An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian

Description

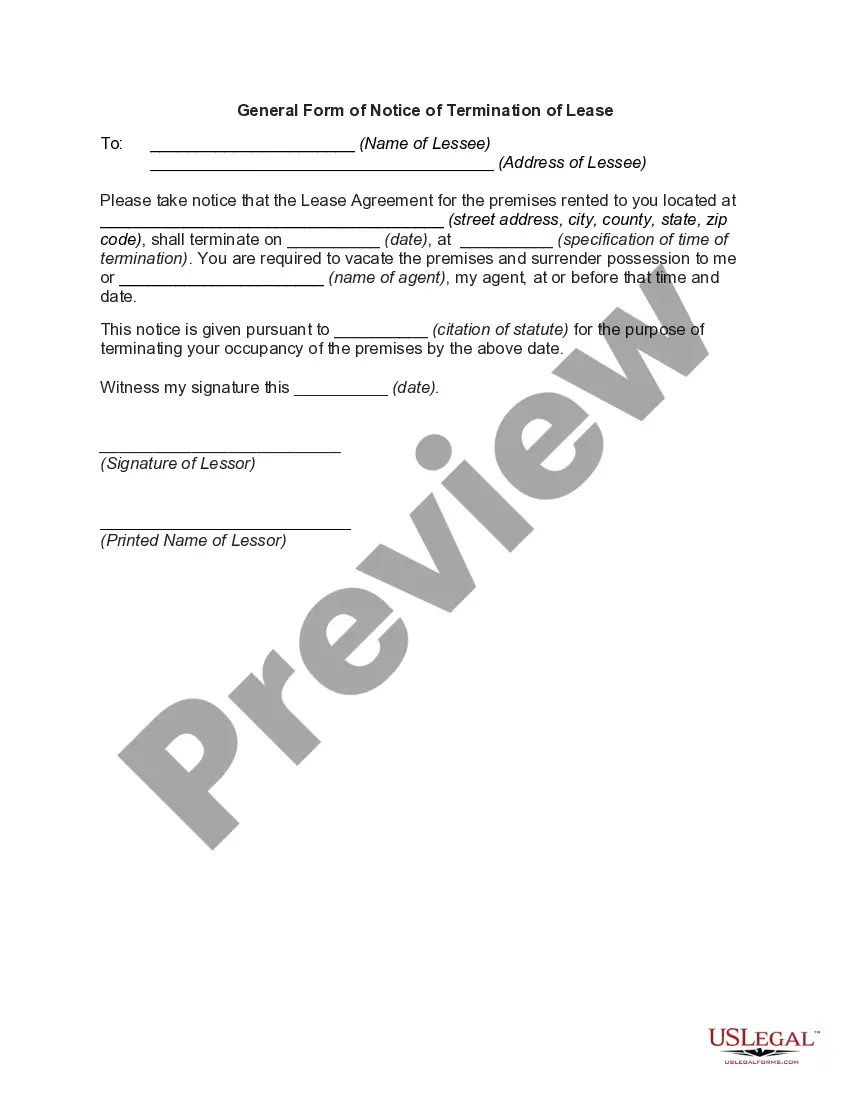

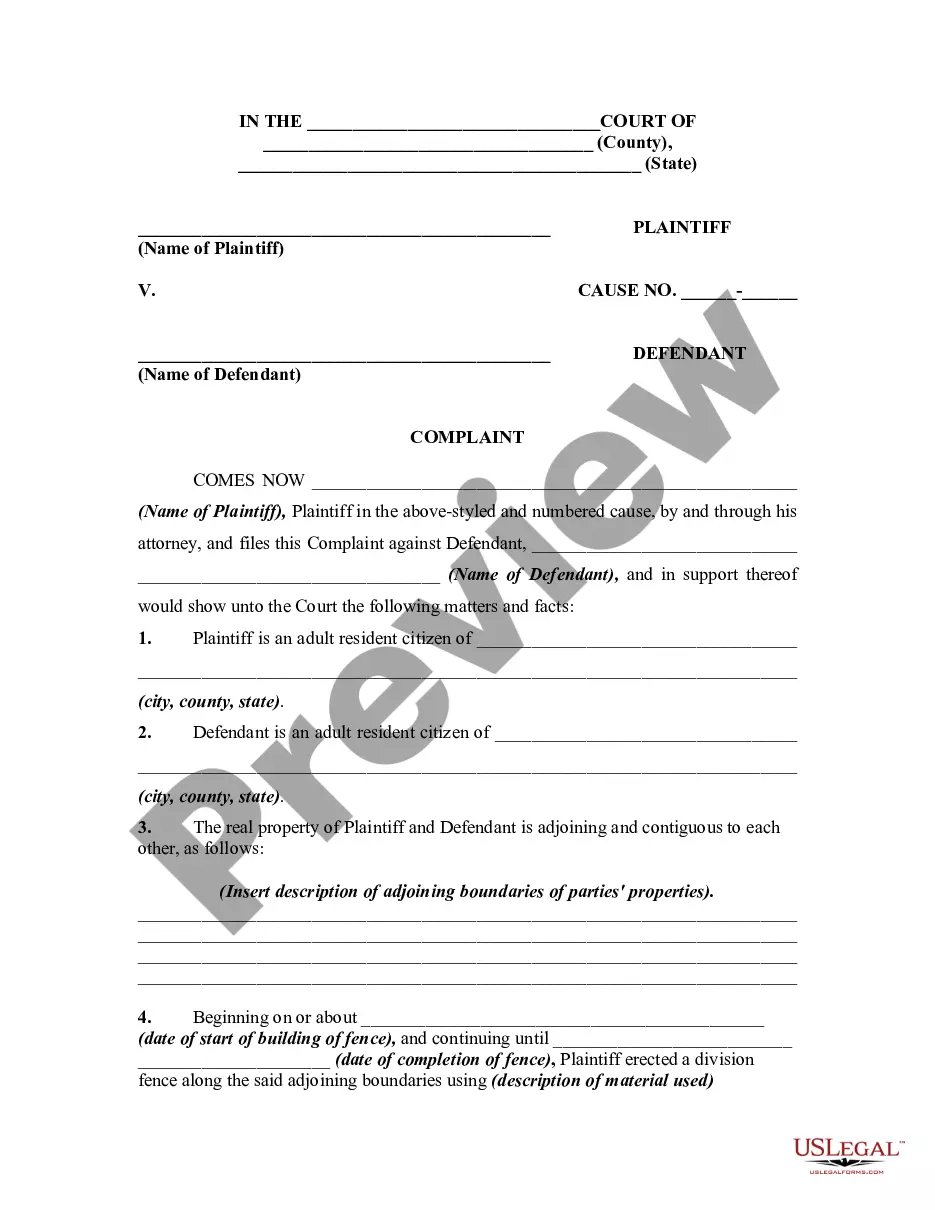

How to fill out Demand For Accounting From A Fiduciary Such As An Executor, Conservator, Trustee Or Legal Guardian?

If you desire to finalize, obtain, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and user-friendly search function to locate the paperwork you need.

Various templates for business and personal purposes are organized by categories and claims, or keywords.

Step 4. Once you have found the form you need, click the Purchase now option. Choose your preferred pricing plan and input your information to register for an account.

Step 5. Complete the transaction. You can utilize your Visa or MasterCard or PayPal account to process the payment. Step 6. Select the format of your legal form and download it onto your device. Step 7. Complete, modify, and print or sign the Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian.

- Utilize US Legal Forms to discover the Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian with just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click on the Download option to access the Colorado Demand for Accounting from a Fiduciary like an Executor, Conservator, Trustee, or Legal Guardian.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct location/region.

- Step 2. Use the Review feature to examine the form's details. Remember to read the description.

- Step 3. If you are unhappy with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

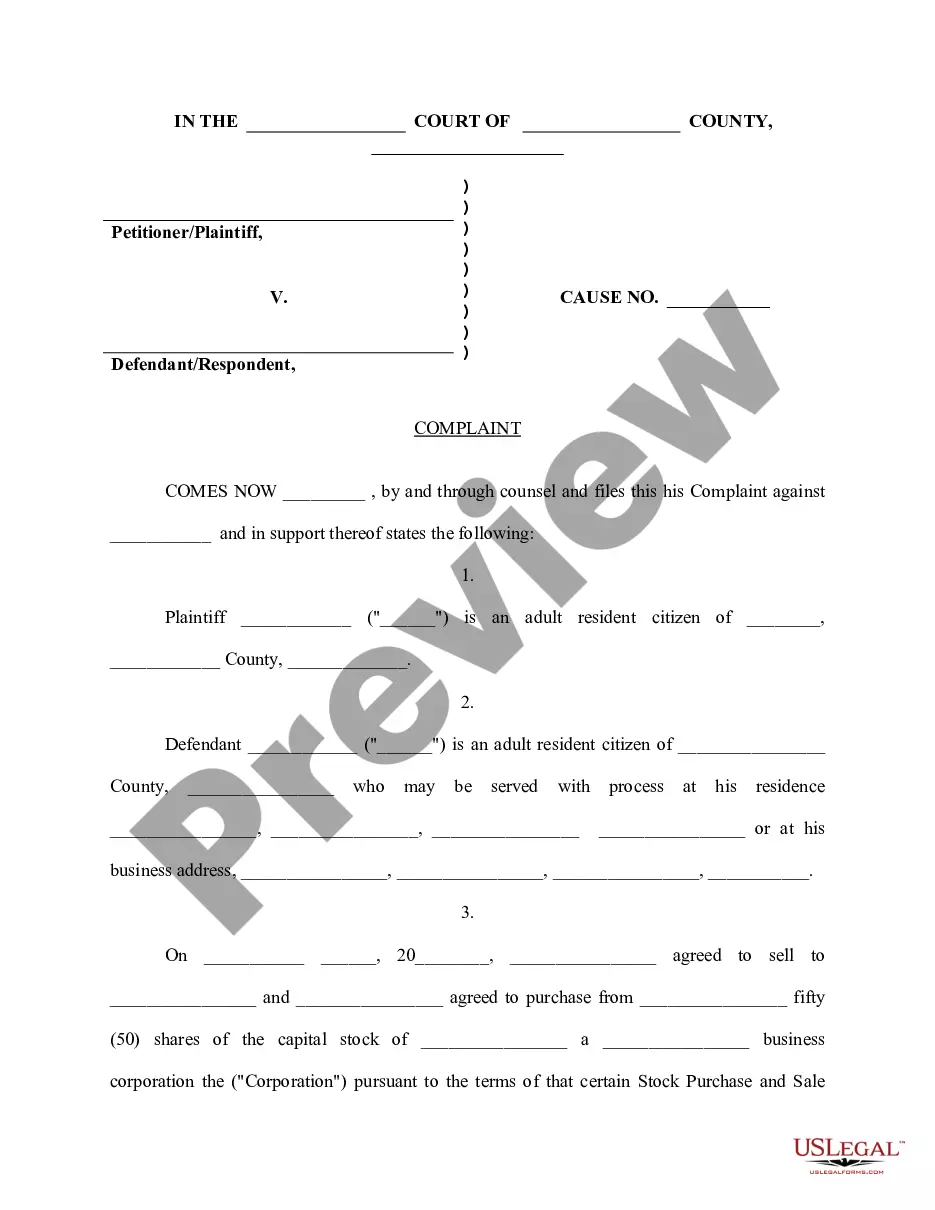

To file for conservatorship in Colorado, you must first complete the necessary court forms and file them with your local court. You will need to provide evidence of the individual's need for a conservator, often supported by medical documentation. Once filed, the court will schedule a hearing, allowing for a determination regarding your Colorado demand for accounting from a fiduciary such as an executor, conservator, trustee, or legal guardian, and ensuring proper oversight of the individual’s affairs. Consider using US Legal Forms for streamlined resources and guidance throughout this process.

In simple terms, a fiduciary is someone who acts on behalf of another person, managing their financial or personal interests with the highest level of care. This could include roles like executors, trustees, or conservators. They are legally obligated to act in the best interests of the individuals they serve, especially when it comes to handling a Colorado demand for accounting from a fiduciary such as an executor, conservator, trustee, or legal guardian.

A fiduciary conservator is a court-appointed individual responsible for managing the financial affairs and personal care of someone who cannot make those decisions themselves. This role often includes overseeing assets, paying bills, and ensuring the well-being of the individual. In Colorado, a demand for accounting from a fiduciary such as an executor, conservator, trustee, or legal guardian may arise to ensure transparency and uphold the best interests of the person under protection.

Yes, estate accounts are indeed considered fiduciary accounts. These accounts are created to manage the assets of a deceased person's estate and are operated by fiduciaries such as executors or trustees. When it comes to a Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, these accounts must be maintained with transparency and accuracy, ensuring all transactions reflect the best interests of the beneficiaries. To navigate these responsibilities effectively, explore the resources available at US Legal Forms.

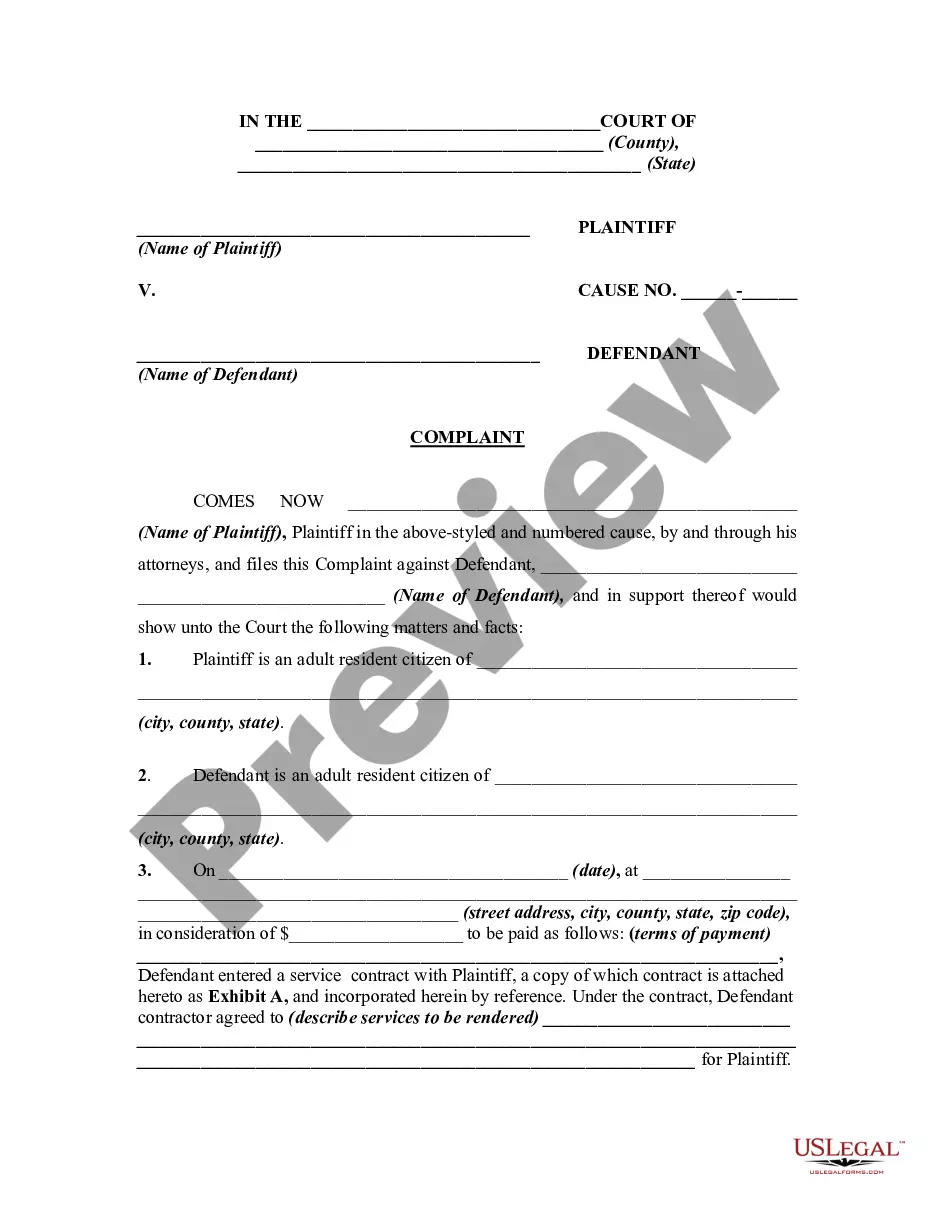

Fiduciary law in Colorado establishes the responsibilities and obligations of individuals acting on behalf of another, such as executors, conservators, trustees, or legal guardians. This law ensures that fiduciaries act in the best interest of the individuals they represent, managing their assets and affairs responsibly. When dealing with a Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, it is crucial to understand these legal duties. For your needs, consider using US Legal Forms to access reliable templates and guides.

Rule 62 of the Colorado Rules of Probate Procedure focuses on the demands for accounting and the obligations of fiduciaries to provide financial transparency. It outlines the process beneficiaries can follow when they seek detailed accounting from a fiduciary. Utilizing the Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can facilitate compliance with this rule, ensuring heirs receive the necessary information.

Yes, a personal representative is indeed a fiduciary in Colorado. This means they are legally bound to act with loyalty and care in managing the estate. As a fiduciary, they must provide transparency, and the Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian is a vital tool for beneficiaries wishing to ensure their interests are upheld.

The power of a personal representative can be considerable, allowing them to administer the estate according to probate law in Colorado. They can settle debts, sell properties, and distribute assets, but they must do so while prioritizing the interests of the beneficiaries. To safeguard their actions, a Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian provides necessary oversight and protection.

A personal representative in Colorado possesses significant powers, including managing the deceased's estate, paying debts, and distributing assets to beneficiaries. This role requires fiduciaries to adhere to Colorado laws and maintain transparency with beneficiaries. For accountability and to ensure fair practices, a Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can be invaluable.

In Colorado, the fiduciary duty refers to the legal obligation that a fiduciary, such as an executor, conservator, trustee, or legal guardian, has to act in the best interests of the beneficiaries. This duty includes managing assets, making decisions responsibly, and providing a full accounting of actions taken. If you need clarity on this responsibility, the Colorado Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian is essential for protecting beneficiary rights.