Colorado Irrevocable Trust Agreement Setting up Special Needs Trust for Benefit of Multiple Children

Description

How to fill out Irrevocable Trust Agreement Setting Up Special Needs Trust For Benefit Of Multiple Children?

You might spend numerous hours online trying to locate the legal document template that complies with the state and federal regulations you need.

US Legal Forms offers a vast array of legal templates that have been reviewed by experts.

It is easy to obtain or print the Colorado Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children from their services.

If you need to obtain another version of your form, use the Search field to find the template that meets your needs and criteria.

- If you already possess a US Legal Forms account, you can Log In and select the Acquire option.

- After that, you can complete, modify, print, or sign the Colorado Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children.

- Every legal document template you obtain is yours indefinitely.

- To get an additional copy of a purchased form, visit the My documents tab and click on the relevant option.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the appropriate document template for your area or region of interest. Review the form description to confirm you have chosen the correct one.

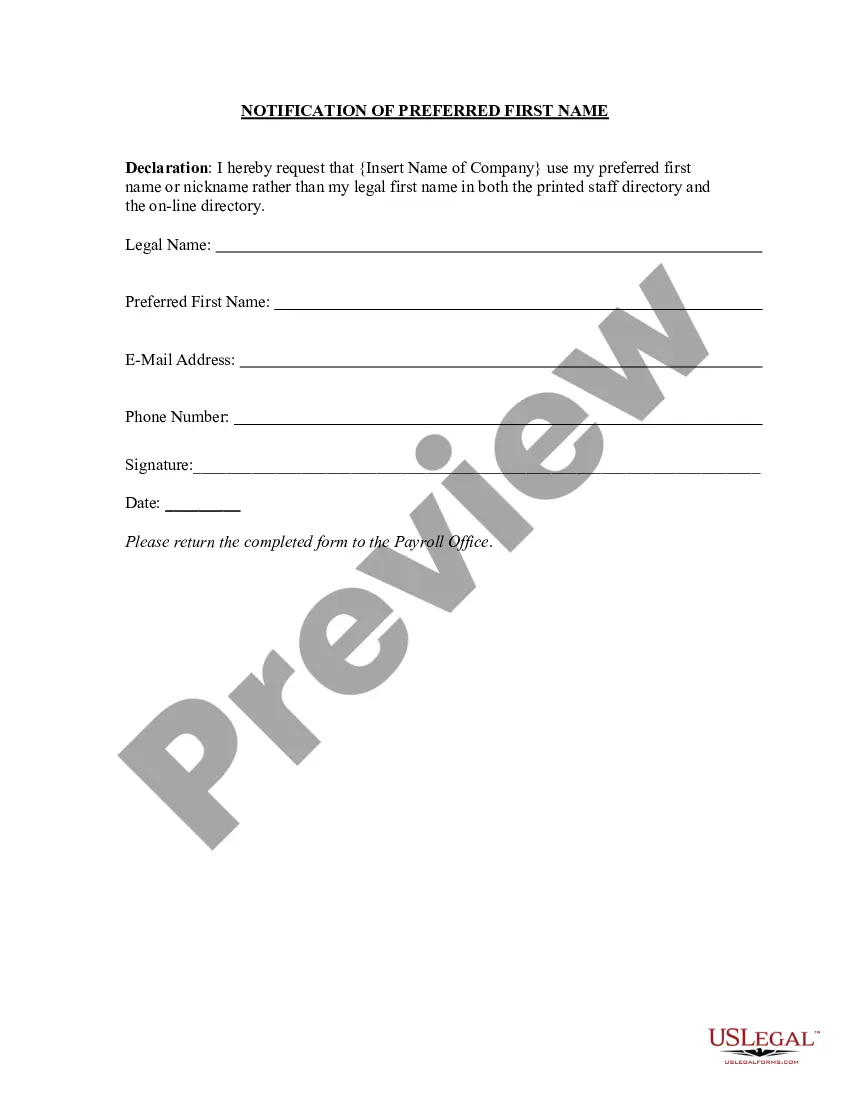

- If available, utilize the Preview option to review the document template as well.

Form popularity

FAQ

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

The term special needs trust refers to the purpose of the trust to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name supplemental needs trust addresses the shortfalls of our public benefits programs.

Once you move your asset into an irrevocable trust, it's protected from creditors and court judgments. An irrevocable trust can also protect beneficiaries with special needs, making them eligible for government benefits, unlike if they inherited properties outright.

Some of the benefits of utilizing an SNT include asset management and maximizing and maintaining government benefits (including Medicaid and Supplemental Security Income). Some possible negatives of utilizing an SNT include lack of control and difficulty or inability to identify an appropriate Trustee.

A special needs trust is a legal arrangement that lets a physically or mentally ill person, or someone chronically disabled, have access to funding without potentially losing the benefits provided by public assistance programs.

Trusts can have more than one beneficiary and they commonly do. In cases of multiple beneficiaries, the beneficiaries may hold concurrent interests or successive interests.

An irrevocable trust is a trust that can't be amended or modified. However, like any other trust an irrevocable trust can have multiple beneficiaries. The Internal Revenue Service allows irrevocable trusts to be created as grantor, simple or complex trusts.

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

Most living trusts automatically become irrevocable upon the grantor's death, so if you were included as a beneficiary of a trust when the grantor died, you will remain a beneficiary of the trust. One of the main exceptions to this rule is where a trust is invalidated through a trust contest.

Yes, but be aware that a co-trustee can be held responsible for another co-trustee's breach of a fiduciary duty. Thus, it is important that all co-trustees pay close attention to everything that is done in the administration of the trust.