Transfer on Death Deed - Colorado - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time.

Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual

Description

Definition and meaning

The Colorado Transfer on Death Deed, also known as the TOD or Beneficiary Deed, is a legal instrument that allows a property owner to designate an individual who will receive the property upon the owner’s death. This method provides an efficient way to transfer real estate without going through the probate process, ensuring the property passes directly to the specified beneficiary.

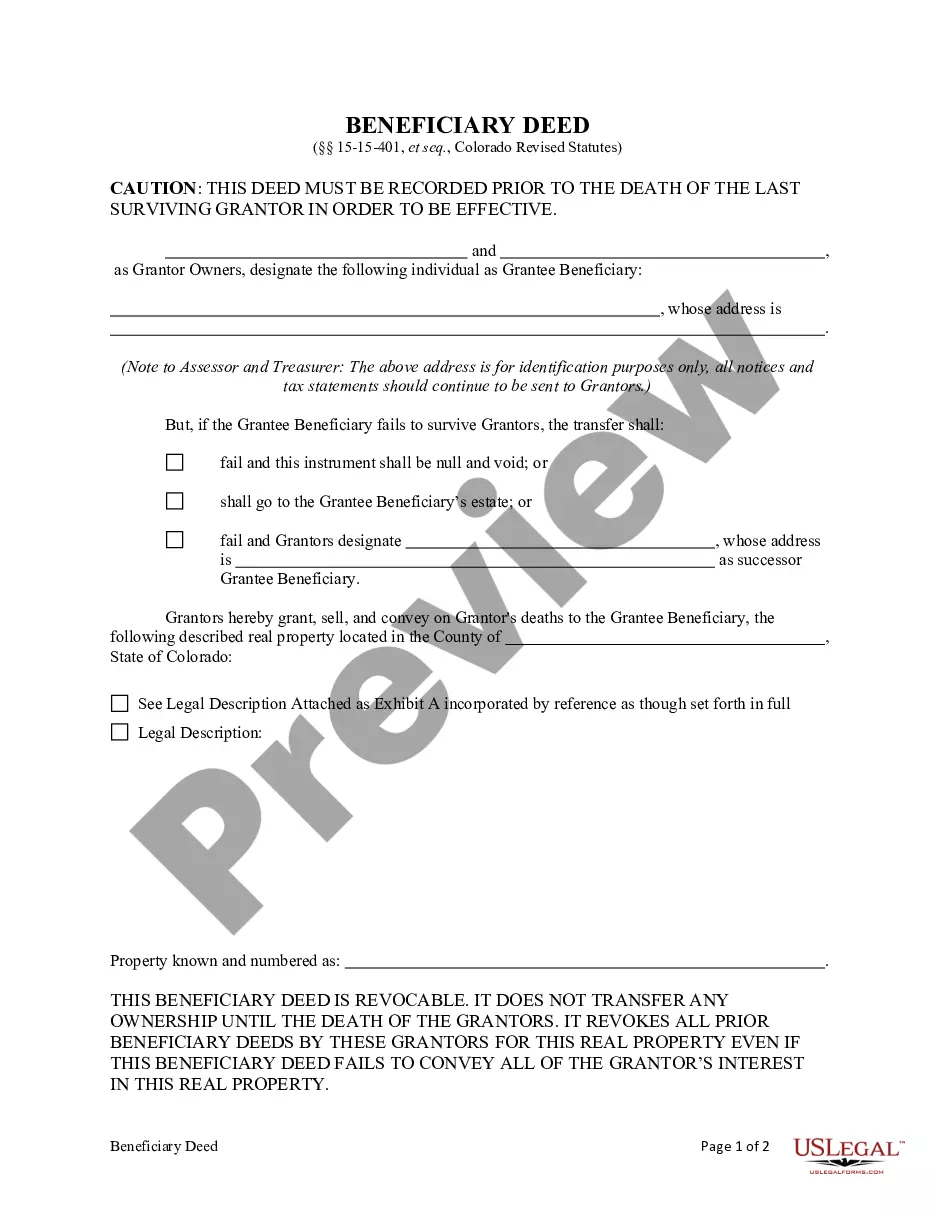

Key components of the form

When filling out a Colorado Transfer on Death Deed, it is essential to understand its key components, which include:

- Grantors: The individuals transferring the property.

- Grantee Beneficiary: The person designated to receive the property after the grantors' death.

- Legal Description: A precise description of the property being transferred.

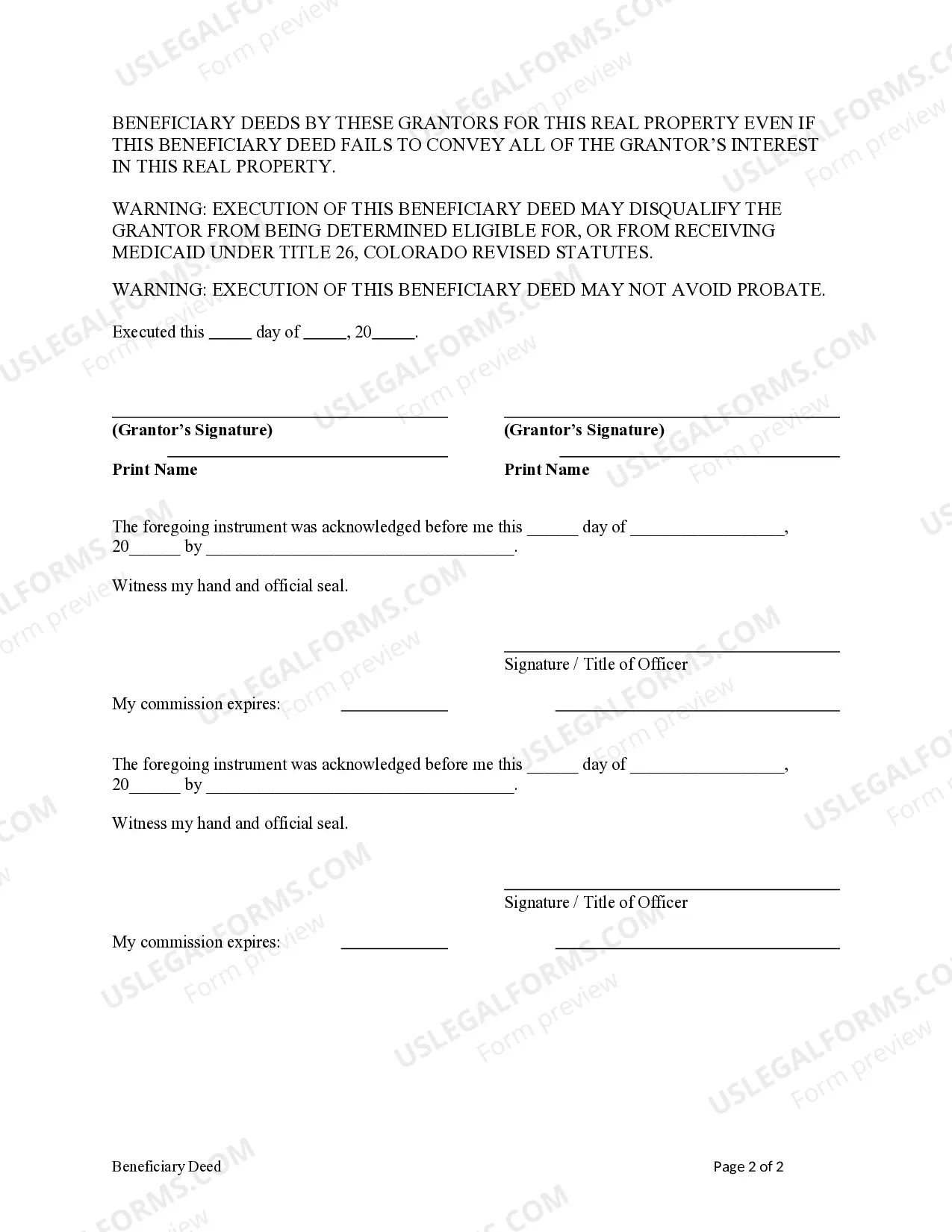

- Notarization: The deed must be acknowledged by a notary public to be valid.

All of these elements must be correctly completed for the deed to be legally enforceable.

How to complete a form

To properly complete the Colorado Transfer on Death Deed, follow these steps:

- Identify the property: Clearly detail the property that will be transferred, including its legal description.

- Fill in grantor information: Provide the full names and addresses of all grantors.

- Designate the beneficiary: Specify the full name and address of the grantee beneficiary.

- Sign the deed: All grantors must sign the deed in the presence of a notary.

- Record the deed: Submit the completed and notarized deed to the appropriate county clerk and recorder’s office to make it effective.

Ensure to keep a copy for your records after the deed has been recorded.

State-specific requirements

In Colorado, specific legal requirements must be adhered to when executing a Transfer on Death Deed. These include:

- State law dictates that this deed must be recorded before the death of the last surviving grantor.

- The deed must include the necessary legal description of the property.

- If the grantee beneficiary does not survive the grantors, the deed may become void unless alternate beneficiaries are specified.

Failing to meet these requirements could lead to complications in the property transfer process.

Benefits of using this form online

Utilizing an online platform to access and complete the Colorado Transfer on Death Deed offers several advantages, such as:

- Convenience: Users can fill out the form from the comfort of their home at any time.

- Access to guidance: Online resources often provide step-by-step instructions and legal insights.

- Instant downloads: Once completed, the form can be downloaded and printed immediately for notarization and recording.

These benefits can enhance the overall experience of preparing important legal documents.

Common mistakes to avoid when using this form

While completing the Colorado Transfer on Death Deed, keep an eye out for these common pitfalls:

- Omitting the legal description of the property, which is essential for identification.

- Failing to have the deed notarized, making it invalid.

- Not recording the deed promptly, which can lead to the transfer not being effective.

- Neglecting to name alternate beneficiaries in case the primary beneficiary does not survive.

Avoiding these mistakes can help ensure a smooth transfer of property.

How to fill out Colorado Transfer On Death Deed Or TOD - Beneficiary Deed - Husband And Wife To Individual?

If you are seeking appropriate Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual samples, US Legal Forms is exactly what you require; obtain documents crafted and verified by state-licensed attorneys.

Utilizing US Legal Forms not only alleviates concerns regarding legal documents; you also save time, effort, and money! Downloading, printing, and completing a professional document is significantly less costly than hiring an attorney to draft it for you.

And that’s it. In just a few simple clicks you obtain an editable Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual. After you create an account, all future purchases will be even more straightforward. Once you have a US Legal Forms subscription, simply Log In to your profile and then click the Download option found on the form’s webpage. Then, whenever you need to access this blank again, you’ll always be able to locate it in the My documents menu. Don’t waste your time comparing countless forms across various web sources. Acquire professional versions from a single secure service!

- To start, finish your registration process by entering your email and creating a password.

- Follow the guidelines below to set up your account and acquire the Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual template to address your needs.

- Use the Preview feature or examine the document description (if available) to ensure that the form meets your requirements.

- Verify its validity in your jurisdiction.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Establish an account and pay using a credit card or PayPal.

- Choose a suitable format and save the form.

Form popularity

FAQ

Several states allow transfer on death deeds, including Colorado. This option is designed to facilitate the transfer of property directly to a designated beneficiary, bypassing the probate process. Familiarize yourself with your state laws to ensure compliance, as each state may have its specific regulations. Consulting resources like UsLegalForms can provide valuable guidance when navigating this process.

Determining whether a Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual is better depends on individual circumstances. A TOD deed can simplify the transfer process and avoid probate, making it a favorable option for many. However, a beneficiary deed might offer additional flexibility by allowing for more beneficiaries or changes in the future. Carefully consider your goals and consult with a professional to ensure the best choice for your estate.

A Transfer on Death Deed and a beneficiary deed in Colorado serve similar purposes but have differences in terminology. A TOD deed allows a property owner to name a beneficiary who automatically receives the property upon the owner's death. In contrast, a beneficiary deed is a broader term that can apply to various types of assets. Understanding these distinctions helps individuals create the most effective estate plan tailored to their needs.

Indeed, Colorado recognizes transfer on death deeds as a legitimate way to transfer assets. Such a deed allows property owners to designate beneficiaries who will inherit the property outside of probate. This method streamlines the process, making it easier for loved ones to access their inheritance. Proper execution and recording of the deed are vital to ensure its effectiveness.

The primary disadvantages of a Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual include the potential for financial risks and lack of legal control. Once the deed is in place, you cannot change your mind easily if your relationship with the beneficiary changes. Additionally, this deed does not shield assets from creditors or legal claims, making it crucial to consider these factors as you plan. An informed decision can help you navigate potential pitfalls.

Yes, Colorado does recognize transfers on death deeds. This method allows property owners to designate a beneficiary who will receive the property upon their death without going through probate. Using a Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual can simplify the transfer process and provide clear instructions for your estate. It is essential to consult an expert to ensure the deed is drafted and recorded correctly.

One significant disadvantage of a Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual is that it does not allow you to control the assets after death. If the beneficiary experiences financial difficulties or legal issues, your property might be at risk. Additionally, there is no protection from probate challenges, as beneficiaries can contest the deed. Therefore, careful consideration is essential to determine whether this option aligns with your overall estate plan.

While Colorado Transfer on Death Deeds or TOD - Beneficiary Deeds - Husband and Wife to Individual offer convenience, they do have potential issues. One concern involves how they interact with other estate planning documents, which can create confusion and lead to disputes. Additionally, if not structured correctly, they can complicate the estate's overall tax obligations.

To file a Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual, you must complete the deed form correctly. After filling out the necessary information, you need to sign it in front of a notary. Finally, record the signed deed with the county clerk and recorder where the property is located to ensure it is legally recognized.

Using a Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual can be a beneficial choice for many. It simplifies the transfer of property at death without needing to go through probate. Additionally, it allows you to maintain control over the property during your lifetime, making it a flexible option for estate planning decisions.