Colorado Checklist in Drafting Articles of Association for Association or Club

Description

How to fill out Checklist In Drafting Articles Of Association For Association Or Club?

Are you presently within a place where you need papers for either business or person functions virtually every working day? There are plenty of lawful file layouts accessible on the Internet, but discovering ones you can rely on isn`t straightforward. US Legal Forms provides a large number of develop layouts, just like the Colorado Checklist in Drafting Articles of Association for Association or Club, which can be written to meet federal and state requirements.

In case you are presently familiar with US Legal Forms internet site and have your account, merely log in. After that, you are able to down load the Colorado Checklist in Drafting Articles of Association for Association or Club template.

Should you not provide an profile and would like to begin to use US Legal Forms, adopt these measures:

- Discover the develop you require and ensure it is to the appropriate area/county.

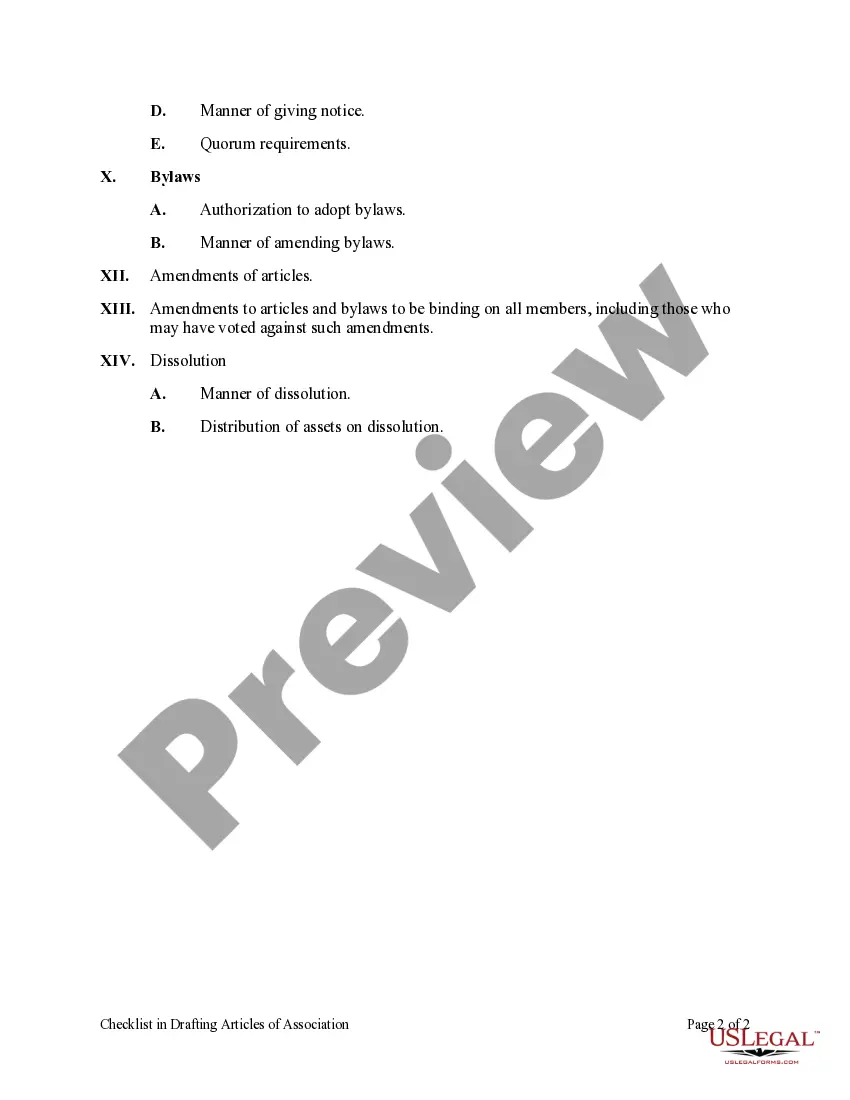

- Make use of the Review switch to review the shape.

- Browse the description to actually have chosen the proper develop.

- In case the develop isn`t what you are looking for, take advantage of the Search discipline to get the develop that suits you and requirements.

- Whenever you obtain the appropriate develop, click Acquire now.

- Choose the costs plan you desire, fill in the necessary details to generate your account, and purchase the transaction making use of your PayPal or charge card.

- Pick a handy file file format and down load your duplicate.

Find all the file layouts you may have purchased in the My Forms food selection. You can get a further duplicate of Colorado Checklist in Drafting Articles of Association for Association or Club at any time, if required. Just go through the required develop to down load or print out the file template.

Use US Legal Forms, by far the most extensive variety of lawful kinds, in order to save time and prevent faults. The services provides appropriately manufactured lawful file layouts that can be used for a variety of functions. Generate your account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

Here's what you can gain by forming a Colorado Limited Liability Company. Limited Personal Liability. ... Tax Advantages. ... Privacy Protection. ... Management Flexibility. ... Ownership Flexibility. ... Flexible Profit Distributions. ... Easy to Set Up and Maintain. ... Inexpensive.

A Limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the business debts and liabilities.

The Colorado Limited Liability Company Act was adopted in 1990. An LLC combines the concepts of partnerships for tax purposes and corporations for liability purposes. LLCs are created by filing ?Articles of Organization? with the Secretary of State. While similar, LLCs are NOT corporations.

The LLC has two main advantages: It prevents its owners from being held personally responsible for the debts of the company. If the company goes bankrupt or is sued, the personal assets of its owner-investors cannot be pursued. It allows all profits to be passed directly to those owners to be taxed as personal income.

Colorado LLC Formation Filing Fee: $50 Once you file Colorado Articles of Organization with the Secretary of State, your Colorado LLC officially exists as a legal entity. Filing in Colorado is way less burdensome than in most other states?the fee is just $50.

Filing Articles of Organization is how you form your LLC in the State of Colorado. Per 7-90-314(1) C.R.S. you must have written consent to list the name of any person in your document, or to use their address. This is for your own records; you do not need to include it with this filing.

The following are taxation requirements and ongoing fees in Colorado: Annual report. Colorado requires LLCs to file an annual report, which is called a Periodic Report. ... Taxes. ... Federal tax identification number (EIN). ... State tax identification number.