your Investment Papers.Properly Store Your Bank Documents.Take Care Of Any Credit Card Issues.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

These documents include:Legal identification documents. Social Security cards. Birth certificates.Tax documents. Tax returns. W-2s and 1099 forms.Property records. Vehicle registration and titles. Mortgage statements, deeds and bills of sale.Medical records. Wills, powers of attorney or living will.Finance records. Pay stubs.27-Sept-2021