Colorado Articles of Association of Unincorporated Charitable Association

Description

Form popularity

FAQ

The primary purpose of an unincorporated association is to carry out activities for a common interest or charitable cause without formal incorporation. This allows flexibility in operations and decision-making while still serving the community effectively. The Colorado Articles of Association of Unincorporated Charitable Association clarify how such groups can organize and govern themselves, ensuring they serve their mission while minimizing administrative burdens. For those seeking to establish a charitable group, using our platform can facilitate this process seamlessly.

A nonprofit organization is a formal entity registered with the state, designed to operate for charitable purposes. In contrast, an unincorporated association does not require state registration and can exist as an informal group. The Colorado Articles of Association of Unincorporated Charitable Association provide a framework for establishing such groups while ensuring adherence to specific legal standards. Both structures serve charitable functions, but their legal requirements and formalities differ significantly.

The 33% rule for nonprofits refers to the guideline that no more than 33% of a nonprofit's revenue can be generated from fundraising events. This rule ensures that organizations maintain a balanced approach to sustainability and funding. Understanding this principle is essential for organizations involved with the Colorado Articles of Association of Unincorporated Charitable Association, as it helps in maintaining compliance and operational health.

Filing a Doing Business As (DBA) in Colorado involves submitting an application to the Secretary of State. This process usually requires a completed form that includes the intended business name and the type of organization. Ensuring that the chosen name does not conflict with existing registered entities is vital, especially for organizations governed by the Colorado Articles of Association of Unincorporated Charitable Association.

Nonprofit organizations in Colorado are regulated by several bodies, with the Secretary of State being the primary authority. This office ensures that nonprofits adhere to regulatory requirements, including those related to the Colorado Articles of Association of Unincorporated Charitable Association. Furthermore, the IRS monitors federal compliance for nonprofits seeking tax-exempt status.

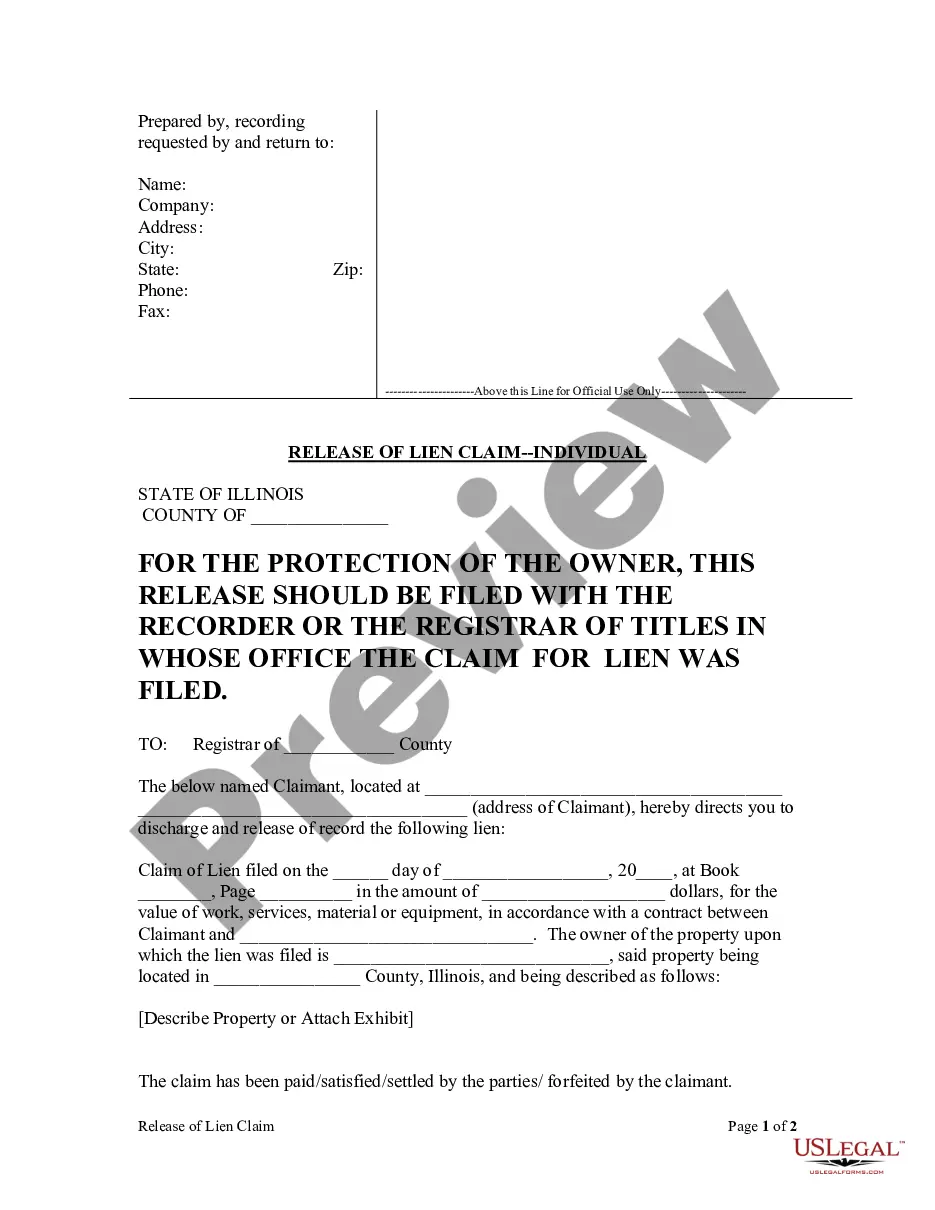

The articles of association are essential documents that outline the structure and purpose of a nonprofit organization. They define the organization's mission, governance procedures, and operational guidelines. When forming a nonprofit in Colorado, it is important to refer to the Colorado Articles of Association of Unincorporated Charitable Association to ensure compliance with local laws.

In Colorado, nonprofits are primarily regulated by the Secretary of State's office. This office oversees the registration and compliance of nonprofit organizations including the review of the Colorado Articles of Association of Unincorporated Charitable Association. Additionally, various state and federal laws provide a framework for nonprofit governance and accountability.

Yes, a 501c3 organization must have articles of incorporation to establish its legal existence. These articles serve as the foundational documents that define the organization’s purpose, governance structure, and operational guidelines. When filing for 501c3 status, including details about the Colorado Articles of Association of Unincorporated Charitable Association is crucial to comply with state regulations.

Nonprofit organizations are held accountable by various entities, including state regulators, donors, and the public. In Colorado, the Secretary of State's office plays a vital role in overseeing compliance with state laws. Additionally, the community often holds nonprofits accountable through feedback and support, thus fostering transparency and responsibility.

The complaint form for a nonprofit organization is a document that individuals can submit to raise concerns or grievances regarding the organization's operations. This form typically includes sections for detailing the nature of the complaint and the relevant facts. When addressing issues related to the Colorado Articles of Association of Unincorporated Charitable Association, it is essential to follow the specific procedures outlined by the state.