Trust Registration Statement: This is an official form from the Colorado Probate Court, which complies with all applicable laws and statutes. USLF amends and updates the Colorado Probate Court forms as is required by Colorado statutes and law.

Colorado Trust Registration Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Colorado Trust Registration Statement?

The larger the quantity of documents you need to produce - the more anxious you feel.

You can obtain a vast array of Colorado Trust Registration Statement templates online, yet you are uncertain which ones to rely on.

Eliminate the hassle and simplify the process of obtaining samples with US Legal Forms. Acquire precisely formulated documents that are available to meet state regulations.

Access every file you download in the My documents section. Simply navigate there to produce a new copy of your Colorado Trust Registration Statement. Even with professionally prepared forms, it remains crucial to consider consulting a local attorney to verify that your completed document is accurately filled out. Achieve more for less with US Legal Forms!

- Verify the Colorado Trust Registration Statement is permitted in your state.

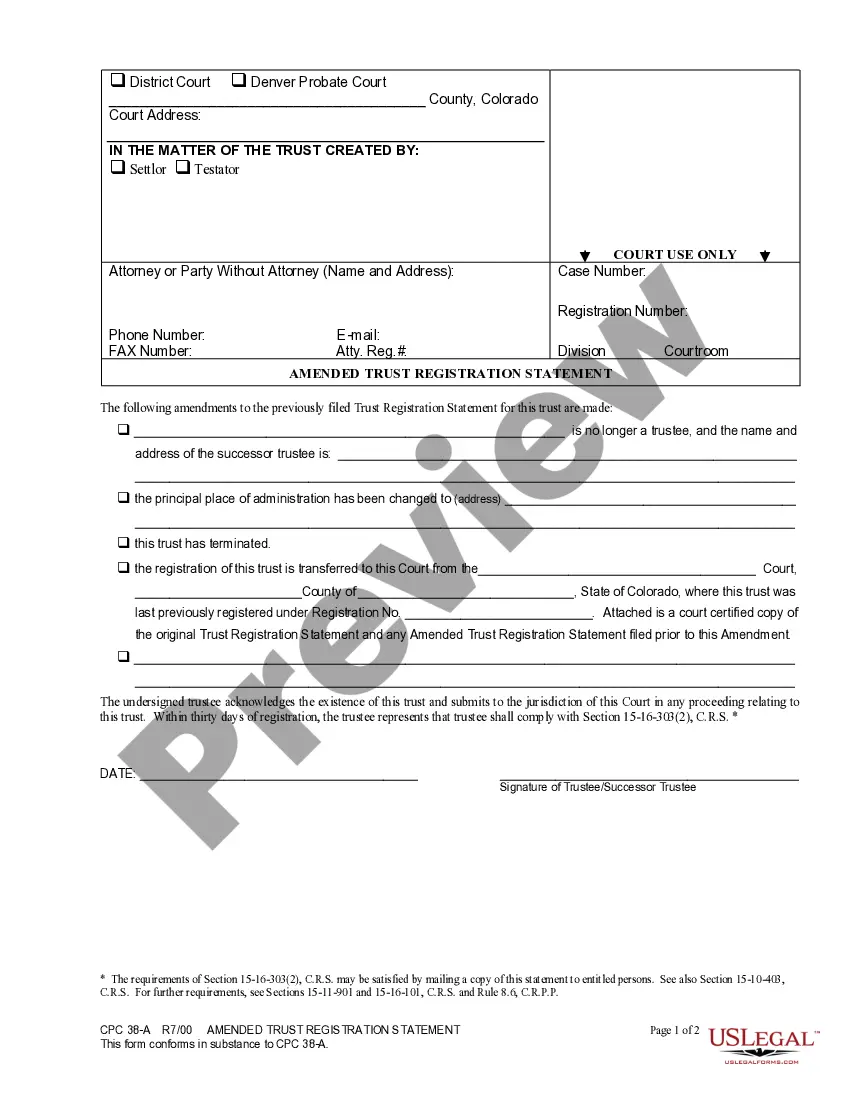

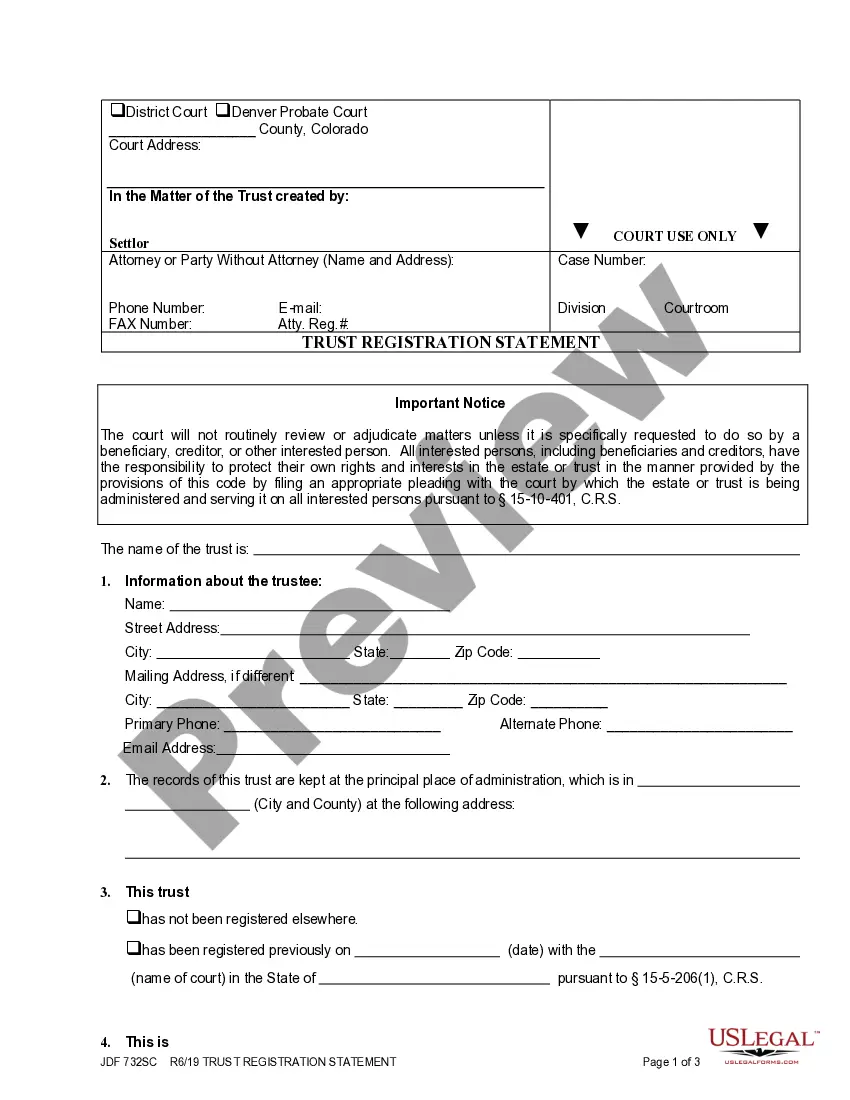

- Confirm your selection by reviewing the description or by utilizing the Preview option if available for the chosen document.

- Click on Buy Now to initiate the registration process and choose a pricing option that fits your needs.

- Enter the required information to establish your account and pay for your purchase with PayPal or credit card.

- Select a suitable document format and obtain your copy.

Form popularity

FAQ

In Colorado, trusts do not have to be formally registered, but certain documents may need to be filed to establish the trust’s legitimacy. A Colorado Trust Registration Statement can be an essential step to ensure that your trust meets legal requirements and your wishes are followed. If you're unsure about the process, US Legal Forms offers resources to help you navigate trust registration and creation effectively.

While both trusts and wills serve important functions in estate planning, trusts often provide greater benefits in Colorado. Trusts can help avoid probate, maintain privacy, and manage assets during your lifetime. Your choice may vary based on your specific situation, but a properly executed Colorado Trust Registration Statement can simplify asset transfer for your beneficiaries.

In Colorado, a trust does not necessarily need to be notarized to be valid. However, notarizing the trust document can add an extra layer of legitimacy and ensure clarity of intent. To navigate the nuances of trust creation and the Colorado Trust Registration Statement, you might consider consulting with a legal professional.

A living trust in Colorado is a legal arrangement where your assets are held and managed during your lifetime and passed on to beneficiaries upon your death. This type of trust allows for flexibility and control while avoiding the probate process. Completing a Colorado Trust Registration Statement can make this process easier, ensuring your wishes are documented and legally binding.

Certain assets cannot be placed in a trust, including retirement accounts and life insurance policies with designated beneficiaries. Real estate may also be complex to transfer, depending on local laws. It is always best to seek professional advice to ensure your assets are appropriately handled in accordance with a Colorado Trust Registration Statement.

Choosing between a will and a trust in Colorado often depends on your individual circumstances. A trust can help manage your assets while you are alive and facilitate a smoother transition after your passing. Conversely, wills are typically simpler and less expensive to create. However, a Colorado Trust Registration Statement can streamline asset distribution and minimize probate issues.

Putting your house in a trust in Colorado can provide several benefits. It can help you avoid probate, ensuring a faster transfer of ownership to your beneficiaries. Additionally, it may offer some privacy, as the trust does not go through public probate proceedings. To create a proper Colorado Trust Registration Statement, consider consulting a legal expert.

Yes, while a trust itself does not need to be registered per se, it is beneficial to file a Colorado Trust Registration Statement. This process formalizes the trust and provides a framework for managing its assets. Understanding these requirements can save you from unnecessary complications down the line.

No, a trust does not necessarily have to be filed to be legal in Colorado; however, filing a Colorado Trust Registration Statement is recommended. This filing establishes clearer terms and legitimizes the trust in the eyes of the law. It also makes it easier to manage assets and navigate future distributions.

Yes, if you want to ensure all your trust-related matters are in order, registering your trust in Colorado is advisable. This involves filing the Colorado Trust Registration Statement, which creates a public record of the trust. Doing so not only clarifies your intentions but also protects your assets.