Colorado Sample Letter for Collection of Payment for Mobile Home

Description

How to fill out Sample Letter For Collection Of Payment For Mobile Home?

Choosing the best lawful papers template can be quite a struggle. Obviously, there are a variety of web templates available on the net, but how do you find the lawful kind you want? Use the US Legal Forms web site. The services provides thousands of web templates, like the Colorado Sample Letter for Collection of Payment for Mobile Home, which you can use for business and personal needs. Each of the varieties are checked by professionals and meet up with state and federal specifications.

When you are already registered, log in to your profile and click the Down load key to get the Colorado Sample Letter for Collection of Payment for Mobile Home. Use your profile to look from the lawful varieties you may have acquired previously. Visit the My Forms tab of your own profile and get yet another duplicate from the papers you want.

When you are a new consumer of US Legal Forms, allow me to share easy guidelines for you to follow:

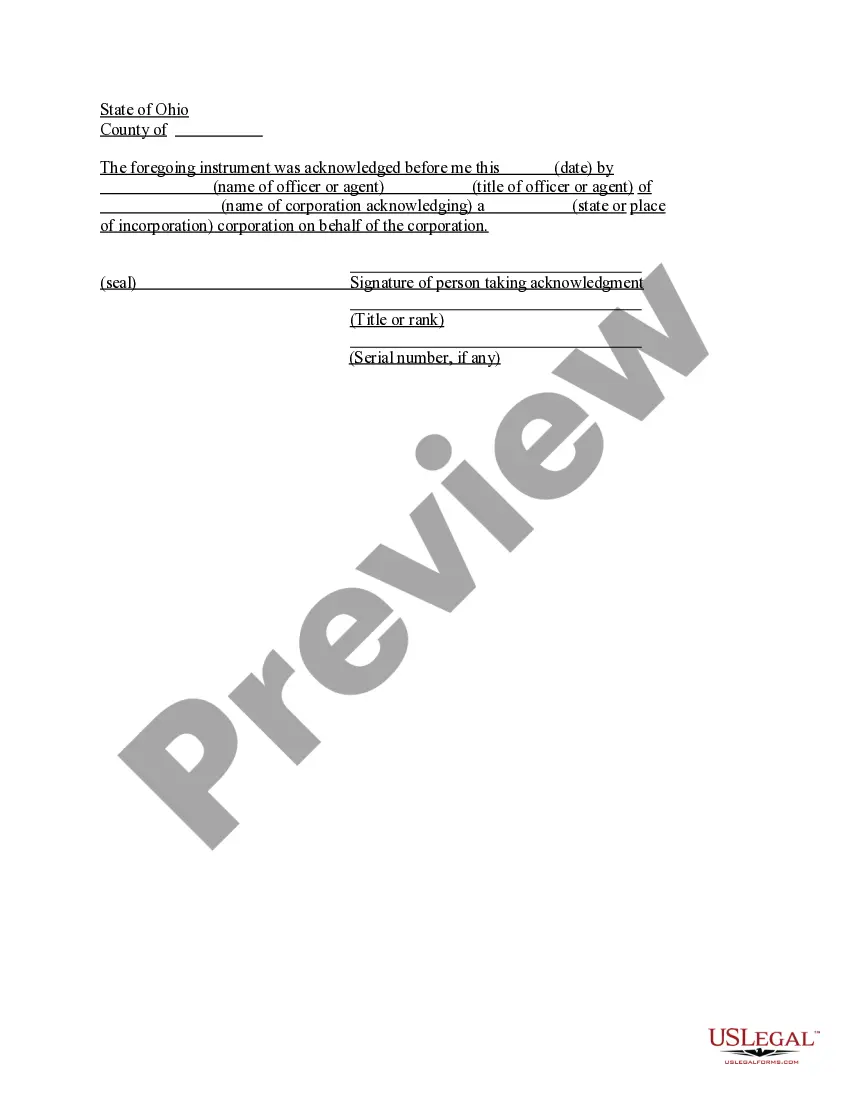

- Initially, make certain you have chosen the appropriate kind for the metropolis/area. It is possible to check out the form making use of the Review key and study the form description to guarantee it is the right one for you.

- When the kind does not meet up with your expectations, make use of the Seach industry to discover the appropriate kind.

- Once you are certain the form is suitable, click the Acquire now key to get the kind.

- Opt for the rates plan you desire and type in the essential information and facts. Design your profile and pay money for an order utilizing your PayPal profile or bank card.

- Select the file format and down load the lawful papers template to your product.

- Comprehensive, change and print out and indication the attained Colorado Sample Letter for Collection of Payment for Mobile Home.

US Legal Forms is definitely the biggest catalogue of lawful varieties for which you can find different papers web templates. Use the service to down load appropriately-created paperwork that follow condition specifications.

Form popularity

FAQ

Here are some of the details a demand letter needs to include: Your information and the debtors' information (contact details, address etc.) The date when the debt began and the amount of money owed. Details and dates of any disputes relating to this payment.

THIRD & FINAL COLLECTION LETTER SAMPLE Dear Mr. Smith, At this time we still have not heard from you in regards to invoice #12345 which was due on ___nor have we gotten a response to the letter sent on _____, the letter sent on ___, or our numerous attempts to call and email you.

Official collections letters. Reminder Collection Letter. Inquiry Collection Letter. Appeal collection Letter. Ultimatum Collection Letter.

Dear [Client name], We're sending you this letter as a friendly reminder that your account in the amount of [amount due to you] is past due. Your invoice was due on [month, day and year their payment was originally due as stated in their invoice]. This payment is now [number of days since the due date] past due.

Include your full name, company name, and mailing address. Address the letter to your client by their full name. State the problem: Specify and provide proof of the debt in question. Reference the original contract or agreement that states the services the client owes you for.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

This first collection letter should contain the following information: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not ?in the next 7 business days? as this can be vague.

Instead, the first collection letter should include the following information: Friendly greeting. Reason for sending the email; i.e., friendly reminder. Invoice number, date, and amount. Payment due-date and now, past-due status. Accounts receivable contact information. Payment methods.