Colorado Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption

Description

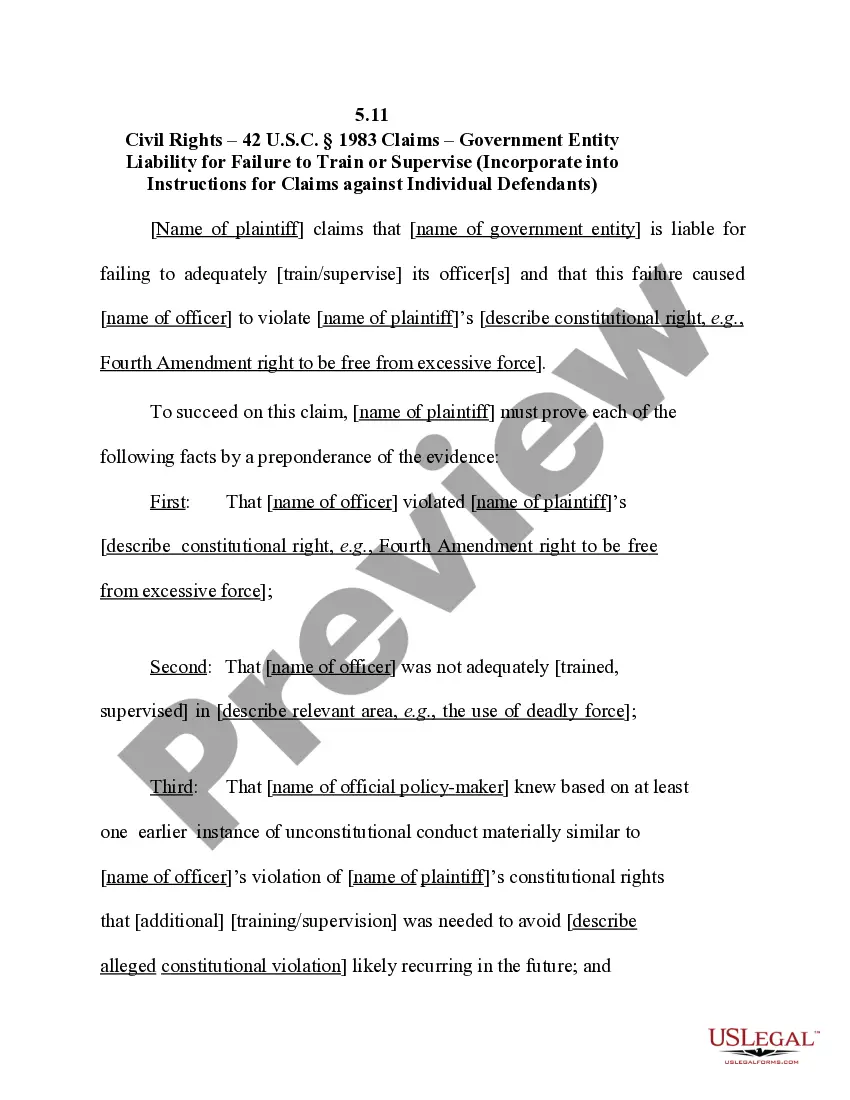

How to fill out Sample Letter For Tax Exemption - Discussion Of Office Equipment Qualifying For Tax Exemption?

Finding the right lawful papers template can be a have a problem. Obviously, there are a variety of templates available on the Internet, but how can you discover the lawful type you require? Take advantage of the US Legal Forms site. The support provides a huge number of templates, including the Colorado Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption, that can be used for organization and private demands. All the types are examined by pros and satisfy state and federal requirements.

If you are previously authorized, log in to your accounts and then click the Download button to find the Colorado Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption. Make use of accounts to look with the lawful types you possess purchased previously. Proceed to the My Forms tab of the accounts and have yet another copy from the papers you require.

If you are a new customer of US Legal Forms, listed here are easy guidelines that you can stick to:

- Initially, make sure you have selected the correct type to your metropolis/region. It is possible to examine the form making use of the Preview button and study the form description to ensure it will be the right one for you.

- In the event the type will not satisfy your needs, make use of the Seach area to discover the correct type.

- When you are positive that the form would work, go through the Get now button to find the type.

- Select the costs program you desire and type in the essential information. Build your accounts and purchase the transaction with your PayPal accounts or Visa or Mastercard.

- Select the submit structure and down load the lawful papers template to your device.

- Comprehensive, revise and printing and signal the received Colorado Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption.

US Legal Forms will be the largest catalogue of lawful types where you will find numerous papers templates. Take advantage of the company to down load appropriately-produced files that stick to express requirements.

Form popularity

FAQ

How to Apply Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. ... Attach a copy of your latest financial statement to reflect sources of Colorado income and expenditures. ... Attach a copy of Colorado Articles of Incorporation or of Organization.

To apply for this certificate with Colorado, use the Application for Sales Tax Exemption for Colorado Organization (DR 0715(opens in new window)). No fee is required for this exemption certificate and it does not expire. All valid non-profit state exemption certificates start with the numbers 98 or 098.

The exemption reduces your taxable income just like a deduction does, but typically has fewer restrictions to claiming it. If you are married and file a joint tax return, both you and your spouse each get to claim an exemption.

How do I verify a Denver sales tax license account? Visit .denvergov.org/treasury and click on the Search Now button on the Sales Tax License Search box. You can also call the Taxpayer Service Unit at 720-913-9400 to verify a license.

(a) A seller must verify that the purchaser's sales tax license or exemption certificate is current and valid at the time of the sale. a license or certificate is current and valid, a seller can go online to and follow the link to ?Verify a License or Certificate.?

State Sales Tax Exempt Products & Services Food, including food sold through vending machines. ... Residential Energy Usage(opens in new window) - all gas, electricity, coal, wood and fuel oil. Medical Equipment & Medicine. Coins and Precious Metal Bullion. Farm Equipment. Seeds, Plants and Trees. Pesticides.

The Colorado Account Number is listed on the Sales Tax License as the first eight (8) digits of the Use Account Number. The CAN is located on the upper left portion of the sales tax license.

To apply for this certificate with Colorado, use the Application for Sales Tax Exemption for Colorado Organization (DR 0715(opens in new window)). No fee is required for this exemption certificate and it does not expire. All valid non-profit state exemption certificates start with the numbers 98 or 098.