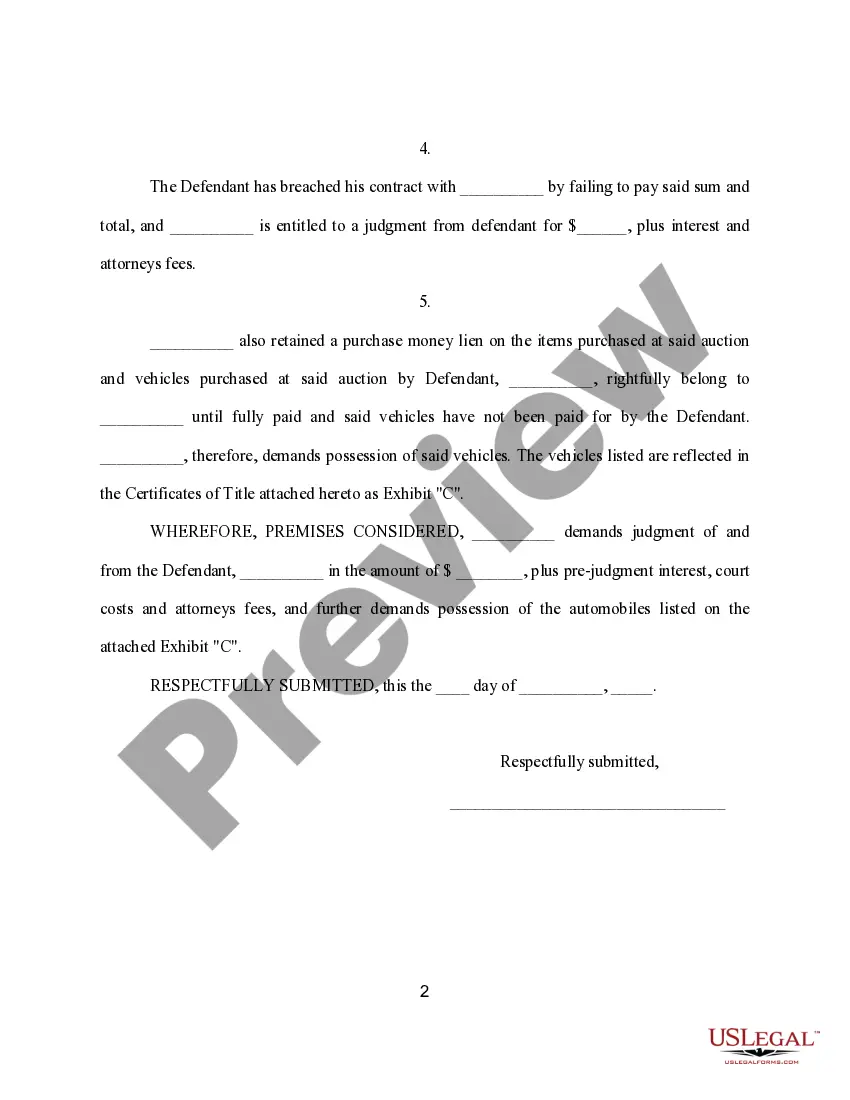

Colorado Complaint regarding Auction Collection

Description

How to fill out Complaint Regarding Auction Collection?

If you need to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the biggest collection of sanctioned formats, that can be accessed online.

Employ the site’s straightforward and handy search feature to locate the documents you require. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to locate the Colorado Complaint concerning Auction Collection with just a few clicks of the mouse.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded through your account. Visit the My documents section and choose a form to print or download again.

Be proactive and download, and print the Colorado Complaint concerning Auction Collection with US Legal Forms. There are numerous professional and state-specific templates you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and press the Acquire button to find the Colorado Complaint concerning Auction Collection.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, take advantage of the Lookup field at the top of the screen to find other versions of your legal form format.

- Step 4. After you have found the form you want, click the Purchase now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Colorado Complaint concerning Auction Collection.

Form popularity

FAQ

?Negotiating with a collection agency can be challenging, but it is vital to reach a fair settlement,? Raymond Quisumbing, a registered financial planner at Bizreport, said. ?Offering 25%-50% of the total debt as a lump sum payment may be acceptable.

Here are six steps to deal with collection agencies. Be Willing to Communicate. Communicating with debt collectors can make it easier to resolve your debt. ... Organize Your Information. ... Know Your Rights. ... Know the Statute of Limitations. ... Go to Court. ... Settle the Debt.

Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt. You also have the right to ask a debt collector to stop contacting you entirely.

9 Ways to Turn the Tables on Debt Collectors Don't Wait for Them to Call. Consider picking up the phone and calling the debt collector yourself. ... Check Them Out. ... Dump it Back in Their Lap. ... Stick to Business. ... Show Them the Money. ... Ask to Speak to a Supervisor. ... Call Their Bluff. ... Tell Them to Take a Hike.

Colorado. General contractors are not licensed by the state of Colorado, so to file a complaint against a contractor, submit a complaint with the Colorado Attorney General. Online: An online complaint form can be filed here. Once completed, you may submit the complaint.

You can outsmart debt collectors by following these tips: Keep a record of all communication with debt collectors. Send a Debt Validation Letter and force them to verify your debt. Write a cease and desist letter. Explain the debt is not legitimate. Review your credit reports. Explain that you cannot afford to pay.

Don't give a collector any personal financial information. Don't make a "good faith" payment, promise to pay, or admit the debt is valid. You don't want to make it easier for the collector to get access to your money, or do anything that might revive the statute of limitations.

How to Deal With Rude and Aggressive Debt Collectors Know Your Rights. Take Notes. Keep Your Emotions Under Control. Stop Trying to Explain Yourself. End the Call. Don't Pick Up the Phone. Make Them Stop Calling. Dispute the Debt.

Speak with confidence and respect. If the conversation turns nasty do not continue to argue over the phone but calmly inform the collector that you will not allow yourself to be harassed and hang up the phone. The most important thing one needs to know is that repeated harassing calls from debt collectors are illegal.

The Colorado Consumer Protection Act protects consumers from a wide range of unfair and deceptive business practices.