US Legal Forms - one of the most significant libraries of legal forms in the USA - delivers a wide range of legal papers web templates you are able to down load or print. While using site, you will get a large number of forms for organization and personal purposes, sorted by types, states, or keywords and phrases.You will find the latest models of forms such as the Colorado Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement in seconds.

If you already have a subscription, log in and down load Colorado Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement from your US Legal Forms catalogue. The Download button will show up on each type you look at. You get access to all formerly downloaded forms inside the My Forms tab of your respective accounts.

If you wish to use US Legal Forms initially, listed below are easy directions to get you began:

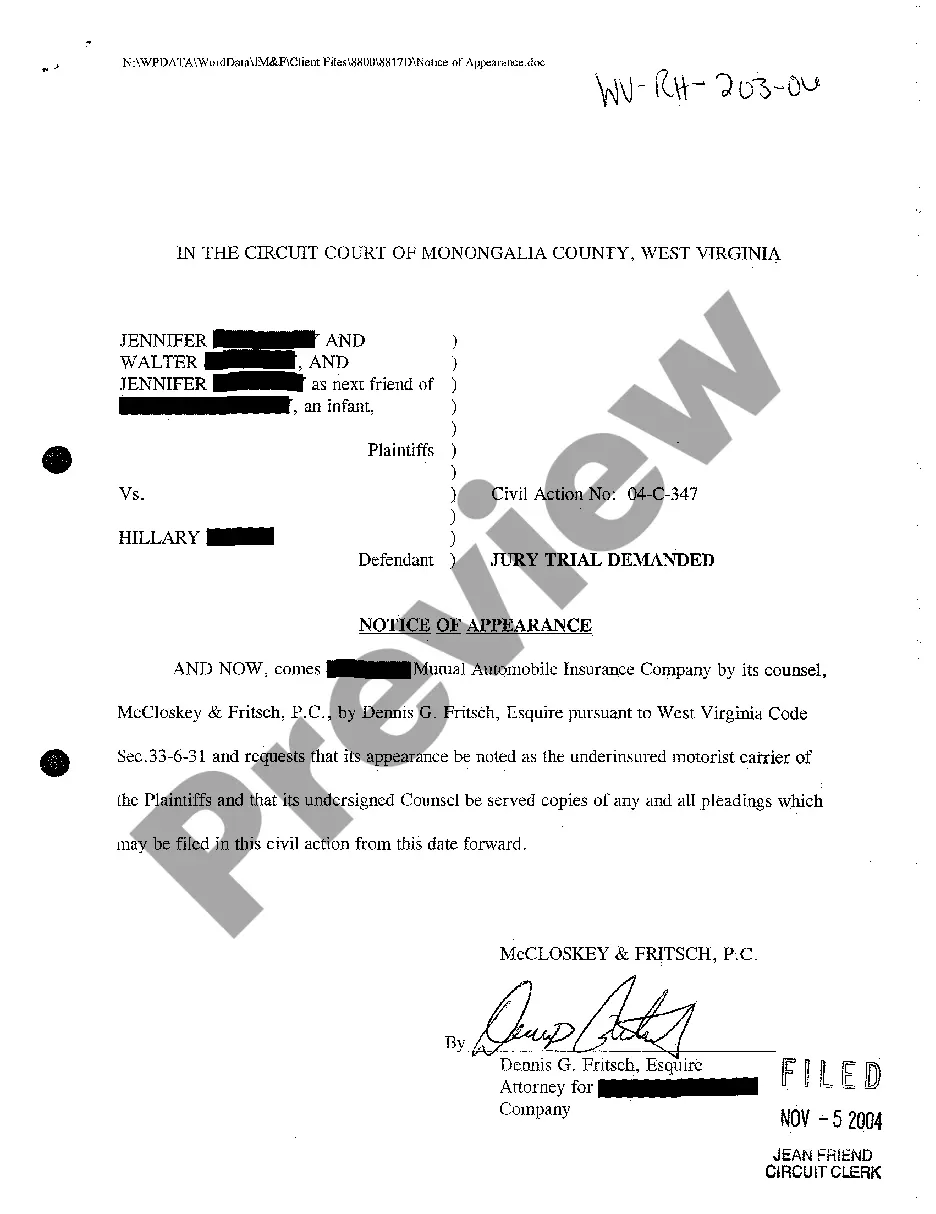

- Be sure to have chosen the correct type for the city/state. Select the Preview button to examine the form`s content material. Look at the type outline to ensure that you have chosen the right type.

- In case the type does not satisfy your needs, make use of the Research discipline on top of the display screen to discover the one who does.

- When you are content with the shape, validate your decision by visiting the Get now button. Then, select the rates program you want and give your accreditations to register for an accounts.

- Method the purchase. Utilize your bank card or PayPal accounts to perform the purchase.

- Find the formatting and down load the shape on your device.

- Make changes. Load, modify and print and signal the downloaded Colorado Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Every single web template you added to your bank account lacks an expiration particular date and is also yours forever. So, if you want to down load or print another version, just visit the My Forms section and click around the type you will need.

Gain access to the Colorado Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms, probably the most considerable catalogue of legal papers web templates. Use a large number of professional and state-particular web templates that satisfy your company or personal requires and needs.