Colorado Agreement Between Board Member and Close Corporation

Description

How to fill out Agreement Between Board Member And Close Corporation?

If you require complete, fetch, or reproduce authentic form templates, utilize US Legal Forms, the most extensive collection of lawful documents, accessible online.

Employ the site’s straightforward and efficient search to locate the documents you seek.

A range of templates for commercial and personal purposes is organized by categories and suggestions, or keywords.

Step 4. Once you have found the form you desire, choose the Buy now option. Select the pricing plan you prefer and enter your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Colorado Agreement Between Board Member and Close Corporation with just a few clicks.

- If you are presently a US Legal Forms user, Log In to your account and then select the Download option to retrieve the Colorado Agreement Between Board Member and Close Corporation.

- You can also access the forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

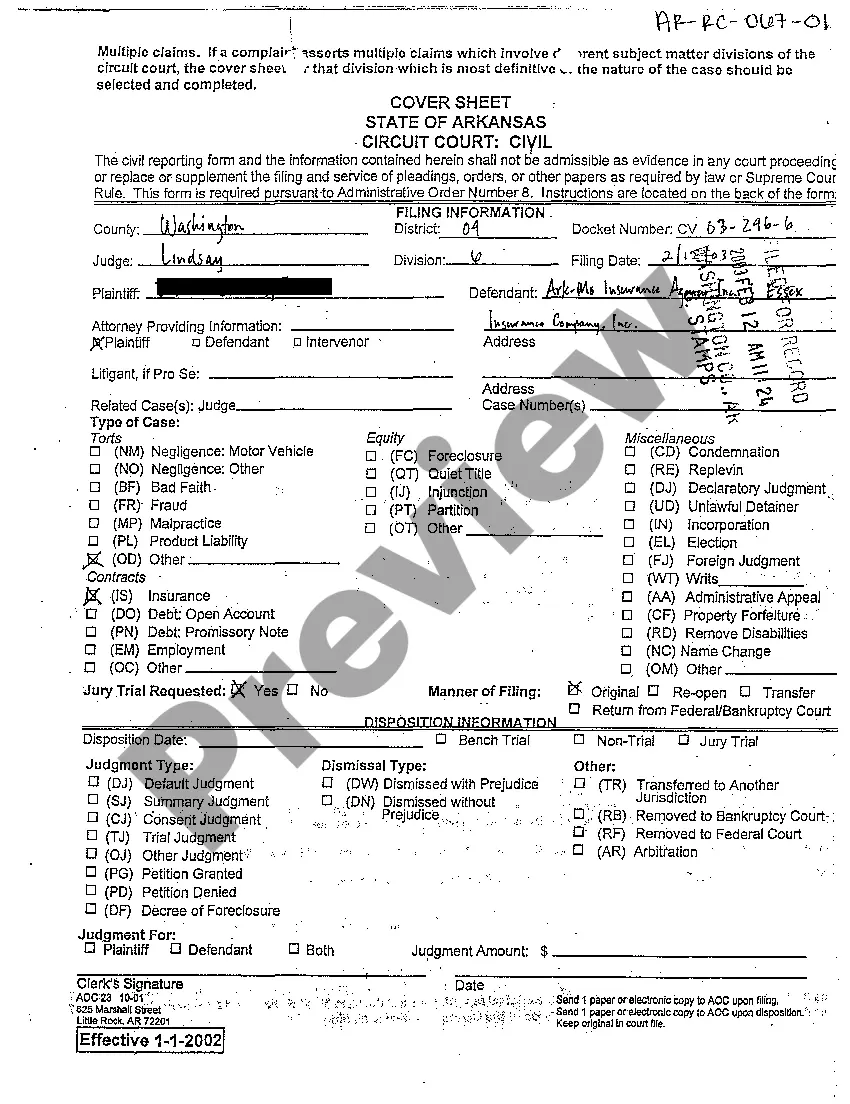

- Step 1. Make sure you have selected the form for your correct city/state.

- Step 2. Utilize the Preview option to review the document’s content. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other variations of the legal form template.

Form popularity

FAQ

A Close Corporation has members and a Company has shareholders and directors. The Close Corporation has its own estate seperate from its members.

6 Steps to Dissolve a Corporation#1 Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors.#2 File Articles of Dissolution.#3 Finalize Taxes.#4 Notify Creditors.#5 Liquidate and Distribute Assets.#6 Wrap Up Operations.29-Aug-2021

A CC has no share capital and therefore no shareholders. The owners of a CC are the members of the CC. Members have a membership interest in the CC. Members' interest is expressed as a percentage.

The first step in dissolving a corporation usually involves having your board of directors and shareholders vote to approve the dissolution. Under most state rules, you start by holding a meeting of the board of directors to vote on a resolution to approve the dissolution of the corporation.

What are 5 steps that are necessary in order to dissolve your Colorado business?Obtain agreement to dissolve according to corporation formalities & contracts.File a Certification of Dissolution (Articles of Dissolution)File federal, state, and local tax returns.Notify creditors, customers, and employees.More items...?

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

ORC § 1701.591 entitled Close Corporation Agreement provides a mechanism for shareholders of a close corporation to agree in advance on issues related to the internal management and business operations of their corporation and the relations between and among themselves as shareholders.

Different states have different rules for the organization of their S corporations and C corporations, but all for-profit and nonprofit corporations are required by law to have boards of directors. The rules of the state in which you incorporate determine when they must be named and how many directors are required.

If your business is a corporation, then you are required by law to have a board of directors. Depending on your particular corporate structure and your state, one or two directors may be all that's legally required.

A corporation maybe dissolved either voluntarily or involuntarily. There are three ways by which a corporation can be dissolved voluntarily. The most common method of voluntary dissolution is by shortening the corporate term through the amendment of the articles of incorporation.