Colorado Sample Letter for Insufficient Amount to Reinstate Loan

Description

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

Are you presently in a circumstance where you require documentation for either business or personal reasons nearly every day.

There are numerous valid document templates available online, but locating forms that you can rely on isn't easy.

US Legal Forms offers thousands of form templates, such as the Colorado Sample Letter for Insufficient Amount to Reinstate Loan, which are designed to comply with federal and state regulations.

Once you find the correct form, click on Purchase now.

Select the payment option you prefer, complete the required information to create your account, and finalize your purchase with your PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Colorado Sample Letter for Insufficient Amount to Reinstate Loan at any time if needed. Just select the appropriate form to download or print the document format. Use US Legal Forms, one of the most extensive collections of valid forms, to save time and prevent mistakes. The service provides correctly crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Colorado Sample Letter for Insufficient Amount to Reinstate Loan template.

- In case you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and verify that it corresponds to the correct region/area.

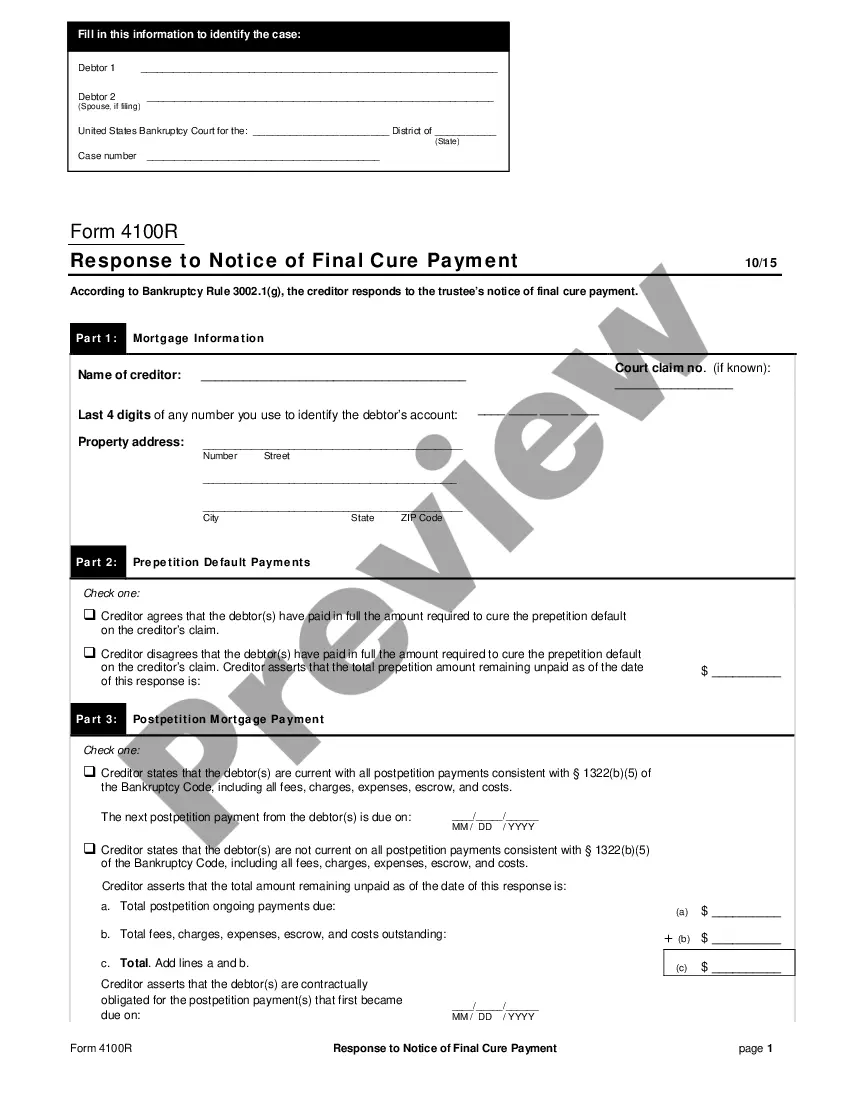

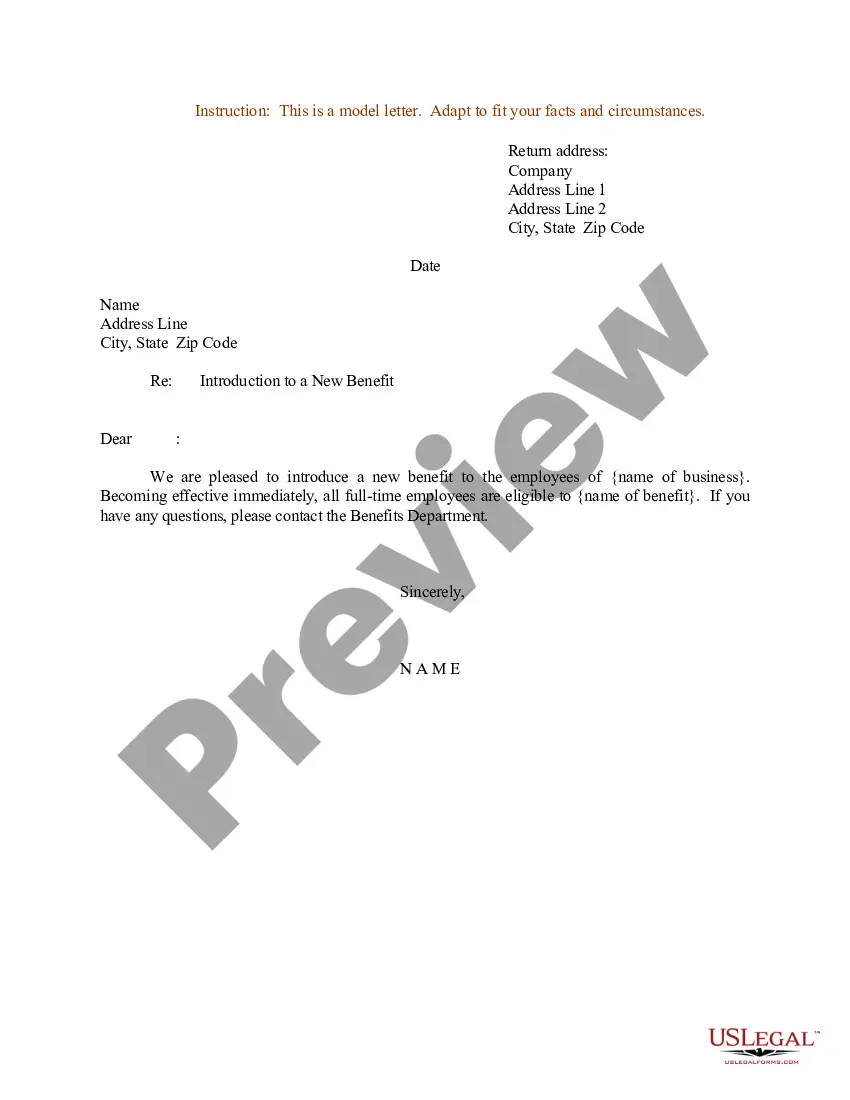

- Use the Review feature to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form isn't what you are looking for, utilize the Search section to find the form that suits your needs and preferences.

Form popularity

FAQ

To write an effective reconsideration letter, structure your message clearly and concisely. Start with a polite introduction, followed by a reference to the Colorado Sample Letter for Insufficient Amount to Reinstate Loan. State your case firmly, but kindly, explaining any new information or changes that support your request. Conclude with a request for a meeting or further discussion, demonstrating your willingness to find a solution.

When asking for reconsideration, it is important to maintain a respectful tone. Begin your request by expressing appreciation for the original decision and acknowledge the lender's position. Clearly state your reasons for seeking a review, referencing the Colorado Sample Letter for Insufficient Amount to Reinstate Loan as necessary. This approach fosters goodwill and increases the likelihood of a favorable response.

To write a reconsideration request, start by clearly stating the purpose of your letter, which should include a reference to your Colorado Sample Letter for Insufficient Amount to Reinstate Loan. Make sure to outline your reasons for the request, including any changes in your financial situation. Providing thorough documentation to support your claims can significantly enhance your chances of success.

An example of reconsideration occurs when a lender decides to review a borrower's request to avoid foreclosure after the submission of a Colorado Sample Letter for Insufficient Amount to Reinstate Loan. In this context, the borrower may provide additional information or documentation that could support their case. By illustrating a change in circumstances, such as improved income or a recent financial gain, the lender may be persuaded to reassess the reinstatement of the loan.

Start your letter by acknowledging your credit issues directly. Be concise yet comprehensive in describing the reasons for your delinquency, and do not shy away from taking responsibility. The Colorado Sample Letter for Insufficient Amount to Reinstate Loan serves as an excellent example to help you create a well-organized and persuasive explanation letter.

To explain delinquent credit issues, provide a clear account of the events that led to the delinquency. Include any relevant context that can help the reader understand your situation. Consider using the Colorado Sample Letter for Insufficient Amount to Reinstate Loan as a framework to ensure you include all necessary information while articulating your message clearly.

When writing a delinquency letter, start by identifying yourself and your account information. Clearly explain the reasons for your delinquency while maintaining a respectful tone. It is advantageous to reference the Colorado Sample Letter for Insufficient Amount to Reinstate Loan to ensure your letter is structured properly and effectively communicates your situation.

Begin your letter by addressing the reader directly and stating that you are writing to explain your bad credit. Describe the factors that contributed to your credit issues in a straightforward manner. You may find it useful to refer to the Colorado Sample Letter for Insufficient Amount to Reinstate Loan for guidance on how to format your explanation effectively.

Start by clearly stating the purpose of your letter. Include a brief overview of your credit problems, outlining the events that led to these issues. Finally, provide a solution or explain the steps you have taken to rectify the situation, referencing the Colorado Sample Letter for Insufficient Amount to Reinstate Loan as a helpful template.