California Storage Services Contract - Self-Employed

Description

How to fill out Storage Services Contract - Self-Employed?

Locating the appropriate authentic document template can be a challenge. Naturally, there are numerous formats available on the Internet, but how can you discover the legitimate form you require? Utilize the US Legal Forms website.

This service provides a vast array of templates, such as the California Storage Services Contract - Self-Employed, which you can utilize for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click on the Download button to obtain the California Storage Services Contract - Self-Employed. Use your account to browse the legal forms you may have purchased previously. Visit the My documents tab of your account and retrieve another copy of the document you need.

Complete, modify, print, and sign the received California Storage Services Contract - Self-Employed. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to acquire professionally crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

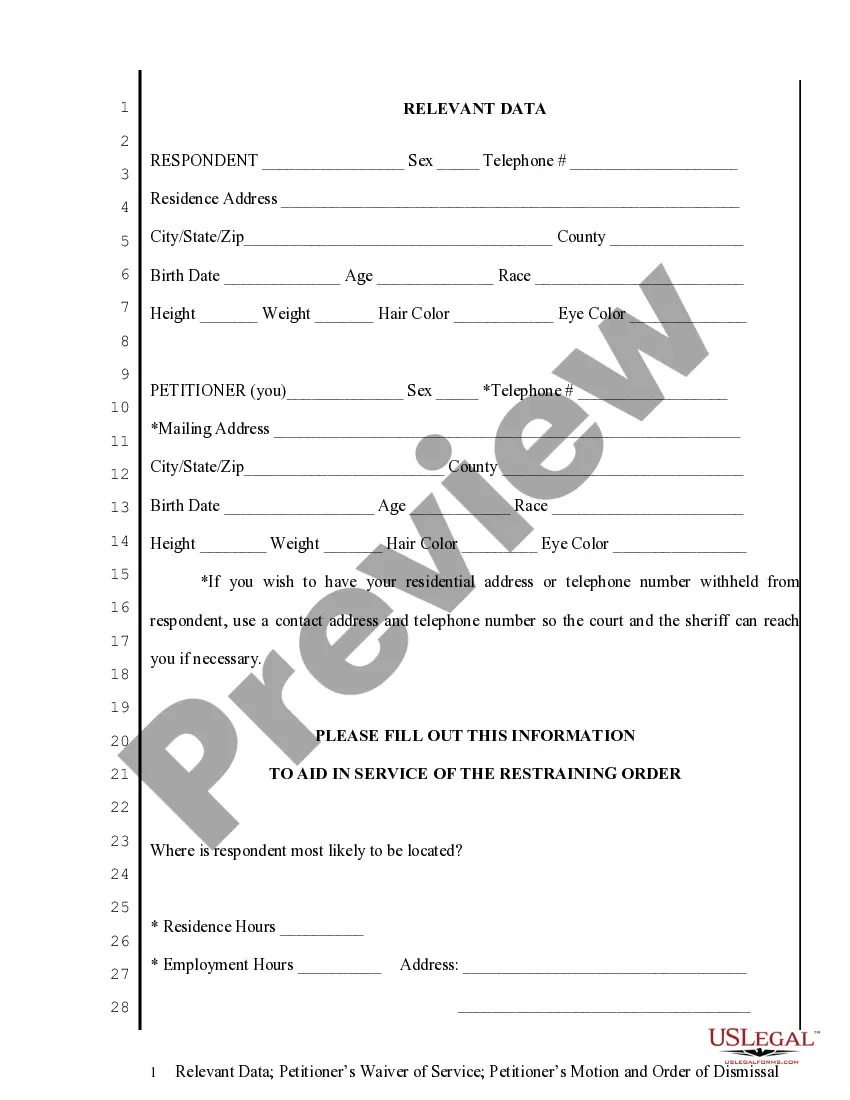

- First, ensure you have selected the correct form for your city/region. You can review the document using the Preview button and read the form description to confirm this is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click on the Get Now button to obtain the form.

- Select the pricing plan you wish and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the document format and download the legal document template for your records.

Form popularity

FAQ

The new law affecting independent contractors in California, known as AB 5, changes how workers are classified. Under this law, many individuals may now be considered employees instead of independent contractors. This shift impacts various industries, including those utilizing California Storage Services Contract - Self-Employed. It is important to understand these changes and consult resources like U.S. Legal Forms for guidance on compliance.

Filing taxes as an independent contractor in California involves several key steps. First, you should gather all your income statements and expenses related to your California Storage Services Contract - Self-Employed. You will need to report your income using Schedule C, and you may qualify for deductions to lower your taxable income. Additionally, consider using platforms like U.S. Legal Forms to simplify the process and ensure you meet all requirements.

In California, a storage unit may be considered abandoned if rent remains unpaid for a specific period, typically set in the storage contract. After this time, facility owners may take steps to auction the contents to recover losses. Understanding the implications of a California Storage Services Contract - Self-Employed can help you safeguard your belongings and fulfill your financial obligations.

Storage unit contracts define the terms of rental between the storage facility and the tenant. These contracts typically outline payment details, duration of rental, and responsibilities regarding access and maintenance. Knowing the specifics of a California Storage Services Contract - Self-Employed can help you make informed decisions and avoid disputes.

The self-service storage act provides a legal framework for the rental and management of storage units in California. This act includes important provisions regarding tenant rights, responsibilities, and the handling of units in cases of delinquency. When entering into a California Storage Services Contract - Self-Employed, familiarize yourself with this act to ensure you understand your rights.

Generally, running a business from a storage unit is not permitted under California law. Storage facilities are intended for storage purposes, not as permanent business locations. If you are considering a California Storage Services Contract - Self-Employed, be sure to review the specific policies of the storage facility you intend to use.

The storage mandate in California emphasizes clear regulations surrounding the operation of self-storage facilities. This includes guidelines for contracts and the treatment of tenant belongings, especially in events of non-payment. A California Storage Services Contract - Self-Employed should reflect these mandates to protect both parties and ensure a fair transaction.

The California Self-Service Storage Facility Act outlines the rights and responsibilities of both storage facility owners and renters. It regulates how storage units operate, including lease agreements and procedures for the auction of abandoned property. Understanding this act is essential for anyone considering a California Storage Services Contract - Self-Employed to ensure compliance and protect their business interests.

Bidding on your own storage unit typically falls into a gray area and may not be legal in some states. Generally, laws require transparency and fairness in auctions, which may be outlined in the California Storage Services Contract - Self-Employed. To avoid potential legal issues, consult a legal professional to understand the specifics of your situation and ensure compliance with state regulations.

Yes, storage units can be seen as a source of passive income, especially when you rent them out. However, it's essential to consider the local laws and business regulations, which include a legally sound California Storage Services Contract - Self-Employed. This contract will help you outline your responsibilities as a business owner and the terms of rental agreements with your clients, ensuring you operate within legal boundaries.