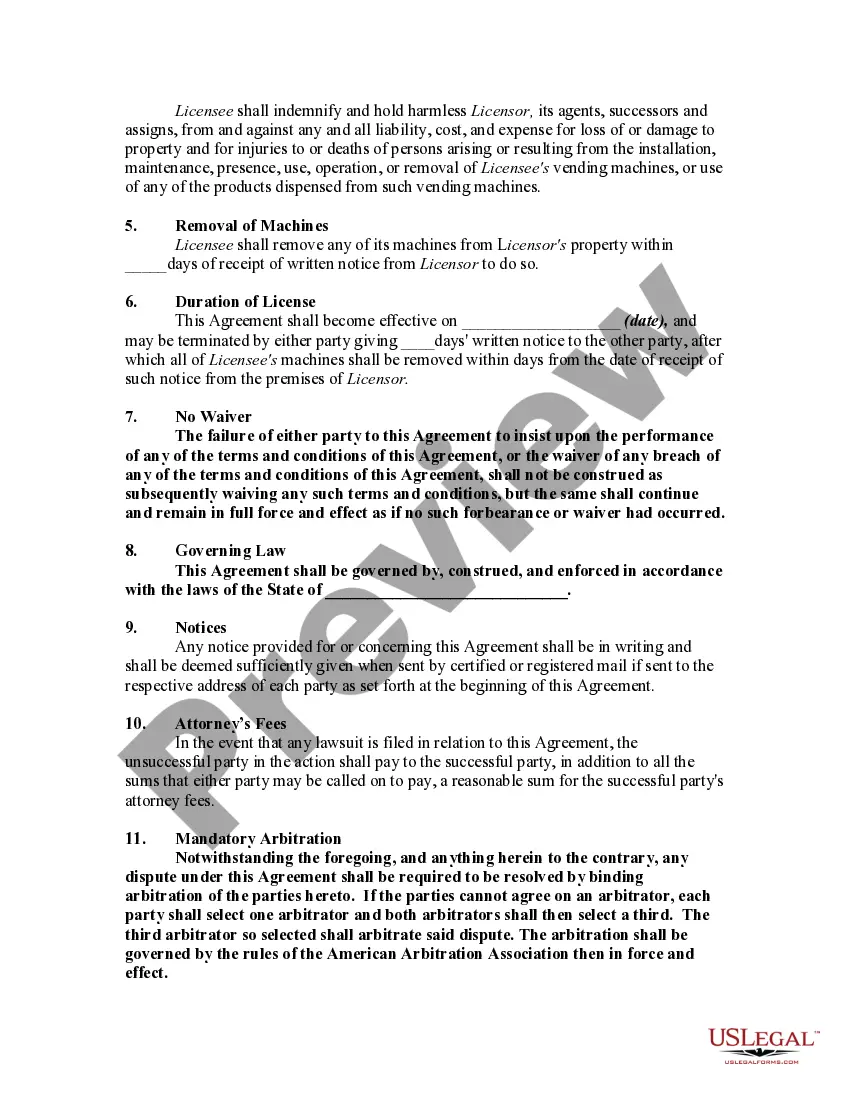

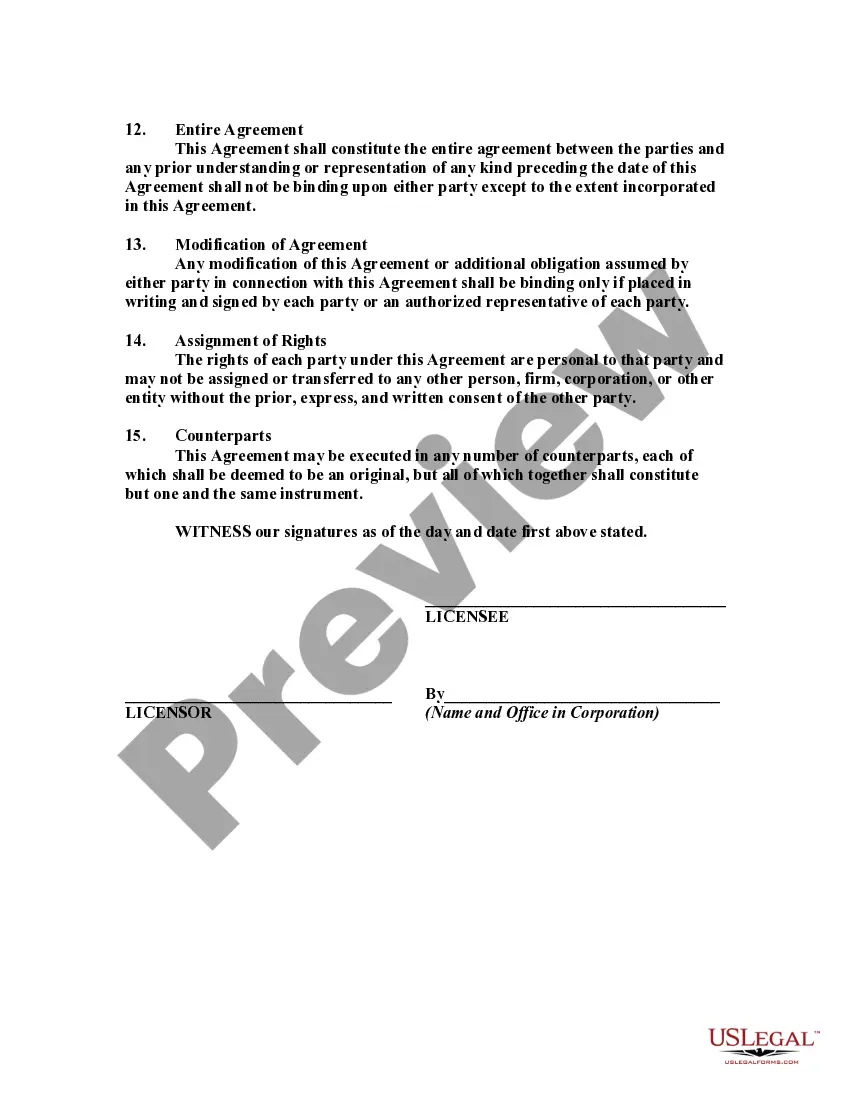

Generally, a license in respect of real property (since it is a mere personal privilege), cannot be assigned or transferred by the licensee. A license does not pass with the title to the property, but is only binding between the parties, expiring upon the death of either party. This form is an example of such.

Colorado License to Operate Vending Machines on Real Property of Another

Description

How to fill out License To Operate Vending Machines On Real Property Of Another?

You can spend hours online trying to locate the authentic documents template that satisfies the state and federal regulations you require.

US Legal Forms offers thousands of authentic forms that are reviewed by experts.

It is easy to download or print the Colorado License to Operate Vending Machines on Real Property of Another from their service.

If available, use the Preview button to look through the document template as well. If you want to find another version of the form, utilize the Search field to locate the template that suits your needs and requirements. Once you have found the template you need, click Acquire now to proceed.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, modify, print, or sign the Colorado License to Operate Vending Machines on Real Property of Another.

- Every authentic document template you purchase is yours permanently.

- To obtain another copy of the obtained form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your county/town of choice.

- Review the form details to ensure you've selected the appropriate form.

Form popularity

FAQ

Yes, Colorado requires sales tax for most online sales. As a seller, it is your responsibility to collect tax from your customers and remit it to the state. If you’re operating through vending machines, the Colorado License to Operate Vending Machines on Real Property of Another can provide additional clarity on tax regulations. Always stay updated with the latest tax laws to ensure compliance.

Selling on Etsy in Colorado usually requires a business license. This helps you comply with local and state regulations as you operate your online storefront. For those considering vending machine services, the Colorado License to Operate Vending Machines on Real Property of Another offers additional legitimacy. Keep in mind, regulations can vary, so it’s wise to verify with local authorities.

Yes, obtaining a seller's permit is often necessary for selling online in Colorado. This permit allows you to collect sales tax from your customers legally. If you use vending machines, consider acquiring the Colorado License to Operate Vending Machines on Real Property of Another. This compliance step helps in avoiding any legal issues down the line.

In most cases, you will need a local license to sell online. Local governments may require specific permits, especially if you are operating from a fixed location. The Colorado License to Operate Vending Machines on Real Property of Another can also enhance your credibility. Be sure to consult local authorities to understand your particular obligations.

Yes, you typically need a business license to operate legally in Colorado. Regardless of your sales platform, having a Colorado License to Operate Vending Machines on Real Property of Another may also be beneficial. It helps ensure compliance with state laws and regulations. Always check with your local government to confirm specific requirements for your business.

Yes, you must obtain a license for operating a vending machine in Colorado. This licensing not only legitimizes your business but also ensures adherence to local regulations. Specifically, a Colorado License to Operate Vending Machines on Real Property of Another is crucial for your operation's legality and overall success.

The ownership of a vending machine typically resides with the individual or business that invests in and places it at a location. However, if you partner with a property owner, terms of ownership may vary based on your agreement. To navigate these nuances and ensure compliance, consider the requirements of obtaining a Colorado License to Operate Vending Machines on Real Property of Another.

Yes, obtaining a sales tax permit is necessary to collect sales tax on products sold through your vending machines in Colorado. This permit enables you to operate legally and avoid potential fines. Don't forget that having a Colorado License to Operate Vending Machines on Real Property of Another is also essential for your vending endeavors.

Yes, you need a permit for a vending machine in Colorado. This ensures that your vending machine business complies with state regulations. Additionally, securing a Colorado License to Operate Vending Machines on Real Property of Another will further legitimize your operations and protect your interests.

Yes, you do need a permit to sell in Colorado. This includes various types of sales, including vending machine sales. Obtaining a seller's permit is essential and contributes to your overall compliance strategy, which includes the necessity for a Colorado License to Operate Vending Machines on Real Property of Another.