California Interest Verification

Description

How to fill out Interest Verification?

Are you inside a position in which you require files for sometimes organization or personal reasons almost every day time? There are a lot of lawful document web templates available on the net, but discovering versions you can rely is not easy. US Legal Forms gives a huge number of develop web templates, like the California Interest Verification, that are created in order to meet state and federal specifications.

In case you are already familiar with US Legal Forms website and also have a merchant account, just log in. After that, you may down load the California Interest Verification template.

If you do not provide an account and wish to start using US Legal Forms, follow these steps:

- Find the develop you want and ensure it is to the right metropolis/state.

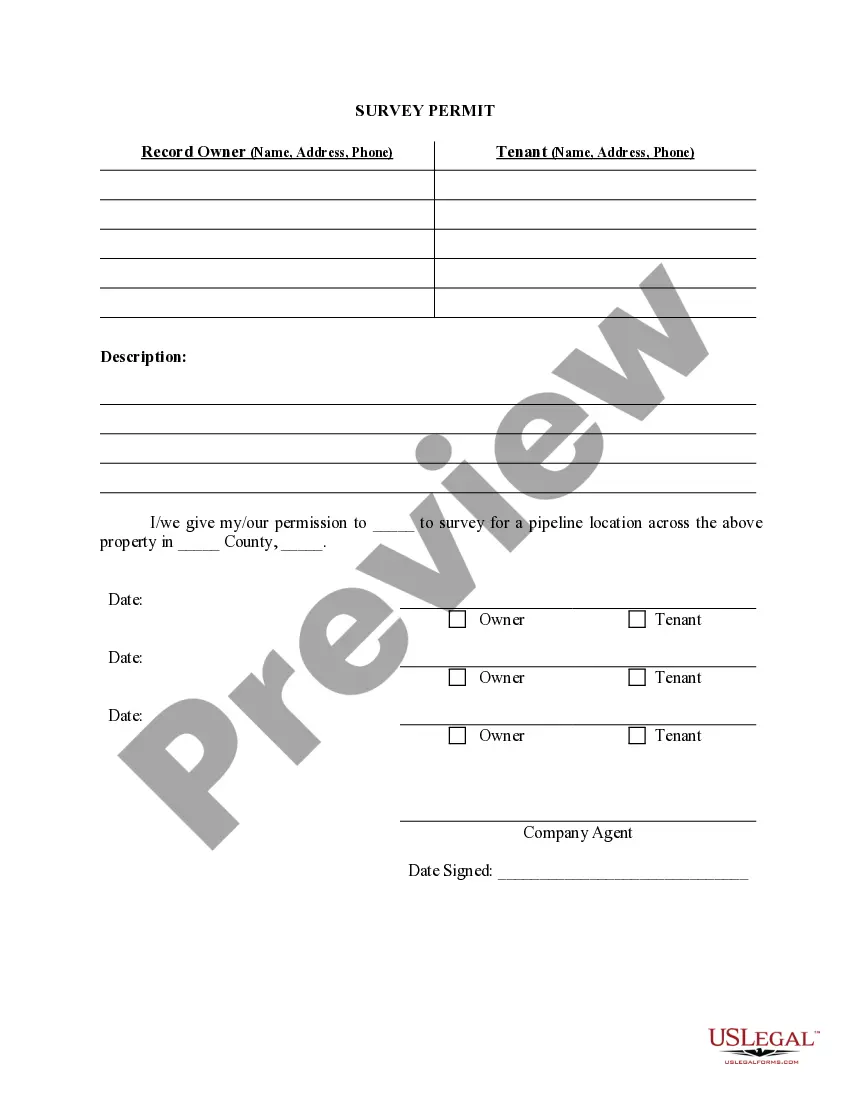

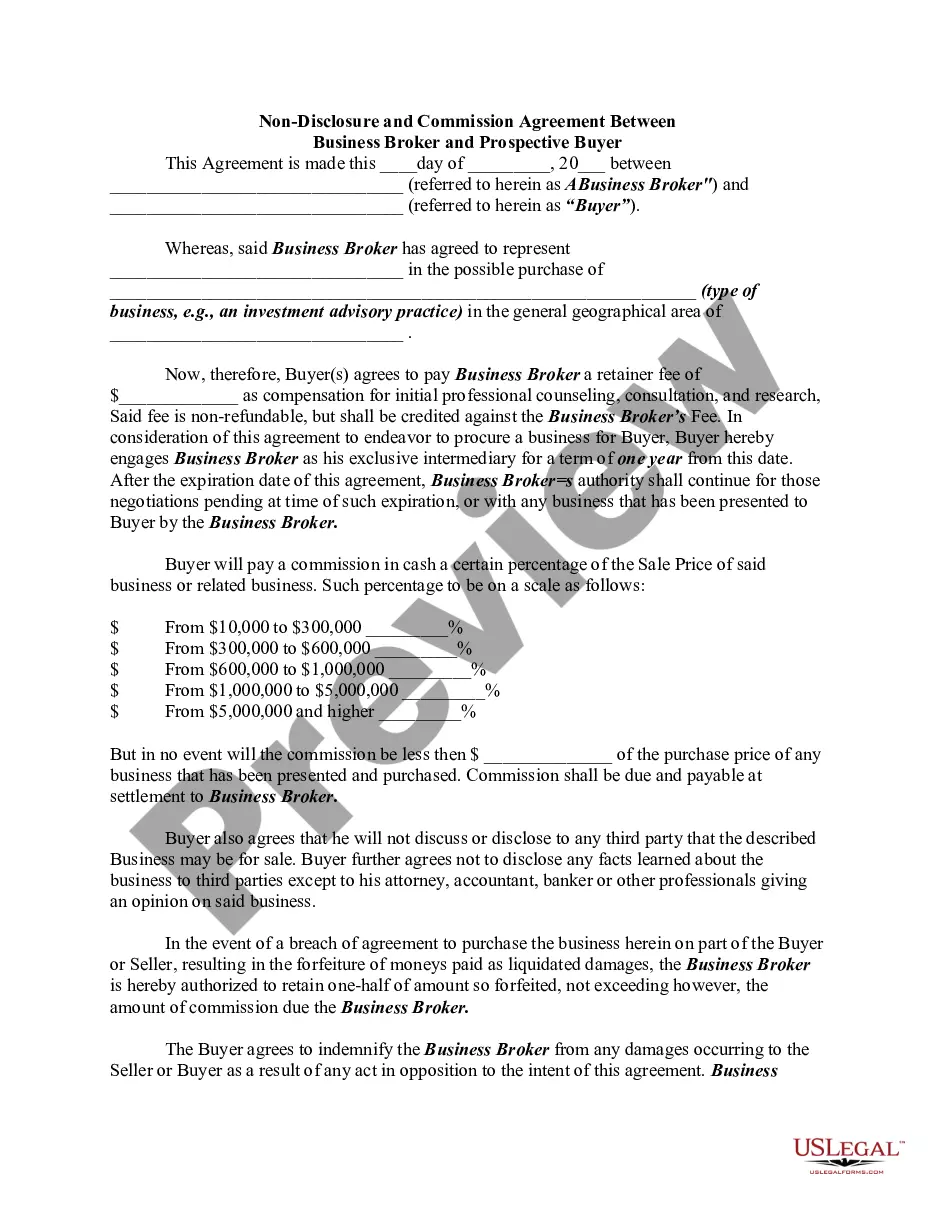

- Make use of the Review switch to analyze the form.

- Look at the information to actually have chosen the correct develop.

- If the develop is not what you are searching for, make use of the Look for discipline to obtain the develop that fits your needs and specifications.

- If you obtain the right develop, click on Buy now.

- Select the costs prepare you want, fill out the specified details to generate your bank account, and pay for the order using your PayPal or bank card.

- Pick a hassle-free document formatting and down load your version.

Locate every one of the document web templates you possess bought in the My Forms menu. You can aquire a more version of California Interest Verification whenever, if required. Just go through the necessary develop to down load or produce the document template.

Use US Legal Forms, one of the most comprehensive collection of lawful forms, in order to save time and stay away from errors. The service gives expertly created lawful document web templates that you can use for an array of reasons. Generate a merchant account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Submit Form 592-Q, if additional withholding is required, with the annual Form 592-PTE and the pass-through entity withholding payments. Do not use Form 592-PTE if: You are reporting withholding on domestic nonresident individuals who are not owners of your pass-through entity (independent contractors). Use Form 592. Pass-Through Entity Withholding | FTB.ca.gov ca.gov ? pay ? pass-through-entity-withh... ca.gov ? pay ? pass-through-entity-withh...

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Taxpayers with general questions can call (800) 852-5711 or visit our website at ftb.ca.gov .

Protest Procedures Go to ftb.ca.gov and select Register or log in to your MyFTB. From the options listed, select Account and then Proposed Assessments. Select the NPA number for the proposed assessment you want to protest and follow the online protest instructions.

Disagree. File an appeal with the Office of Tax Appeals (OTA). File your appeal within 90 days from the date of the Notice of Action that denied your refund claim. Or, you may file a suit in Superior Court.

Also, Form 592 is used by pass-through entities to flow through withholding credits to their pass-through owners. Important: This form is also used to report withholding payments for a resident payee. Do not use Form 592 if you are the buyer or escrow person withholding on the sale of real estate. Instructions for Form 592 eformrs.com ? Forms09 ? States09 eformrs.com ? Forms09 ? States09

Every elected official and public employee who makes or participates in making governmental decisions is required to submit a Statement of Economic Interests, also known as the Form 700. The Form 700 provides transparency and ensures accountability in governmental decisions. Statement of Economic Interests for Candidates - FPPC ca.gov ? candidate-toolkit-getting-started ca.gov ? candidate-toolkit-getting-started

Fill out the ?Reply to FTB? form included with your notice. It allows you to tell us that you (A) already filed a tax return or (B) you don't have to file or you are unsure if you have to file. Letters | FTB.ca.gov ca.gov ? help ? letters ca.gov ? help ? letters