California Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Finding the right legitimate record design could be a battle. Naturally, there are tons of templates accessible on the Internet, but how can you discover the legitimate form you require? Make use of the US Legal Forms web site. The services provides a huge number of templates, for example the California Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, that you can use for company and private needs. Each of the types are inspected by specialists and meet up with federal and state demands.

In case you are presently listed, log in in your accounts and click the Obtain option to get the California Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. Make use of accounts to look from the legitimate types you have bought in the past. Visit the My Forms tab of your accounts and obtain an additional duplicate in the record you require.

In case you are a whole new customer of US Legal Forms, listed here are simple guidelines that you should adhere to:

- Very first, ensure you have chosen the right form for your personal metropolis/region. You may look through the shape using the Review option and browse the shape description to make sure this is basically the right one for you.

- In the event the form will not meet up with your requirements, take advantage of the Seach field to find the appropriate form.

- When you are positive that the shape would work, click the Acquire now option to get the form.

- Opt for the rates program you want and type in the needed information and facts. Build your accounts and buy the transaction making use of your PayPal accounts or bank card.

- Choose the submit format and obtain the legitimate record design in your gadget.

- Complete, edit and print out and signal the attained California Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

US Legal Forms is the largest local library of legitimate types for which you can find a variety of record templates. Make use of the company to obtain professionally-manufactured files that adhere to condition demands.

Form popularity

FAQ

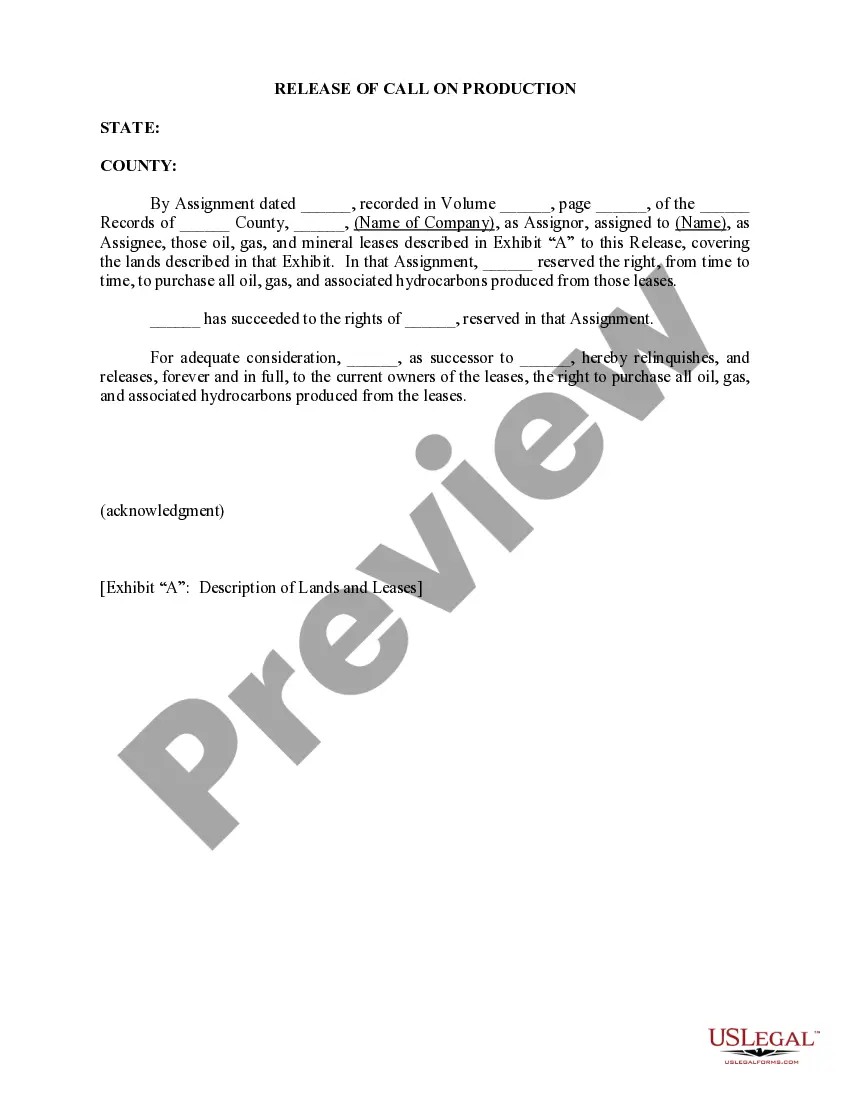

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

As ownership of land changes, NPRIs are commonly created and assigned to whoever the owners want. The amount of revenue the mineral and surface rights generate can make present and past owners want to share in the future resources of their royalty payments.