An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

If you desire to complete, acquire, or print authentic document templates, utilize US Legal Forms, the finest collection of legal forms, which can be accessed online.

Leverage the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are categorized by type and region, or keywords.

Employ US Legal Forms to retrieve the Colorado Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary with just a few clicks.

Every legal document template you purchase is yours permanently. You can access every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Act promptly and download, and print the Colorado Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Colorado Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the Review option to assess the form's content. Make sure to read through the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms in the legal form template.

- Step 4. Once you locate the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Colorado Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

Form popularity

FAQ

In Colorado, most forms of income, including wages, dividends, and interest, are taxable. However, some specific exceptions may apply, depending on the source of income. Understanding how these tax rules relate to your assets can be complex, especially if you are involved in a Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

No, a trust does not need to be recorded in Colorado. While it is not required, documenting the trust can provide clarity and accessibility for its beneficiaries. Opting for a Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can facilitate smooth transitions and ensure that all parties clearly understand their rights.

Yes, trust income is generally taxable in Colorado. The income earned by the trust may be subject to state taxes, which can impact the beneficiaries. It's important to consult tax guidelines or a tax professional to fully understand the implications of income derived from a Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

In Colorado, a trust is a legal arrangement where one party holds assets for the benefit of another. The trustor creates the trust, placing their assets into it, while the trustee manages those assets according to the trust's terms. Understanding the operation of trusts is crucial, especially when considering a Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, as it affects how benefits are distributed.

Yes, a beneficiary can transfer their interest in a trust. This process is known as a Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. Keep in mind that the trust's terms may impose specific restrictions, so it's essential to review these conditions before proceeding with any transfer.

The purpose of beneficiary designation is to ensure that your assets are distributed according to your preferences after your passing. This designation simplifies the transfer process, often allowing assets to bypass probate. Utilizing the Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can help you achieve this goal seamlessly.

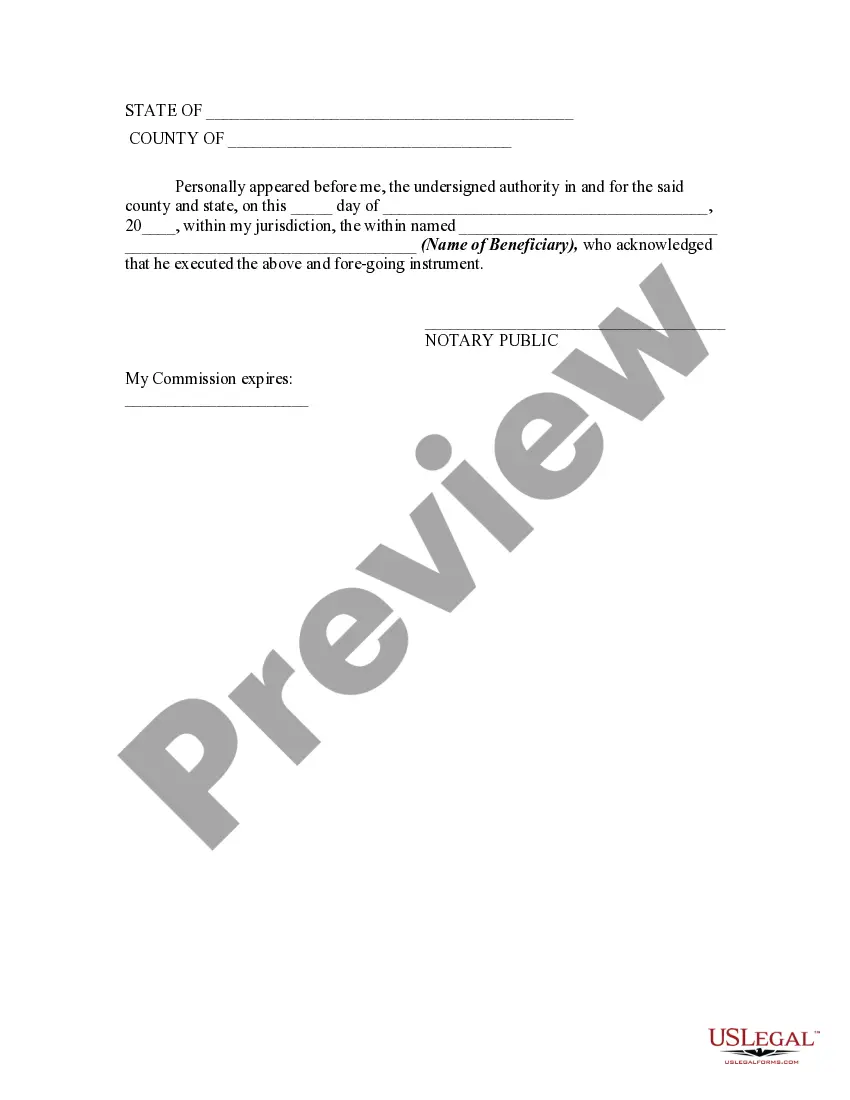

Filling out a beneficiary statement involves providing specific details such as names, addresses, and the relationship to the beneficiary. Make sure to include all required information, ensuring clarity in your intentions. The Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary provides a structured way to complete this process efficiently.

Informing beneficiaries about their designation can help prevent misunderstandings and foster transparent communication. While it's not strictly mandated, discussing your decisions can alleviate potential conflicts. Taking the time to share your choice can enhance the effectiveness of the Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

It is essential to fill out a beneficiary form to facilitate the clear transfer of your assets upon your passing. This form helps prevent legal disputes and ensures that your chosen beneficiaries receive what you intend for them. By utilizing the Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, you can manage this requirement effectively.

Yes, filling out a beneficiary designation form is crucial to clarify your intentions for asset distribution. This form officially names the individual or entity you wish to receive your assets, avoiding uncertainty down the line. Using the Colorado Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can simplify this process.