Colorado Computer Software Lease with License Agreement

Description

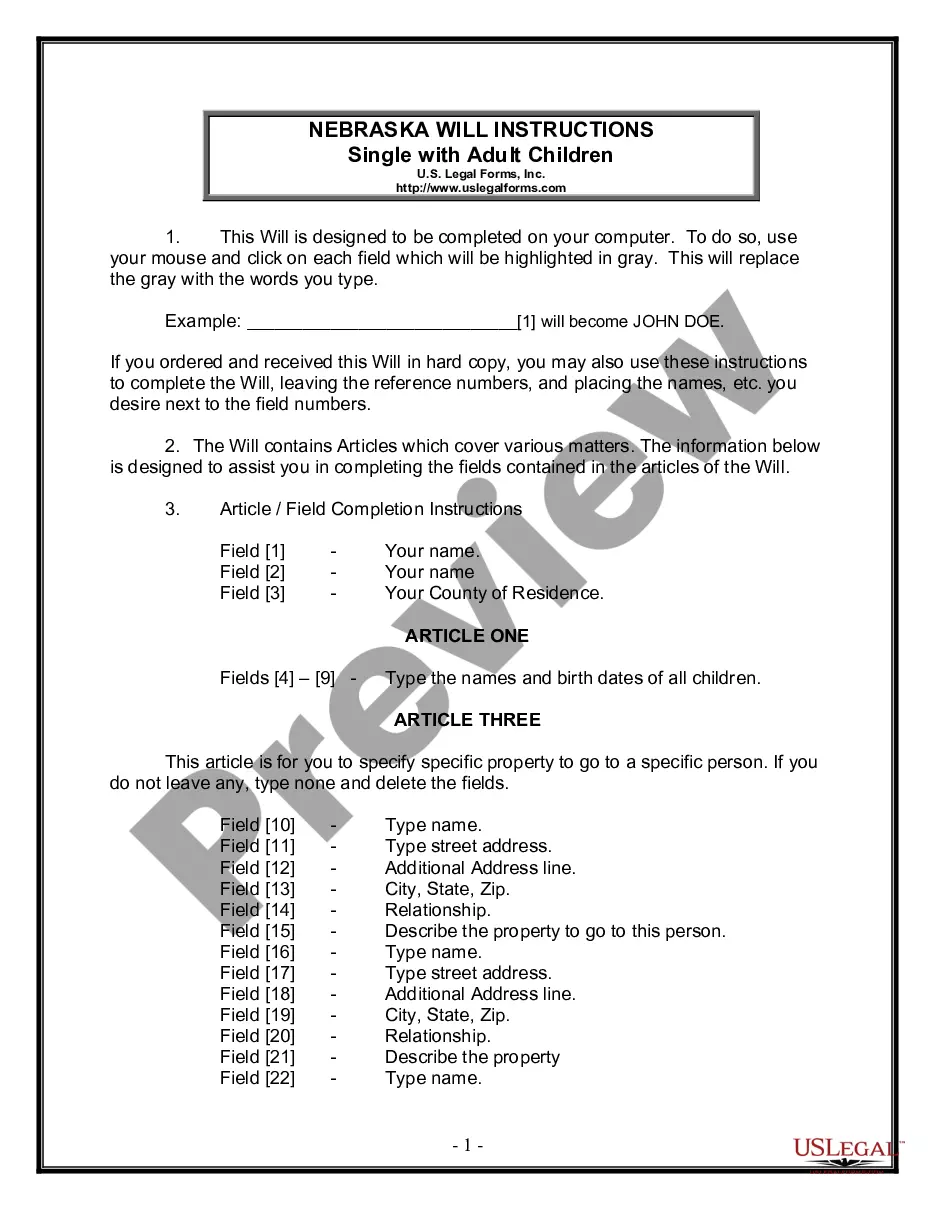

How to fill out Computer Software Lease With License Agreement?

If you need to finalize, download, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site’s simple and user-friendly search to find the documents you require.

A range of templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. After locating the form you need, click the Buy now button. Select your preferred payment plan and input your credentials to sign up for an account.

Step 5. Complete the transaction. You can use your Мisa or Ьastercard or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Colorado Software Lease with License Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Colorado Software Lease with License Agreement.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review feature to examine the form’s details. Make sure to read the overview.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Using software without permission or payment is not legal and constitutes copyright infringement. Such actions can lead to severe consequences, including fines or lawsuits. To protect yourself and your business, always adhere to the terms of the Colorado Computer Software Lease with License Agreement. By obtaining software through legal channels, you not only stay compliant but also support the developers who create valuable tools.

Software licenses are legally binding agreements that dictate how the software can be used. Users agree to follow the terms set within the Colorado Computer Software Lease with License Agreement when they install or activate the software. Violating these terms can result in legal action from the software owner. Therefore, it is essential to read and understand any software license before use.

Yes, using unlicensed software is illegal and considered a form of software piracy. This practice jeopardizes the integrity of software creators and can result in significant penalties. By understanding the legality surrounding software use, you can better navigate your obligations under the Colorado Computer Software Lease with License Agreement. Always opt for licensed software to stay compliant and avoid potential legal issues.

No, copying software without permission is a violation of copyright laws. It is crucial to respect the terms of the Colorado Computer Software Lease with License Agreement, which outlines the rights granted by the license holder. Engaging in unauthorized copying not only undermines software developers but can also lead to legal consequences. Always ensure you have the right permissions before duplicating any software.

A software license is typically considered an asset, as it provides a company with rights to use a specific software product. This value can contribute to the overall worth of a business. However, companies may also treat software licenses as expenses, depending on how they account for costs associated with their acquisition and usage. Understanding the distinction can help businesses make informed decisions regarding their Colorado Computer Software Lease with License Agreement.

Yes, Software as a Service (SaaS) is taxable in Colorado. This includes services offered under a Colorado Computer Software Lease with License Agreement. Understanding these tax liabilities can be crucial for proper financial planning and compliance.

In Colorado, all income sources, including wages, investment income, and business income, are generally taxable. This means that income generated from a Colorado Computer Software Lease with License Agreement is also subject to taxation. It's essential to keep accurate records to comply with state regulations.

Colorado does permit a foreign tax credit, which can help residents reduce state taxes on income earned outside the U.S. For businesses under a Colorado Computer Software Lease with License Agreement, utilizing this credit may provide significant savings. Consulting with a tax advisor can ensure that you navigate this benefit correctly.

Yes, Software as a Service (SaaS) is generally taxable in the USA, depending on state regulations. If you're engaging in a Colorado Computer Software Lease with License Agreement, it’s crucial to understand both state and federal tax implications. This awareness can help you remain compliant with tax laws.

Yes, in Colorado, software licenses are typically considered taxable sales. This includes licenses related to a Colorado Computer Software Lease with License Agreement. Knowing this can help businesses plan their budgets and taxes more accurately.