California Assignment and Conveyance of Net Profits Interest

Description

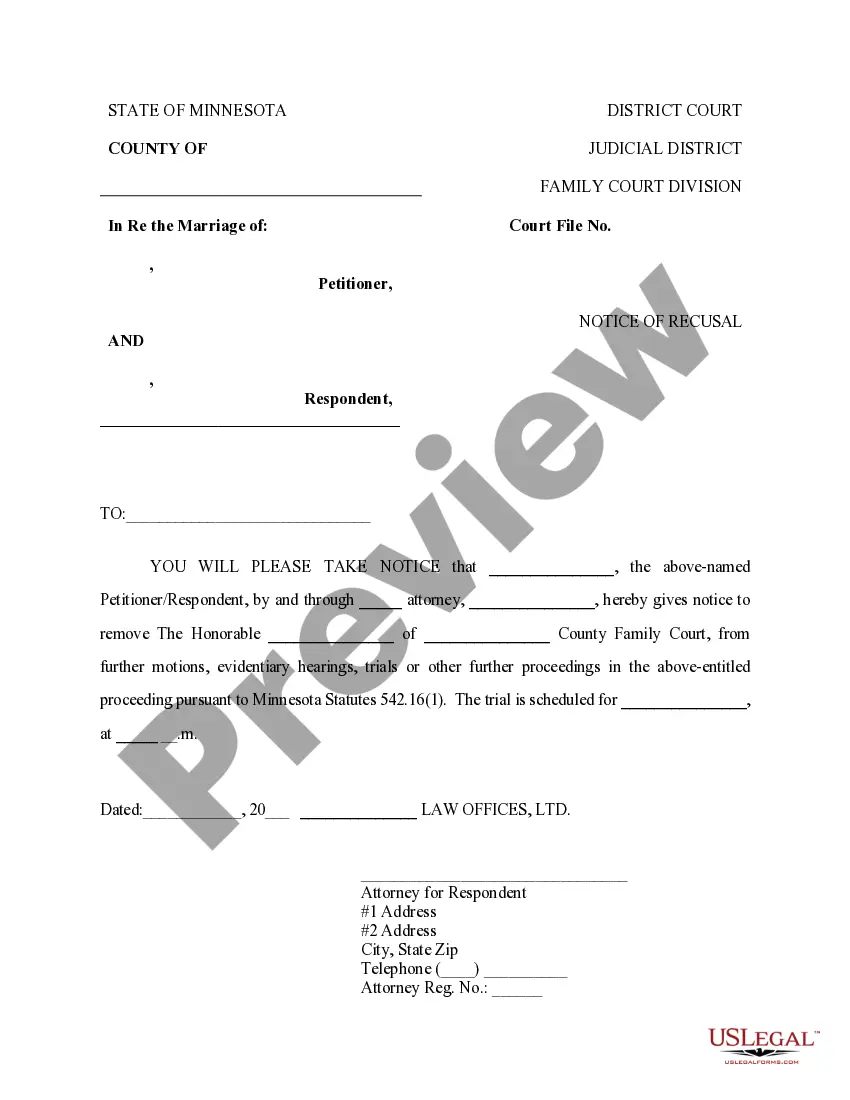

How to fill out Assignment And Conveyance Of Net Profits Interest?

If you wish to comprehensive, down load, or printing lawful record templates, use US Legal Forms, the largest collection of lawful kinds, that can be found online. Make use of the site`s easy and practical look for to obtain the papers you want. Various templates for enterprise and specific purposes are categorized by classes and claims, or keywords. Use US Legal Forms to obtain the California Assignment and Conveyance of Net Profits Interest in just a handful of click throughs.

In case you are currently a US Legal Forms consumer, log in in your bank account and click on the Down load button to obtain the California Assignment and Conveyance of Net Profits Interest. You may also gain access to kinds you in the past acquired within the My Forms tab of the bank account.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape to the proper area/region.

- Step 2. Utilize the Review option to look over the form`s articles. Never overlook to see the outline.

- Step 3. In case you are unsatisfied with the form, use the Look for industry at the top of the monitor to discover other variations of your lawful form web template.

- Step 4. After you have identified the shape you want, click the Buy now button. Choose the rates program you choose and put your credentials to sign up to have an bank account.

- Step 5. Process the transaction. You can utilize your credit card or PayPal bank account to finish the transaction.

- Step 6. Find the format of your lawful form and down load it on the gadget.

- Step 7. Total, edit and printing or indication the California Assignment and Conveyance of Net Profits Interest.

Every single lawful record web template you purchase is the one you have forever. You might have acces to each and every form you acquired with your acccount. Click the My Forms portion and choose a form to printing or down load yet again.

Remain competitive and down load, and printing the California Assignment and Conveyance of Net Profits Interest with US Legal Forms. There are thousands of expert and state-distinct kinds you may use for your enterprise or specific demands.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

However, there are key differences between Form 565 and Form 568. Form 565 is used by LLCs classified as corporations for federal tax purposes, whereas Form 568 is for LLCs classified as partnerships or disregarded entities. Determining your LLC's federal tax classification is essential to determine which form to use.

What is net profit? Net profit is the amount of money your business earns after deducting all operating, interest, and tax expenses over a given period of time.

Example 1: Profits interest ? Let's say that the company is worth $1,000,000 and has $50,000 in annual profits. A worker with a 10% interest grant doesn't have any interest in the company's current market value, but they do have a 10% interest in annual profits, which equates to $5,000.

A profits interest is a right to receive a percentage of future profits (but not existing capital or accumulated profits) from a partnership.

A net profits interest is an agreement that provides a payout of an operation's net profits to the parties of the agreement.

A capital interest is a type of equity commonly issued by LLCs, under which the member of the LLC contributes capital to the LLC and has an ownership interest. Unlike a capital interest, profits interests do not represent ownership in the LLC.