Colorado Notice of Returned Check

Description

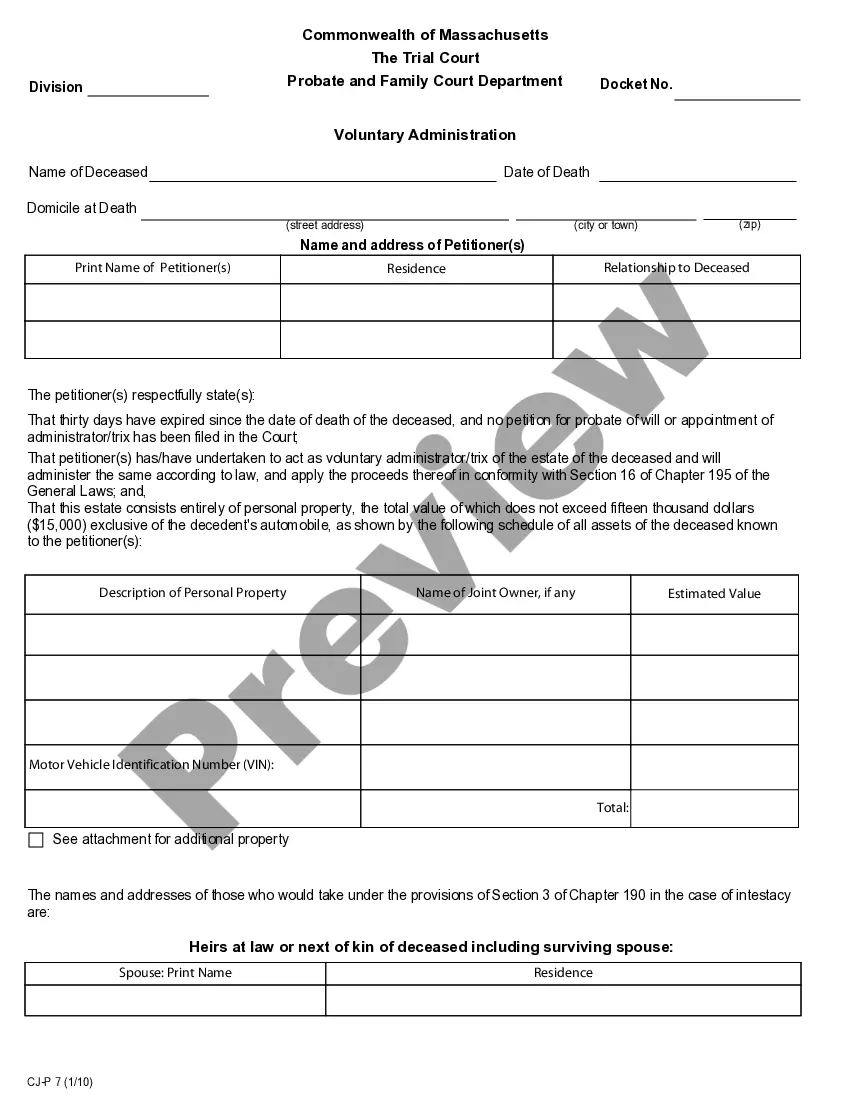

How to fill out Notice Of Returned Check?

US Legal Forms - one of the largest collections of legal templates in the country - offers a wide selection of legal document formats that you can download or print.

While navigating the site, you can discover thousands of templates for business and personal use, organized by categories, states, or keywords.

You can quickly access the newest versions of documents such as the Colorado Notice of Returned Check in mere moments.

If the document doesn’t meet your needs, utilize the Search field at the top of the screen to find one that does.

Once you're satisfied with the document, confirm your choice by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your credentials to register for the account.

- If you hold a subscription, Log In and obtain the Colorado Notice of Returned Check from the US Legal Forms collection.

- The Download button will appear on every document you view.

- You can find all previously obtained documents within the My documents section of your account.

- To use US Legal Forms for the first time, here are basic steps to get started.

- Ensure you've selected the correct document for your specific area/region. Click the Review button to examine the document’s details.

- Review the document summary to confirm you’ve chosen the correct form.

Form popularity

FAQ

If your check was returned, start by reviewing the Colorado Notice of Returned Check for details on the reasons for the return. Next, reach out to your bank for clarification and check your account to ensure you resolve any outstanding issues. Consider using USLegalForms for easy access to templates and legal advice that can help you navigate this situation smoothly.

To contest a returned check, you should first gather any evidence supporting your claim. Review the original agreement and communicate with the bank to understand the reasoning behind the return. A Colorado Notice of Returned Check may also contain vital information for your case. Utilizing legal resources like USLegalForms can provide additional guidance on how to challenge the returned check effectively.

You have several options if you receive a Colorado Notice of Returned Check. First, contact the check issuer to resolve the issue directly. You may need to make a payment arrangement or cover the amount to avoid further penalties. Additional resources, such as USLegalForms, can guide you through the necessary steps to resolve the situation.

Yes, a returned check will generally be submitted for processing. The Colorado Notice of Returned Check informs you that the check could not be processed due to insufficient funds or other issues. It serves as a legal notice to the issuer. Understanding this notice is essential for managing your finances effectively.

A returned check notice is a formal document notifying someone that their check was not honored by the bank. This document typically includes information about the recipient, the check details, and the reason for the return. In Colorado, providing a Colorado Notice of Returned Check is fundamental to remind the issuer of their legal obligation to cover the bounced check amount. Using USLegalForms can simplify the process of creating this notice.

A check may be returned to the sender for several reasons, such as insufficient funds or a closed account. Other reasons include a signature mismatch or altered amounts, which can raise red flags at the bank. When you receive a check back, informing the issuer with a Colorado Notice of Returned Check helps clarify matters and encourages them to address the issue promptly. USLegalForms can provide you with the necessary resources to handle this effectively.

When you receive a returned check, you should first confirm the reason for its return with your bank. After this, contacting the person who issued the check is essential to discuss the matter. Issuing a Colorado Notice of Returned Check is a good practice, as it outlines the outstanding amount and informs the issuer of their responsibility. You might find useful templates on platforms like USLegalForms if you need assistance with this notice.

Colorado law provides clear guidelines regarding bounced checks. If a check bounces, the issuer is responsible for covering any resulting fees and fulfilling the debt. Under this law, you can send a Colorado Notice of Returned Check to formally inform the issuer of their obligation. This notice can be an important step in resolving the situation amicably.

When someone gives you a check that bounces, it means the bank could not process it due to insufficient funds or a closed account. Consequently, you may have to address the issue with the person who issued the check. If you receive a Colorado Notice of Returned Check, this document provides formal notification about the bounced check, outlining steps for resolution. You can seek further assistance using platforms like USLegalForms to navigate the situation.

To fix a returned check, start by reviewing the Colorado Notice of Returned Check for specific reasons behind the return. Communicating with the check issuer is crucial; they may resolve the issue with a direct payment. Additionally, if the situation escalates, seeking assistance from platforms like US Legal Forms can guide you through resolving paperwork or understanding local regulations related to returned checks. Taking quick action can help you prevent further complications.