California Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor

Description

How to fill out Athletic Person Training Or Trainer Agreement - Self-Employed Independent Contractor?

Are you in a location where you often require paperwork for business or personal reasons? There are many legal document templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms offers thousands of form templates, such as the California Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor, designed to comply with federal and state regulations.

If you are already aware of the US Legal Forms website and have an account, simply Log In. After that, you can obtain the California Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor template.

Select a convenient document format and obtain your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the California Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor whenever necessary. Just follow the required form to download or print the document template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to view the form.

- Review the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find a form that meets your requirements.

- Once you find the correct form, click on Buy now.

- Choose the payment plan you prefer, fill in the required information to process your payment, and pay for the order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

To prove you are an independent contractor, especially in the context of a California Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor, you need to establish your work relationship. Gather documents like your signed agreement, invoices, and tax forms that confirm your status. Additionally, demonstrate your control over your work hours and methods, as these factors emphasize your independence. If you need assistance navigating this process, consider the resources available on the USLegalForms platform.

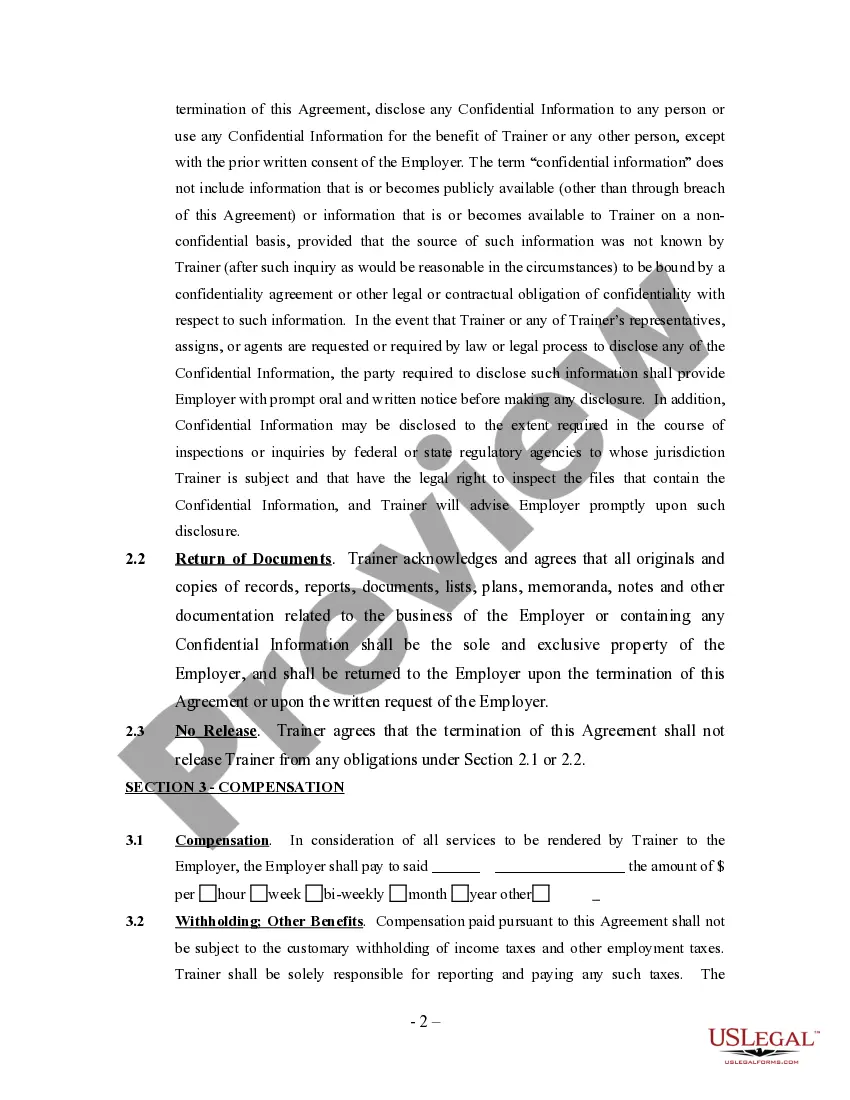

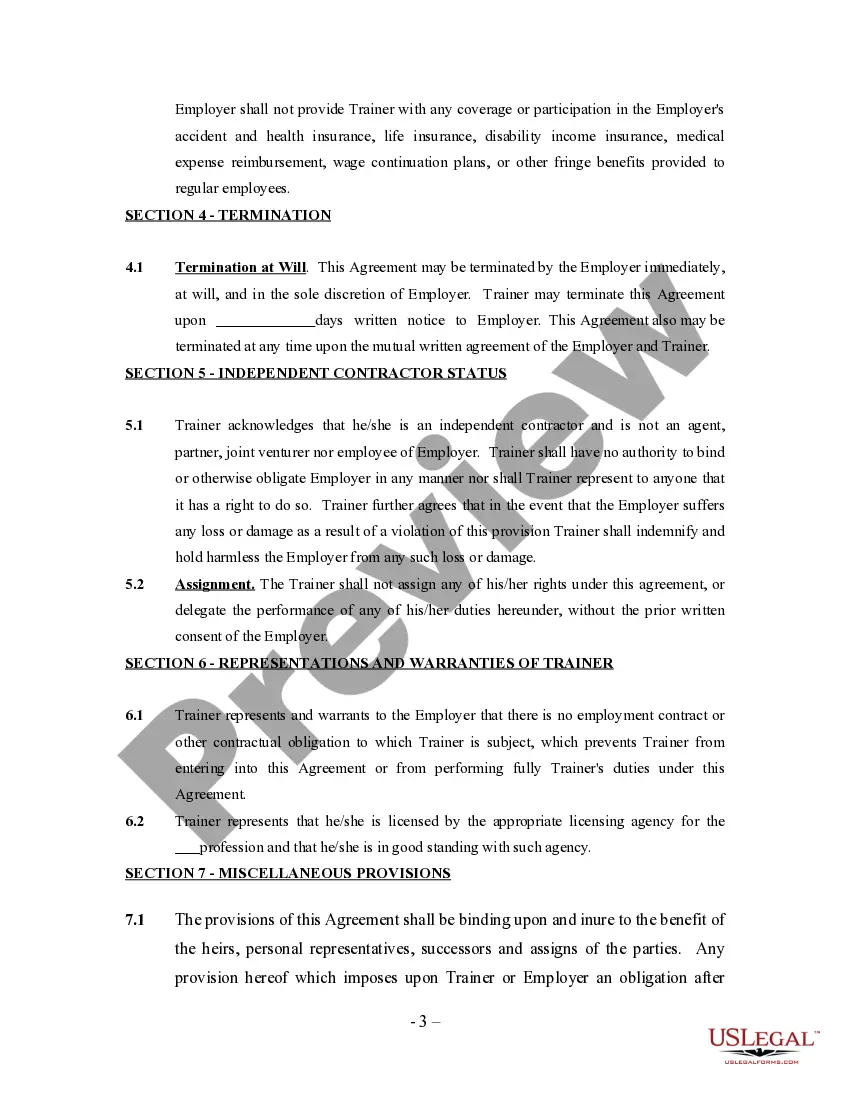

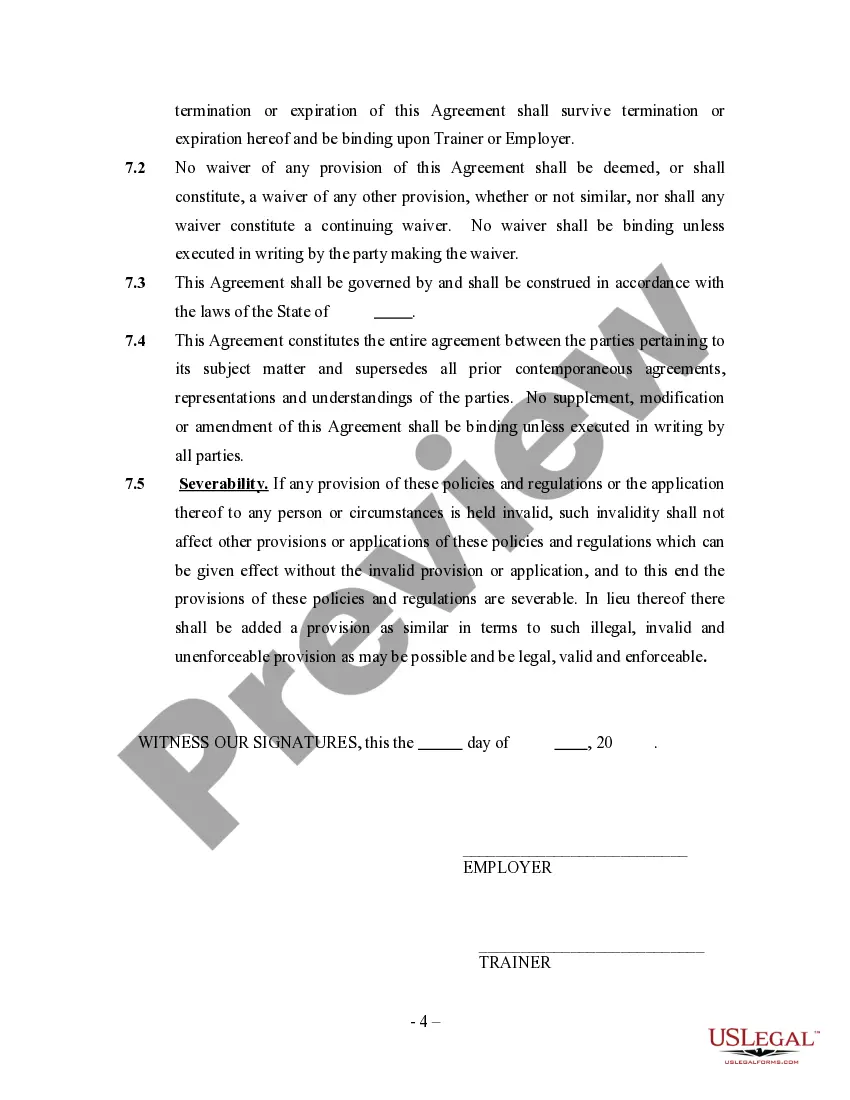

Filling out an independent contractor agreement for California Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor requires careful attention to detail. Begin by inputting the names and contact information of the contractor and the company. Next, complete the sections that define the services provided, compensation arrangements, and any additional terms that govern the relationship. Consider using uslegalforms for guidance and pre-made templates that simplify this process.

To write an independent contractor agreement for California Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor, start by clearly stating the parties involved in the agreement. Include sections detailing the scope of work, payment terms, and termination clauses. You should also outline responsibilities and rights of both parties, ensuring clarity on independent contractor status. Using a reliable platform like uslegalforms can streamline this process, providing templates that meet legal requirements.

Independent contractors can receive training, but it should be optional and not mandated. For those involved in California Athletic Person Training or Trainer Agreements, offering training can enhance their service quality without compromising their independent status. By framing training as a professional development opportunity, you encourage growth while respecting their autonomy.

Independent contractors can be asked to attend meetings, but such meetings should not infringe on their independent status. In the context of California Athletic Person Training or Trainer Agreements, keeping the meetings contractual and limited in scope helps preserve the autonomy of the contractor. Clear communication about expectations during these meetings is vital for maintaining a professional relationship.

Yes, a personal trainer can be self-employed, allowing them to operate their businesses independently. This self-employment status often provides flexibility in work hours and client selection. When engaging in California Athletic Person Training or Trainer Agreements, ensure that the contract reflects the trainer's self-employed status, as this will impact taxation and liability.

Legal requirements for independent contractors include proper classification according to state laws and adherence to the terms of their agreements. For California Athletic Person Training or Trainer Agreements, it is important to include details about the scope of work, payment terms, and other obligations. Proper documentation ensures both parties understand their rights and responsibilities, fostering a positive working relationship.

Yes, you can require training for independent contractors, but the extent of that requirement should align with their role and the agreement terms. In the case of California Athletic Person Training or Trainer Agreements, it is essential to specify expectations in writing, while still respecting the independent status of these trainers. By doing so, trainers can enhance their skills while maintaining their autonomy.

Fitness trainers can be classified as independent contractors based on the nature of their work and their relationship with clients. Many fitness professionals, particularly those operating under California Athletic Person Training or Trainer Agreements, choose this model to maintain flexibility and control over their business. However, it's important to review the guidelines set by AB 5 to determine the correct classification for your situation.

The new law in California, known as Assembly Bill 5 (AB 5), redefined the criteria under which workers can be classified as independent contractors. This law emphasizes the need for workers to meet a stringent three-part test, known as the ABC test, to qualify as independent contractors. For those involved in California Athletic Person Training or Trainer Agreements, understanding this law is crucial. It ensures compliance and guides you in structuring your contracts accurately.