Colorado Articles of Association

Description

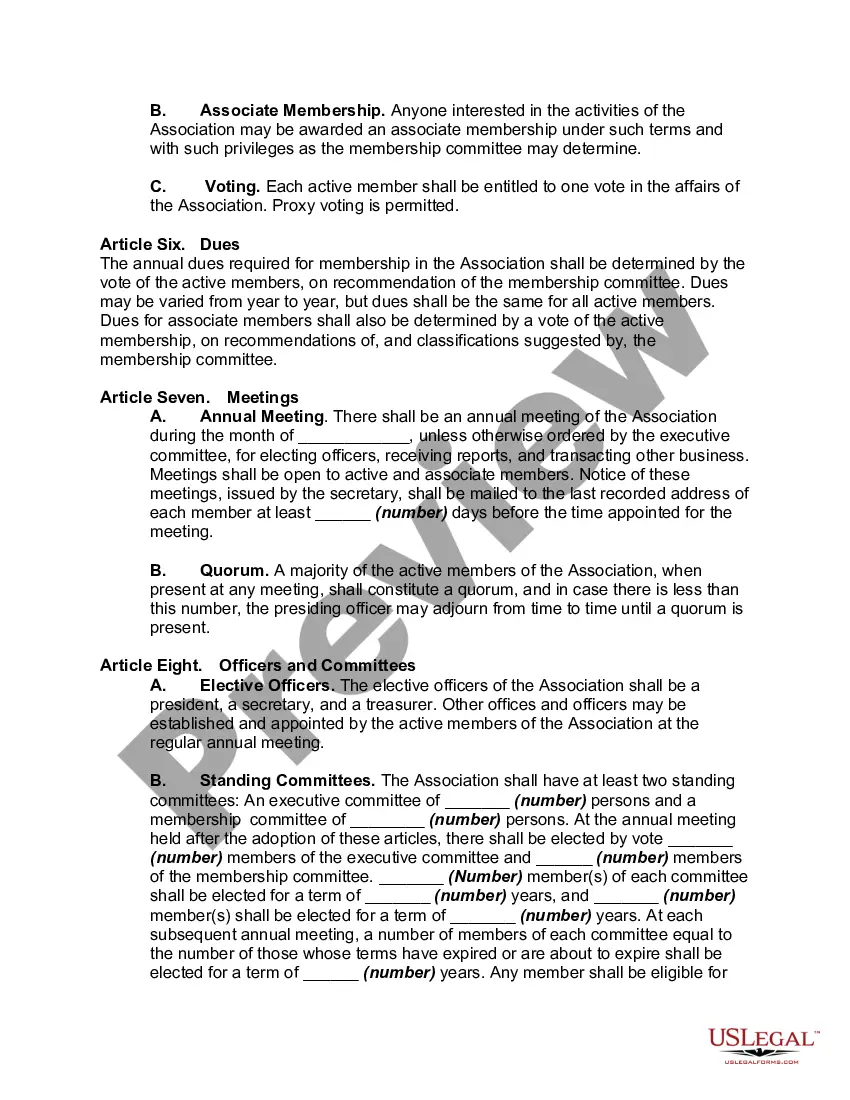

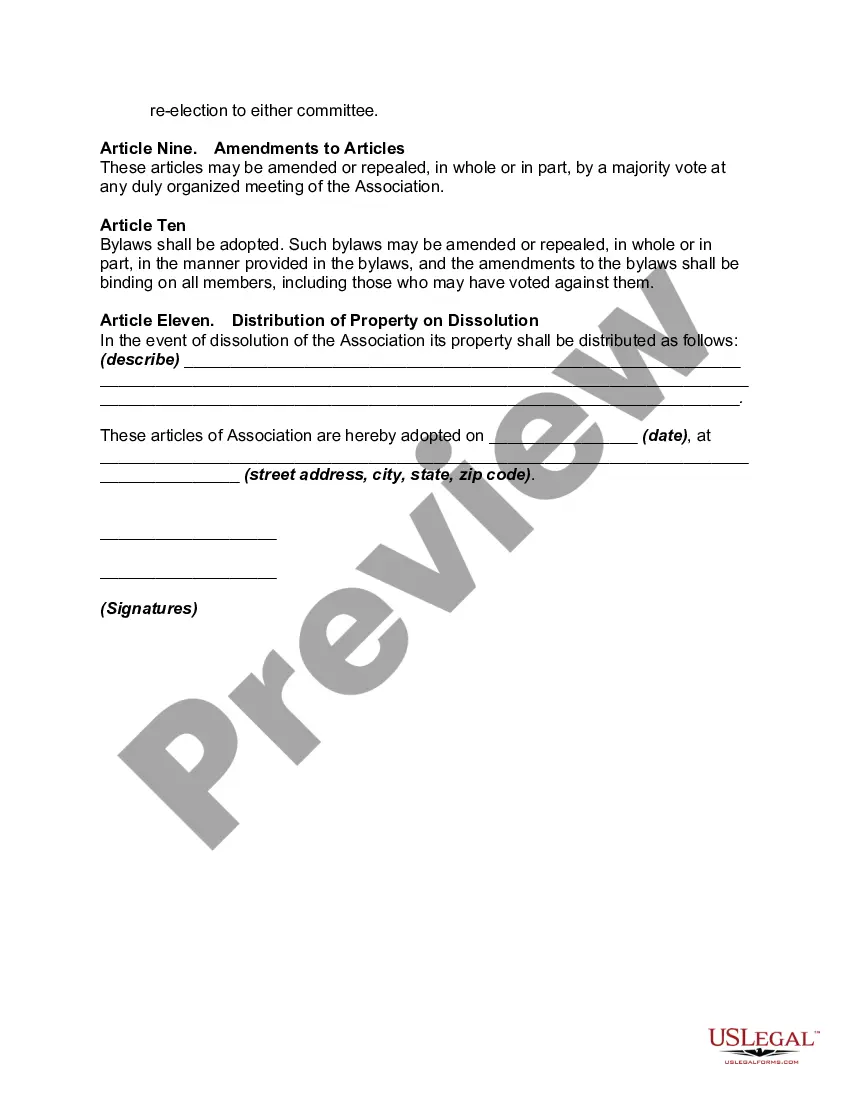

Statutes in some jurisdictions require that the constitution or articles of association, and the bylaws, be acknowledged or verified. In some jurisdictions, it is required by statute that the constitution or articles of association be recorded, particularly where the association or club owns real property or any interest in real property.

How to fill out Articles Of Association?

If you wish to completely, download, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the website's simple and efficient search function to find the documents you require.

Different templates for business and individual purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your credentials to create an account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to obtain the Colorado Articles of Incorporation in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to receive the Colorado Articles of Incorporation.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form template.

Form popularity

FAQ

Yes, if you're forming an LLC in Colorado, you must file Articles of Association. This step is crucial for legally recognizing your LLC and ensuring compliance with state laws. Resources like uslegalforms can guide you through the process, making it easier to start your business on the right foot.

The purpose of Colorado Articles of Association is to formally establish your organization in the eyes of the law. They outline essential details such as the entity’s name, purpose, and structural hierarchy. Filing these articles helps protect your business's legitimacy and lays the groundwork for future operations.

Colorado Articles of Association do not directly show ownership; instead, they outline the structure of the organization. Ownership information, such as member or shareholder details, is typically found in other documents, like an operating agreement. It's crucial to maintain accurate records to clarify ownership and responsibilities.

No, Colorado Articles of Association and bylaws are not the same. The articles of association establish the framework for your organization, detailing its purpose and structure. Bylaws provide the internal rules that govern how the organization operates. Understanding these differences is essential for effective management.

To locate Articles of Incorporation in Colorado, you can access the Colorado Secretary of State's website, which maintains a database of business filings. Simply enter the name of the company you’re interested in, and you will be able to view the Articles of Incorporation along with other relevant documents. This information is vital for verifying a company’s legitimacy and understanding its structure. If you need to draft your own documents, USLegalForms offers a streamlined solution to create compliant Colorado Articles of Association.

The Articles of Organization is a crucial document for forming a limited liability company (LLC) in Colorado. This document formally establishes your LLC and includes essential information such as the company's name, address, and the registered agent's details. By filing the Articles of Organization, you are laying the groundwork for your business according to Colorado law. You can find a user-friendly platform like USLegalForms to help you create and file your Colorado Articles of Association effortlessly.

The purpose statement in the Articles of Organization outlines your company's activities. For instance, you might state that your LLC is formed to provide consulting services, sell products, or conduct any legal business activity. This purpose helps define your business's scope and responsibilities in Colorado. Clearly stating your purpose in the Articles of Organization can also enhance clarity for future business dealings.

Yes, an LLC always requires Articles of Organization to be legally established in Colorado. This document outlines your business's vital information and complies with state regulations. Without it, your LLC does not exist as a recognized entity. It’s crucial to ensure that your Articles of Organization are accurate and up to date.

To transfer ownership of an LLC in Colorado, start by reviewing your operating agreement for specific transfer procedures. Typically, you will need a written agreement documenting the terms of the transfer. After finalizing this agreement, you may need to update your Articles of Organization to reflect the new owner. Keep in mind that transparency and clear communication are key to a smooth transition.

Writing Articles of Organization for your LLC involves including specific information required by Colorado law. Start with the business name, its principal address, and details about the registered agent. You also need to state the purpose of your LLC and outline its management structure. Many find using a resource like US Legal Forms helpful for clear templates and guidelines.