Colorado Extended Date for Performance

Description

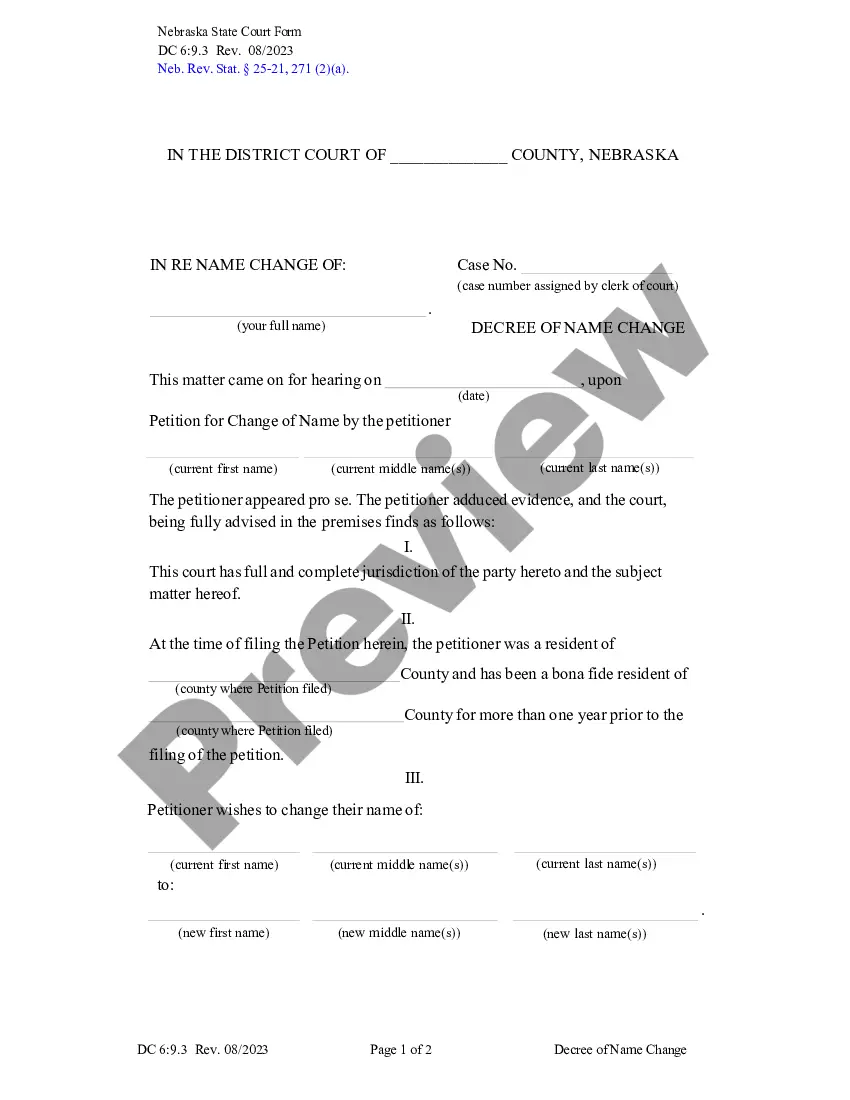

How to fill out Extended Date For Performance?

You have the capability to spend hours online trying to locate the proper legal form template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal documents that have been reviewed by experts.

You can easily download or print the Colorado Extended Date for Performance from their service.

If available, utilize the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Obtain button.

- Then, you can complete, modify, print, or sign the Colorado Extended Date for Performance.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form description to verify you have selected the proper form.

Form popularity

FAQ

The Colorado PTE, or Performance Time Extension, can be retroactive in certain circumstances, but it is essential to carefully review the conditions associated with each case. Retrofitting your extension might help accommodate unforeseen delays and protect your interests. With the Colorado Extended Date for Performance, you can make informed decisions about your obligations. Relying on reliable resources like USLegalForms ensures clarity and accuracy in handling these matters.

In Colorado, extensions are generally not automatic; you must submit the appropriate request to obtain an extended date for performance. However, specific situations may allow for conditional extensions under various laws. Understanding the requirements for extensions is crucial to avoid penalties. Using the Colorado Extended Date for Performance can simplify this process and help maintain compliance with necessary deadlines.

The Colorado extension form is a legal document that allows individuals and businesses to request a delay in performance deadlines. This form is essential for those needing extra time to fulfill obligations under contracts or agreements. Utilizing the Colorado Extended Date for Performance helps ensure that all parties stay informed and in compliance with legal requirements. You can easily access this form through platforms like USLegalForms, which provide user-friendly resources for managing your legal documents.

Filing a tax extension requires a few simple steps. First, determine whether you need to file for a state or federal extension. For Colorado, complete the DR 0158-I form and submit it along with any required payment. Remember that the Colorado Extended Date for Performance allows you additional time to complete your filing, making this process much simpler. Using platforms like uslegalforms can also streamline your submission, ensuring you follow all requirements accurately.

Filling out the Colorado W4 form is straightforward. Begin by entering your personal information, including your name, address, and Social Security number. Next, indicate your filing status, such as single or married, and claim any allowances. This form ensures that your employer withholds the appropriate amount of taxes, which is essential to avoid any surprises when the Colorado Extended Date for Performance arrives.

Yes, you can file your taxes on April 16 even if the official due date is April 18. Filing early can help avoid last-minute issues and give you peace of mind. It's also an excellent way to prepare for the Colorado Extended Date for Performance, as you will have more time to review and ensure accuracy in your submission.

The extended filing deadline for Colorado tax returns is October 15. This date applies if you have successfully filed for an extension by the original due date. Utilizing the Colorado Extended Date for Performance allows taxpayers to take advantage of this additional time while remaining compliant with state requirements.

If you file an extension, you typically have until October 15 to submit your taxes. This additional time helps in gathering necessary documents and ensures accuracy in your filings. The Colorado Extended Date for Performance supports your ability to meet this deadline without stress.

No, you cannot file for an extension after the April 18 deadline. Extensions must be submitted by this date to ensure you qualify for an additional filing period. Engaging with resources like uslegalforms can clarify your options and help you understand the implications of the Colorado Extended Date for Performance in your situation.

Yes, Colorado provides an automatic extension for trusts when the correct forms are submitted on time. Trusts in Colorado benefit from the same automatic extension provisions as individual tax filers. By leveraging the Colorado Extended Date for Performance, trustees can effectively manage their filing deadlines without fear of penalties.