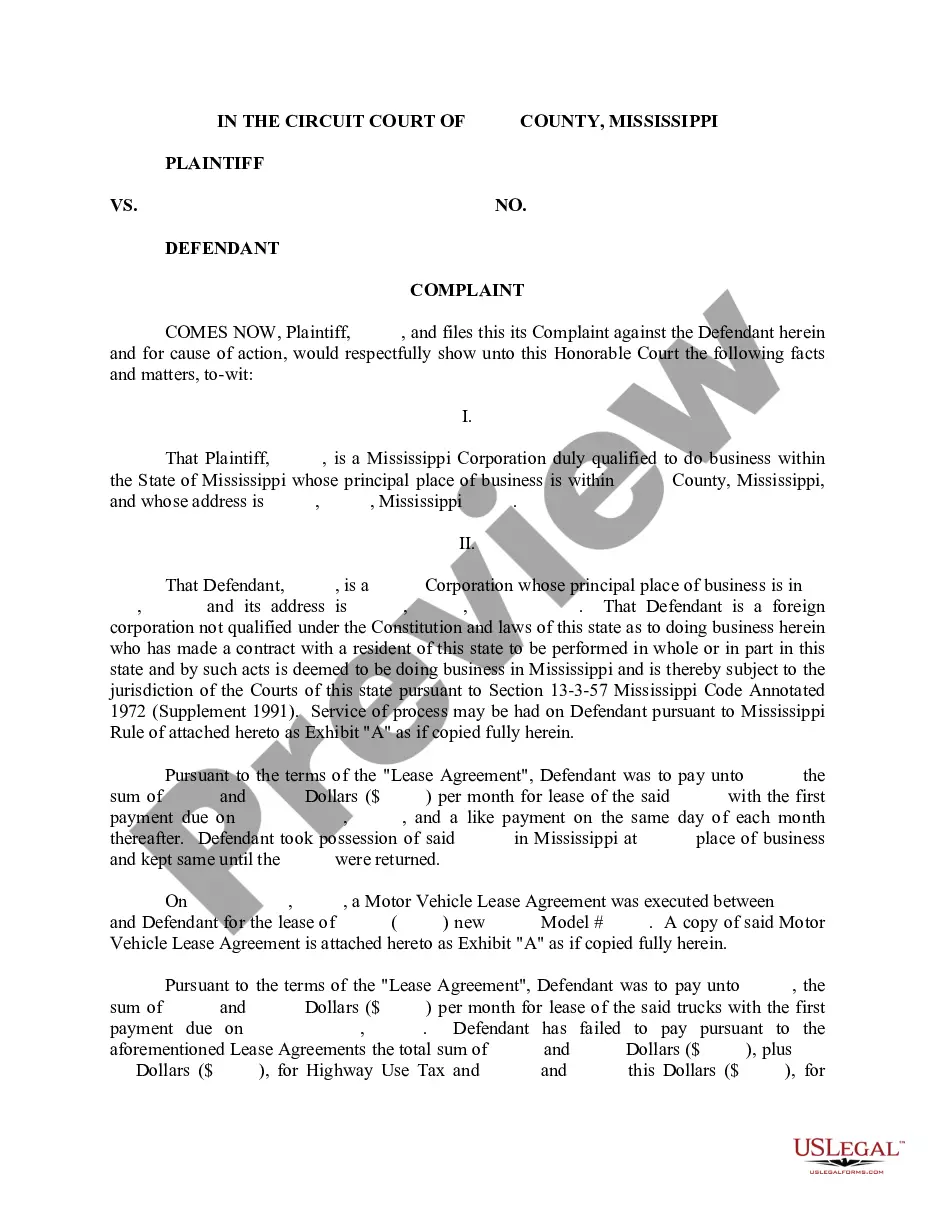

Colorado Sample Letter for Response to Inquiry - Mortgage Company

Description

How to fill out Sample Letter For Response To Inquiry - Mortgage Company?

US Legal Forms - among the most significant libraries of legitimate types in the States - offers a variety of legitimate papers web templates you are able to download or print out. Using the internet site, you can get a large number of types for enterprise and personal functions, sorted by categories, says, or keywords and phrases.You will find the most recent variations of types just like the Colorado Sample Letter for Response to Inquiry - Mortgage Company within minutes.

If you already possess a membership, log in and download Colorado Sample Letter for Response to Inquiry - Mortgage Company from your US Legal Forms local library. The Acquire switch will show up on each and every kind you perspective. You have accessibility to all formerly delivered electronically types inside the My Forms tab of the profile.

If you would like use US Legal Forms the first time, here are straightforward directions to get you started:

- Ensure you have selected the best kind for your area/area. Select the Preview switch to check the form`s content. Browse the kind description to ensure that you have chosen the right kind.

- In case the kind doesn`t suit your needs, utilize the Look for field at the top of the display screen to obtain the one which does.

- If you are satisfied with the form, validate your option by simply clicking the Get now switch. Then, opt for the pricing plan you like and supply your qualifications to sign up for the profile.

- Method the deal. Make use of your bank card or PayPal profile to perform the deal.

- Select the structure and download the form on the device.

- Make changes. Fill up, revise and print out and indicator the delivered electronically Colorado Sample Letter for Response to Inquiry - Mortgage Company.

Each and every format you put into your bank account lacks an expiry day and is also your own property for a long time. So, if you want to download or print out another backup, just proceed to the My Forms section and then click on the kind you need.

Obtain access to the Colorado Sample Letter for Response to Inquiry - Mortgage Company with US Legal Forms, the most substantial local library of legitimate papers web templates. Use a large number of expert and status-particular web templates that satisfy your business or personal needs and needs.

Form popularity

FAQ

A letter of explanation is your opportunity to explain inconsistencies in your mortgage application and any aspects of your financial history that your lender needs to understand better before it can approve you for a loan. After you apply for a home loan, your application goes through the underwriting process.

There is no specific format as such to the Letter of Explanation. The LoE is a single document which should be short, concise and factual (ideally 1 page, maximum 2 pages) and addresses any issues there may be in your application. LoE is only required to explain something that is not apparent and needs clarification.

Credit inquiries, defined. Inquiries happen when there is a legally permitted request to see your credit report from a company or person.

How do I dispute an error or request information about my... To include your name, home address, and mortgage account number. Use the name that is on your mortgage. To identify the error or information. ... Not to write your letter on your payment coupon or other payment form. ... To mail the letter to the right address.

The letter of intent explains a simple process and contains basic conditions that a borrower can review to determine if the lending offer fits with the borrower's project parameters. This is usually used as a first review document to a client and may be changed as needed.

What is a mortgage letter of explanation? Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation.

There are a few guidelines that apply to writing a consumer explanation letter, regardless of the situation. Keep it short and to the point. ... Emphasize the circumstances that led to the issue. ... Explain how your finances have improved. ... Proofread your letter. ... Be nice.