Colorado Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

Selecting the optimal legal document template can be a challenge.

Clearly, there is an array of templates accessible online, but how do you obtain the legal form you desire? Utilize the US Legal Forms website.

The service offers a vast selection of templates, including the Colorado Nonresidential Simple Lease, which you can use for business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If the form does not fulfill your requirements, use the Search field to find the appropriate document. Once you are certain the form is correct, click the Purchase now button to obtain the document. Choose the pricing plan you desire and fill in the necessary details. Create your account and make your purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the received Colorado Nonresidential Simple Lease. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the platform to download professionally crafted documents that adhere to state standards.

- If you are already a registered user, Log In to your profile and click on the Download button to obtain the Colorado Nonresidential Simple Lease.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents section of your account to acquire another version of the document you need.

- If you are a new customer of US Legal Forms, here are straightforward steps to follow.

- Firstly, ensure you have selected the correct form for your city/state.

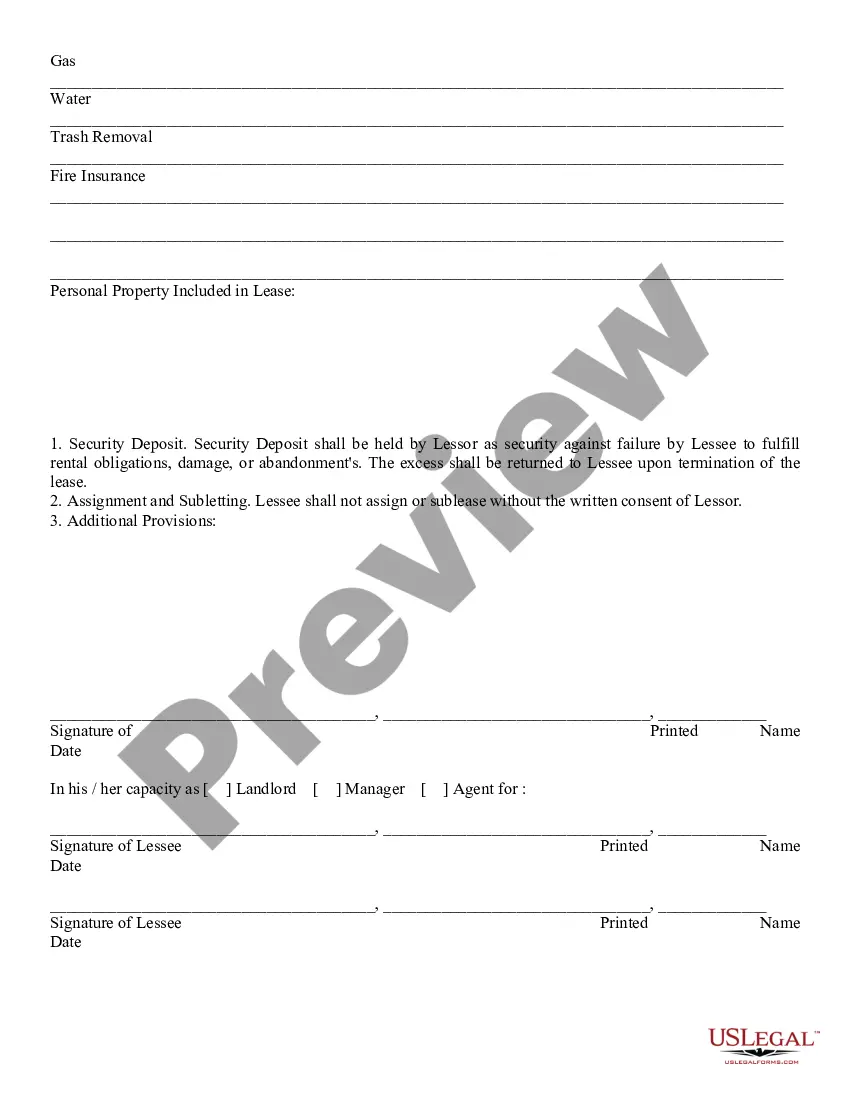

- You can review the document using the Preview button and examine the form outline to confirm it is suitable for your needs.

Form popularity

FAQ

The lowest lease term for a Colorado Nonresidential Simple Lease can vary, but it is often as short as one month. This flexibility allows tenants to test a space before committing to a longer term. Short lease terms can be beneficial for startups and small businesses looking to minimize their financial risk. Consider exploring lease options through US Legal Forms to find a template that aligns with your leasing preferences.

A simple lease, such as the Colorado Nonresidential Simple Lease, is a straightforward rental agreement that outlines essential terms without unnecessary complexity. It typically covers the duration of the lease, rental payments, and responsibilities of both parties. This type of lease is often favored by small business owners and new tenants because it simplifies the leasing process. By using US Legal Forms, you can easily customize this lease to suit your specific needs.

The most common type of lease in Colorado is the standard residential lease, but many businesses prefer the Colorado Nonresidential Simple Lease for commercial spaces. This lease type simplifies the rental process for business owners while offering flexibility and clarity. With its straightforward structure, it meets the needs of many landlords and tenants. Choosing this lease through US Legal Forms can increase your chances of a successful rental arrangement.

In Colorado, a lease becomes legally binding when it has clear terms, is signed by both parties, and is supported by consideration. The Colorado Nonresidential Simple Lease highlights the importance of mutual consent, meaning that both the landlord and tenant must agree to the terms. This mutual agreement, along with proper execution, ensures that the lease holds up in court if needed. Using US Legal Forms can help ensure that your lease meets all legal requirements.

A Colorado Nonresidential Simple Lease generally produces lower risk because it includes clearly defined terms, conditions, and responsibilities for both the landlord and the tenant. This simplicity helps to prevent misunderstandings that can lead to disputes. Additionally, the straightforward nature of this lease type often makes it easier for both parties to negotiate and reach an agreement. Engaging with US Legal Forms can also provide you with templates that adhere to state regulations, minimizing legal risks.

Non-residents must file a Colorado tax return if they earn income from Colorado sources. This includes completing the Form 104PN and reporting their income accurately. In addition, non-residents should gather all necessary documentation related to their earnings. Utilizing the Colorado Nonresidential Simple Lease can also give you insights into any lease-related obligations that may impact your tax filing.

The 104PN form is the Colorado Nonresident Income Tax Form. It is specifically designed for nonresidents who earn income from Colorado sources to report their earnings and tax liabilities accurately. By using this form, you can calculate how much tax you owe based on your Colorado-derived income. When dealing with leasing in Colorado, understanding the 104PN form in relation to the Colorado Nonresidential Simple Lease can clarify your financial responsibilities.

Certain individuals can be exempt from Colorado state tax, including some low-income residents and those who meet specific qualifications. For instance, if your income falls below a certain threshold, you may not owe state taxes. Additionally, some military personnel and their dependents may qualify for exemptions. It's crucial to review the details regarding the Colorado Nonresidential Simple Lease to see how these exemptions could affect your lease agreement.

When you are a nonresident filing taxes in Colorado, you need to use the Form 104PN. This form specifically addresses the tax obligations for individuals who earn income in Colorado but reside in another state. It helps you calculate the income tax that applies to your Colorado earnings. Consider using our Colorado Nonresidential Simple Lease to guide you through relevant regulations and ensure compliance.

In Colorado, most leases, including residential and non-residential leases, do not require notarization to be legally binding. However, having a lease notarized can provide an added layer of protection. If you choose to utilize a Colorado Nonresidential Simple Lease, ensure that all necessary signatures are obtained, even if notarization is not mandatory.